Category

- Trading Strategies

- Get Started

- Exchanges Guidelines

- Trading Tips

Waves Automated Trading Strategy On Trend - Ep 20

Market Analysis

Bitcoin’s price has broken the trend and began its parabolic increase. Usually, this is when investors must exercise caution. The market is known to be cruel, and historically pumps in price similar to this have been accompanied by severe dumps in price later on. Even in the steepest uptrend, we see corrections of up to 20%-30%. We anticipate that two scenarios can occur.

We may have another leg up, followed by a correction of 20%-30%. Alternatively, the price can reach direct a new all-time high, and there accumulate to break out. However, the second scenario is less probable than the first.

WAVES presents one of the most exciting charts. BTC terms’ price shows that WAVES has been doing exceptionally well without suffering much of Bitcoin’s pumps. It smashed a key resistance and never looked back. It was barely able to retest this resistance as it was continually trading above it during October. We can see a clear cup & handle formation, and we anticipate a massive breakout after this phase. A WAVES automated trading strategy could benefit from the great long term setup of the coin. Scalping small trades to reduce the risk.

One of the most profitable rules that we have been running is on YFI. The rule scalps a bit of the coin while there is a solid uptrend.

How to build a suitable strategy

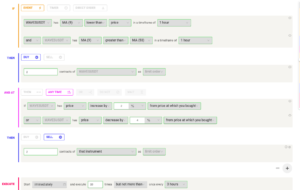

The strategies’ structure allows us to buy during the uptrend and take profit at an increase of 2% while maintaining a stop loss at 3%. This is a WAVES automated trading strategy but the same setup can be implemented on other coins as well.