Trade Gold & Silver ETF’s on Coinrule

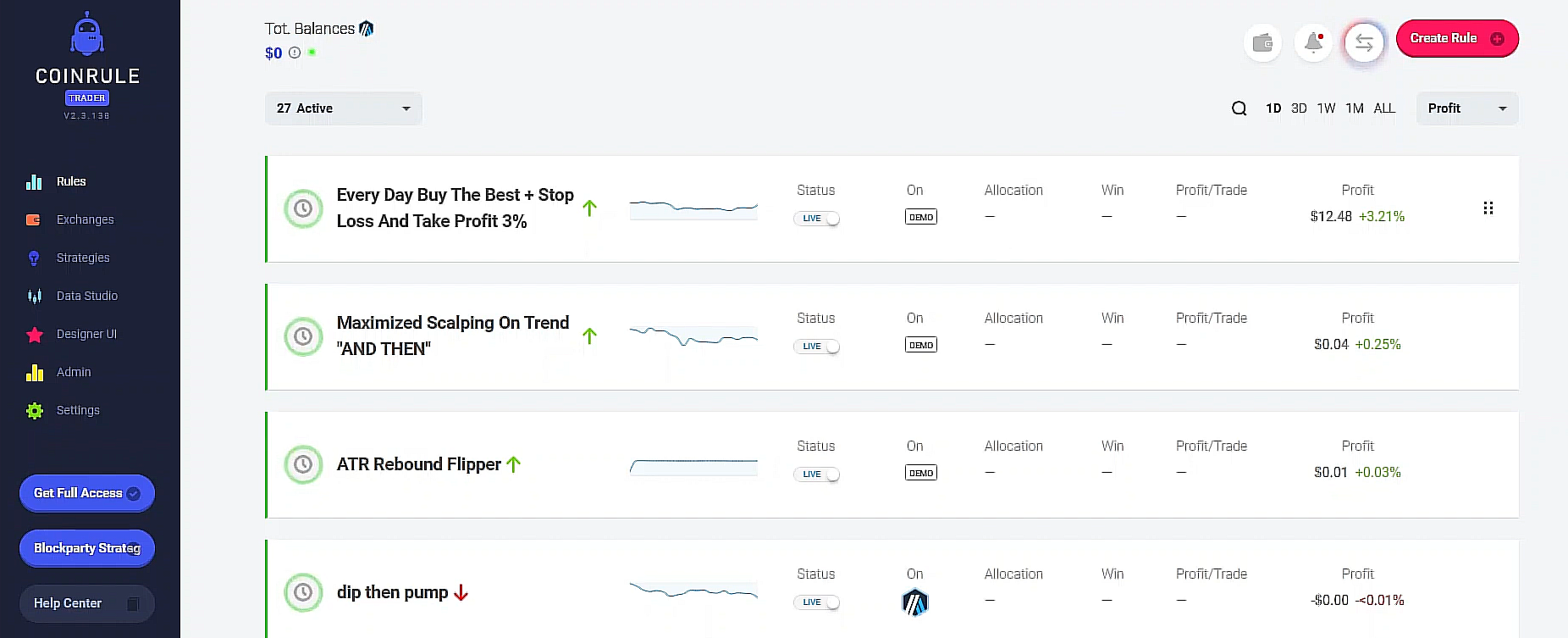

Gold and silver have long played a central role in global markets. From acting as defensive assets during periods of macro uncertainty to serving as inflation hedges and portfolio diversifiers, precious metals remain highly relevant in modern trading strategies. In 2026, access to these markets has become more flexible and systematic, particularly through automated trading platforms like Coinrule. Coinrule enables traders to gain exposure to gold and silver through a wide range of instruments, particularly…