Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

Bearish RSI Crossing Scalper

This strategy uses the RSI together with candlestick confirmation to scalp trades during uncertain times.

“Sell when the RSI is overbought and buy when the RSI is oversold.” This is the basic strategy you learn when using the RSI indicator. Yet, there are times when this straightforward rule is not efficient.

Oscillator indicators such as the RSI struggle to provide valuable signals during periods of uncertainty. If the market is trending higher, the RSI can stay in overbought conditions for a while, forcing the trader to get stuck in a position in loss.

The purpose of this strategy is to seize the moment when the RSI crosses below the threshold of 65, improving the chances of catching a short-term price drop. In this way, traders can exploit the usual RSI signals and maximize the probability of entering a winning trade even during uncertain market conditions.

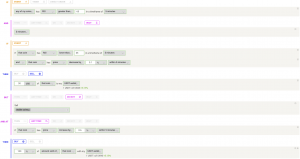

Sell Condition

Firstly, the bot scans the market looking for coins with an RSI greater than 65. Then, the strategy requires waiting for 5 minutes (a fixed period), and it places the sell order if the RSI is now lower than 65.

Additionally, the price decrease by 0.1% (or a small, fixed percentage) provides further confirmation that the price is trending lower.

Buy Condition

This strategy comes with a trailing stop loss/take profit.

Since the rule has particular use in undetermined market conditions, the bot keeps open profitable trades, allowing them to close dynamically by hitting the trailing stop loss/take profit.

This allows maximising gains when the bot has found a good entry price for its short. It rides the downward trend while it can and closes out the position when it looks like it’s about to reverse.

How it Works

This trading system tends to open and close trades very quickly, often in a matter of minutes.

How to Build the Bearish RSI Crossing Scalper with Coinrule

The strategy can also add value to your portfolio in uncertain times when the market does not trade with a clear direction.

It can help especially in downtrending markets with the coins you have in your wallet. By selling coins that you already own, it actually decreases your overall exposure to the market and adds some extra value.

On the other hand, if you are shorting through futures, this strategy allows you to seek extra profit without having to open fresh long positions in downtrending markets.