Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

Automated Trading on Binance Futures

Using Coinrule, any trader can automate their leverage trading, opening the door to new possibilities. Leverage trading allows traders to take advantage of almost-unfathomable opportunities to grow their capital – 125x!

Leverage trading allows traders to open leveraged positions, meaning that they borrow funds against collateral to buy more than they could with their original capital. Doing this enables traders to increase the size of their positions, allowing them to increase their profit.

If a trader has $1,000, he can open a regular position in Bitcoin; this will result in him holding 0.048 BTC. However, with leverage, he can now open a position valued up to $100,000, approximately 4.84 BTC. If the price moves up by 1%, the trader’s return would be $1,000 instead of $10 without leverage.

Setting Margin On Binance

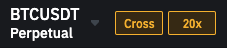

Once you have linked your Binance Futures account to Coinrule, you will need to set the leverage level you will be using to trade. Binance allows leverage trading up to 125x, and you can adjust the leverage by clicking on the icon that displays the current margin level.

Additionally, you can select the type of margin mode you prefer. Selecting “cross” allows you to share your margin across all positions. This aids in avoiding liquidation; however, in the event you are liquidated, you risk losing all your funds.

On the other hand, by selecting “Isolated”, you can isolate each trade independently, meaning that you allocate a specific amount of margin to each position. In this case, If the margin ratio reaches 100%, only your position will be liquidated. Once selecting the settings you are comfortable with, you can then make your way to the Coinrule Dashboard and begin trading.

Smart Limit Orders

Limit orders are orders that you place on the order book, with a specific limit price. When placing a limit order, the trade is executed when the market price reaches the limit price set or higher.

When using Coinrule, the limit price selected is the price at the moment conditions have been met, plus the safety margin that was chosen from the settings page as shown below.

An example of this is if you have an order where the price condition for execution is at $100, if the safety range is 0.5%, the limit price is $100.5. If the safety range that is selected is 0, the limit price will be the same as the price triggered. Setting up a safety range helps ensure a maximum number of executions.

Order Size

When creating a rule and considering contract size, one contract is equivalent to the price of that coin. Thus the value of one contract may vary vastly from one coin to another. An example would be in the case of ChainLink; one contract of chainlink would be worth approximately 12$ while one contract of Bitcoin is currently worth $19,438. Thus, when creating the rule, it is vital to consider contract size to avoid unintentionally opening large positions.

Use Leverage While Managing Risk

Managing risk is a must when trading with leverage, a typical practice between professional traders is using stop-losses on all their positions to protect themselves from large unforeseen losses. For beginners, this is not common.

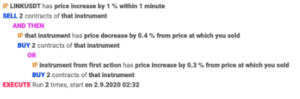

This can be done easily with Coinrule, and many different variations can be created for rules that incorporate stop losses. Using Coinrule, users can create rules that trade crypto derivatives according to pre-set conditions. Here’s an example:

Connect your wallet and get started with automated trading on Binance Futures.

Start trading with leverage on Coinrule today!