Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

Grid Trading Strategy

Whether cryptocurrencies trade in a Bull or Bear market, most of the time, they move with no clear direction. A Grid Trading Strategy helps take advantage of such a setup adding value to your portfolio with relatively low risk.

Read more about how to set up a Grid Trading Strategy with Coinrule.

The strategy is more effective when the trading pair trades within a clear range. Here are some examples of trading pairs you can use to run a Grid Trading Strategy.

Last update: 20/12/2021

BTCUSD

Funds needed to run the strategy:

– Bitcoin

– Stable coin or fiat currency

DOGEUSD

Funds needed to run the strategy:

– Dogecoin

– Stable coin or fiat currency

ALGOUSD

Funds needed to run the strategy:

– Algorand

– Stable coin or fiat currency

LTCBTC

Funds needed to run the strategy:

– Litecoin

– Bitcoin

BCHBTC

Funds needed to run the strategy:

– BitcoinCash

– Bitcoin

How To Build The Strategy

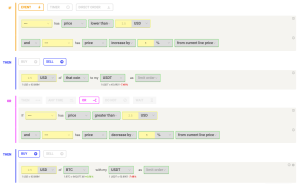

This strategy is available as the template “Grid Trading in Range”. You can also build it manually by referring to the draft below.

DISCLAIMER

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies. This post is for educational purposes only.