FAQ

Why should I use Coinrule

How does Coinrule help me trade cryptocurrency?

Ever since entering the cryptocurrency space, we have been thinking about how to bring the user-friendly, intuitive user-experience we have become accustomed to in other tech areas to the Blockchain space. Coinrule is the product of our imagination, designed to be easy-to-use for technical and non-technical traders. Coinrule is your Lego tool-box for cryptocurrency trading strategies and trading automation that also allows you to backtest your trading rules and strategies prior to launching them. All the trading executions you have wanted to set up on cryptocurrency exchanges but couldn’t due to their limited interfaces? Now Coinrule makes it possible.

What are the benefits of using Coinrule?

Coinrule allows you to set up your own automatic trading strategies based on the “If-This-Then-That” principles without requiring any coding skill. The rules will run 24/7 so that your portfolio management will become more safe and efficient. Coinrule also allows you to backtest your trading rules and strategies prior to launching them.

We make it easy to implement different trading strategies to meet all traders’ needs.

Get started

I am new to automated trading. What is the best way to get started?

The best way for you to get started is by watching this introduction video to give you a brief introduction about Coinrule and how to use our platform.

For more resources, please check the links below:

How to manage my rules

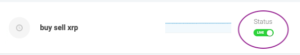

How do I pause/play a rule?

In the dashboard, you can find a list of all your rules. To pause a live rule, simply click on the green Play button. Press it again to re-start:

Where can I see the performance of my rules?

The dashboard shows the performance of any single rule and, additionally, on the top, you will find the aggregate return of your portfolio.

Can I choose between limit and market orders?

At the moment, all the order sent by the algorithm will be “market orders”. We are working on providing an additional option for “limit orders”.

Can I backtest my rules?

The possibility to easily test your rules before running them using historical data is one of the key features of Coinrule. The backtest engine will be available soon.

Do you have any technical analysis indicators or charts?

We integrate Moving Averages and RSI on rules running on Binance and Coinbase Pro. More exchanges will feature this option soon.

You can test technical indicators for free on our Demo Exchange (connected to Binance’s prices). If you want to run these indicators on a live exchange you will be requested to upgrade your plan.

We are also planning to add more indicators in order to provide the best trading experience for every type of trader.

Markets

How do I connect API keys from the available exchanges?

To be able to run your rules, you will be asked to connect your Coinrule account to your crypto exchanges of choice via APIs. The process of creating your API keys is simple and can be slightly different from one exchange to another. You will find all the guides related to the supported exchanges HERE.

Speed

How quickly do rules get executed?

To ensure that quick executions are guaranteed, all orders are sent to the market promptly with minimum latency time. Normally, our orders take only around 500 Milliseconds to reach the market. The only delay could be the frequency of the conditions checks which runs roughly every 40 seconds.

Balances not showing

I’ve linked the exchange to Coinrule using the API keys, however, the balance is not shown correctly.

Here are some possible explanations/solutions:

- Refresh the balance using the “wallet” button on the dashboard

- Some exchanges require users to move their funds into the “trading account” to be able to trade with Coinrule

- Double-check that the coins are not locked on the exchange by open orders. Coinrule will show you only the coins available for trading.

- If you have a small balance on the exchange, it will not show on Coinrule

- If you use Coinbase Pro, we don’t show USD or GBP balance due to Coinbase restrictions on fiat wallet, which depends on the locations of the sender of the order. At the moment, Coinrule only has servers in Europe, and USD/GBP wallets are not available.

Rules not triggering

I’ve created a rule, the conditions have been met but the rule was not triggered.

To trigger the rule, you have to ensure that there is an existing pair between the selected coin and wallet, ex: BTC/USDT.

Also, make sure you are monitoring the trading pair that the bot is checking. The bot picks trading pairs depending on the parameters selected.

Eg. a rule trading “Bitcoin” with the “USDT” wallet will result in price checks on the BTCUSDT trading pairs. For more details please refer to this article.

Orders not executed

The rule was not executed with the message “Order size lower than min. Req…”

Each exchange set a minimum order size for each trading pair. Coinrule needs to comply with these limits so orders that don’t meet the required amounts can’t be executed.

For example, if the rule is running on Binance you can refer to this page for more details.

Order executed at an unexpected price

The rule was set to buy/sell at a specific price but the executed price on the market was different.

At times, there is a lack of liquidity in the market, this can lead to slight differences in the price that is executed. For more information on this topic please read the following article.

Technical indicators not available

I’ve linked my exchange to Coinrule, however, it says that RSI is not available.

The technical Indicators are only available on selected exchanges, more are added regularly. You can test them for free on the Demo Exchange.

Avoid over-trading

Small price fluctuation triggers market orders so I pay the exchange’s fees without achieving a profit on the strategy. How can I solve this?

Here are some possible explanations/solutions:

- Using “no more than once every…” will prevent over-trading.

- You can increase the percentages to trigger the orders or add more restrictive conditions, or multiple conditions to trigger the rule. This will result in the rule to only execute when necessary.

Demo exchange

What prices are used for the Demo exchange?

The prices for the Demo exchange are linked to the Binance exchange with real-time prices. For more information, please refer to this page.

While browsing within the app I get a blank page, why?

Some browser extensions, such as Google Translate conflict with the interface of our platform resulting in this error. Try disabling or removing the extension and refresh the page. If the issue persists, please reach us and we will happy to help you.

Pricing

Which plans do you have?

You can use Coinrule for free with a limited number of live and demo strategies as well as access to certain template strategies. Purchasing a monthly or annual paid plan will give you access to Coinrule’s full power and exclusive features.

You read more about our available plans and their features on our pricing page: https://coinrule.io/pricing.html

Does Coinrule take a commission on trades?

Coinrule only charges the client a subscription fee for the plan he/she upgrades to. Any other fees come from the exchange.

Who are the founders

Who is the team behind Coinrule?

We are a team of blockchain and crypto enthusiasts who found that trading cryptocurrency is unnecessarily complicated. Our backgrounds are in banking, UX Design and tech. All of us have previously built companies and discovered the ‘magic’ of crypto over the past 1-2 years. We are committed both to crypto traders and the wider Blockchain community as we believe in the possibilities that the technology brings for greater decentralization of wealth and power, a more open internet, and much more beyond. You can read more about our profiles on Coinrule.io.

Security

How secure is Coinrule?

We store API keys in encrypted form (256bit AES encryption), encrypted with dedicated private keys that are generated for each user separately. These private keys are stored on detached data storage which is also encrypted with AES-256.

We also use data encryption in transit which means all communication between our web app <-> application backend <-> database/cache nodes is encrypted using TLS 1.2 or higher.

We use Cloudflare CDN as another layer of protection against DDoS and other type of attacks.

What experts say about us

Here is a list of trustworthy publications and reviews about Coinrule.

Glossary

API

API stands for “application programming interface”. We can define APIs as a tool to create a communication protocol between our platform and your crypto wallet or exchange. Thanks to APIs, Coinrule is able to send trade orders to your connected exchanges.

APIs are secure to run since they must first be validated by a complex secret key.

Remember that to run Coinrule, the APIs must be able to just “view” your wallet and send orders, we will never request any “withdrawal” permission from your wallet, so for your further security, we advise to not allow the “withdraw function” at the moment of API creation.

2-Factor Authentication (2FA)

2-Factor Authentication (2FA) is an additional security layer offered by exchanges and other sites and apps to validate some particularly sensitive actions. As the name suggests, 2FA involves using a second, separate device, often a phone, to confirm the identity of the owner of the account. The authentication is usually accomplished by sending an SMS to the registered phone or via an app like Google Authenticator. This additional security measure significantly improves a user’s security since an attacker must be able to hack into both devices successfully.

Orders

Market Order is an order to buy or sell an asset at the best available market conditions without any limit on price execution. A buy-market order will be executed buying the asset from the best available sellers (‘ask price’) at that specific moment, vice-versa a sell-market order will be executed selling the asset to the best available buyers (‘bid price’) at that time. Please note that execution prices can vary from the last traded price significantly depending on the size of the order and the liquidity of the market at that given time.

Eg. I want to buy 5 ETH from my USD wallet using a “market order” and the best available sellers are 1 ETH at 100, 1.5 ETH at 100.05, 2 ETH at 100.10, and 3 ETH 100.15. In this example, I would have multiple executions on my order until the entire amount requested is filled and so the average price would be 100.07 USD (sequentially, 1 ETH @ 100, 1.5 ETH @ 100.05, 2 ETH @ 100.10, and the remaining 0.5 ETH @ 100.15).

Limit Orders use a limit price to your order to make sure that the order will not be filled at an unexpectedly high or low price.

Following the previous example, if I would have used a limit price of 100.05 USD for my 5 ETH buy order, I would have filled immediately 1 ETH @ 100 (lower price than my limit) and 1.5 ETH @ 100.05 (maximum price accepted for execution) and I would have waited for new sellers for the remaining part of my order (2.5 ETH).

We can note that when you use a limit price order, you can have a lower (higher, in case of a sell order) or same execution price, but never higher (lower, in case of a sell order) than the limit you set in your strategy.

Please note that using Limit orders makes sure you don’t have an unexpected execution price, nevertheless, it doesn’t guarantee that the order will be filled. That will depend on the market conditions that need to match the limit price imposed.

Bid Price this is the price that buyers are willing to pay for a certain asset, this is the price that sellers are subjected to when they want to sell the asset immediately. Every sell order (both “market” or “limit”) will find execution at the best available “bid price”, if the amount is not filled, sequentially lower prices will be executed. Only in the case of “limit orders” will the limit price never be breached for execution, if there is not enough amount of the asset to buy at that price, the order will remain unfilled/partially filled.

Ask Price this is the price sellers are willing to pay to sell an asset. It can be viewed also as the price buyers are requested to pay to buy the asset immediately. Like previously said, buy orders will also be executed sequentially at more convenient “ask prices” (from lower to higher) in that given moment until the complete execution of the order, considering that only “limit orders” will have the certainty of not being executed at a higher price than the predefined limit.

Triggers

Event Trigger tracks predefined conditions set by the user and triggers an event such as a Buy or Sell order once the predefined condition occurs in the market. When the event “triggers”, the algorithm sends out one (or more) orders just like it was defined in the rule. Please note that all orders are stored on our cloud awaiting the desired conditions before being sent to the exchange so that no pre-check is made in terms of availability of funds or minimum order allocation.

Time Trigger makes it possible to send orders without any previous checking of a certain condition. The order (or multiple orders) will be sent at a specific time interval defined by the user. Eg. selecting “12 Hours”, the same order will be sent every 12 hours.

Backtesting

BACKTESTING means testing a trading strategy using a set of historical data. In this way, it will be easy to verify how that specific strategy would have performed if it was run in those market conditions. Backtesting a strategy is very useful especially to understand how a given strategy performs with certain conditions, though you can take into account that past results are not a promise that they will recur in the same way in the future.

The difference in results between backtesting and “real trading” depends on the fact that even if price patterns often repeat themselves in time, it is not said that they will repeat in the same way, or that they will repeat at all. Also, please note that the actual result of a trading strategy depends on the execution prices of the orders and no backtesting tool will ever be able to forecast what the market conditions will be like when the order will reach the market.

Technical Analysis

Technical Analysis is a methodology of analysis based on the observation of the price of an asset in order to get insightful information to be used for investment purposes. The idea is that demand and offer (the main driving forces of price) shape how the price evolves over time. According to the theory of technical analysis, observing the charts that are built upon historical prices, it is possible to understand the trend and find recurring patterns that the trader will try to exploit to find opportunities for profit.

An endless number of calculations (technical indicators) can be applied to the price in order to provide specific signals that the trader will use to make her decision about actions to execute (or not execute).

Examples of the most common technical analysis indicators are Moving Averages, Bollinger Bands, or various Oscillators like MACD, RSI, and Stochastic.

Stop Loss

Stop Loss as the name would suggest, is an automatic order of closing a position to prevent further losses. How to deal with losses is probably the most important challenge for any trader or investor, not all trades or investments can be successful, and deciding when it’s time to “stop losing” money/value on the investment is what distinguishes a professional investor from a newbie.

There are two main ways to set up a stop loss. The trader can decide to sell an asset when a certain price is reached on the market or when the position is losing a specific amount of money.

Fear Of Missing Out (FOMO)

Fear Of Missing Out (FOMO) often happens in periods of sudden and strong surges in price. It consists of a feeling that if the trader doesn’t buy a particular (or any) asset on that price spike, she will miss the chance to buy it at a reasonable price later. Often, that is not true because retracements of price are very common. This means that often FOMO can lead to buy-ins at a sub-optimal price.

FOMO behavior is caused by the common psychological bias which makes a short term price movement seem to be something irreversible. It is important to note that occasionally, the price won’t retrace back to where it was before a longl-asting uptrend started. But nonetheless, the main point to consider is that buying an asset just because its price is rising fast is never a good investment decision, more information must be evaluated.

Risk Management

Risk Management is the broad batch of practices that every trader or investor has to put in place in order to mitigate the overall risk on their positions. Other than saving capital, good risk management policies can reduce significantly the stress often connected to trading activities and ultimately permit to always stay focused and rationale for a better decision making process.

The most well-known among these practices is to define the best “stop loss” level to prevent larger than desired losses.

The other two main pillars of a proper risk management approach are setting an appropriate risk/reward ratio and always taking position sizing decisions that could fit with the subjective level of risk tolerance. Read this article for more on this topic: HERE.