Cryptocurrencies are gaining quickly mainstream recognition. Still, the most famous cryptocurrency remains Bitcoin, and there are many reasons Bitcoin is the best-known coin on the market. On the other hand, other projects play a significant role in expanding the use case of cryptocurrencies and promise to bring a global disruption not seen since the advent of the Internet. Ethereum vs Cardano seems very similar, what are their differences?

Both blockchains allow developers to build decentralised applications and run smart contracts, but which one is a better investment?

Let’s dig more into the similarities and differences of these protocols. Is there going to be a winner long-term? Or will they both coexist one next to another?

What Is Ethereum?

Bitcoin is the King of crypto because it’s secure and reliable. That’s because its source code is simple and easy to read. That makes sure there are no bugs or points of failure. Due to its limit in the structure, Bitcoin is not flexible and does not allow many use cases, apart from storing and transferring value (which per-se is a great use case!).

In 2015 Vitalik Buterin understood that blockchain technology’s potentials were much broader. Ethereum is an open-source, peer-to-peer computing platform built on blockchain. Think of it as a distributed computer that can run countless decentralised applications with no need for third-party control or intervention to work. Ethereum has a native cryptocurrency known as Ether. Users pay for transactions on the Ethereum blockchain using Ether.

Since then, the platform has grown to become one of the most well-established blockchains. As a consequence of its success, the price of Ether has grown exponentially since 2016.

Why Has Ethereum Been So Successful So Far?

There are no limits to the number and variety of applications that can run on top of Ethereum, the main driver for its success. In his visionary mind, Buterin foresaw earlier than anyone a future where developers worldwide could create their applications on the blockchain.

These applications, known as decentralised applications (dApps), can have limitless functions. While almost every business model already landed on Ethereum blockchain in some form, the apps that so far gained more traction are those related to the DeFi (decentralised finance), gaming and NFTs.

Ethereum allows developers to code smart contracts that execute pre-set actions with no need for a middle-man to manage them. Smart contracts are self-executing contracts that will only run when a set of pre-determined conditions apply. For instance, a lending app that uses smart contracts will only release the loan after the counterparty places the requested collateral.

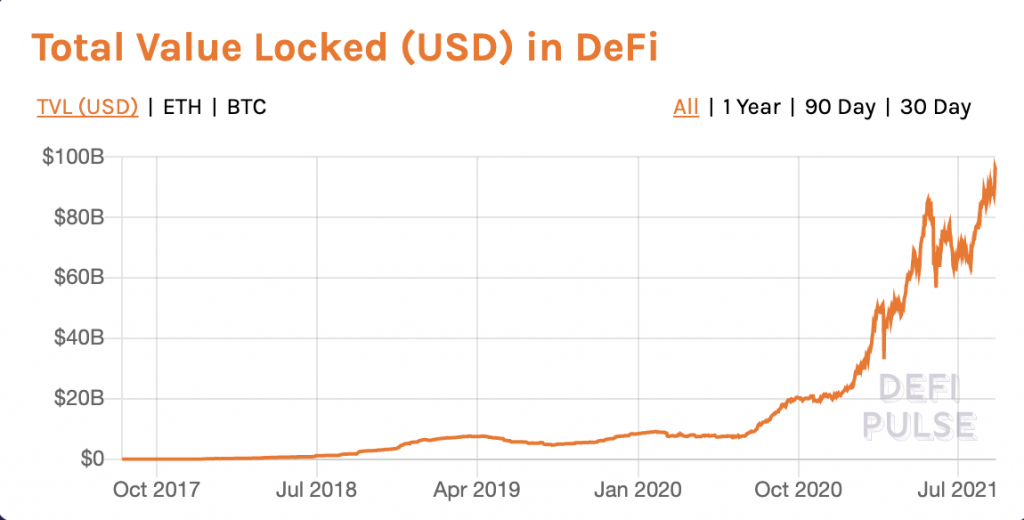

Why Is Decentralised Finance So Important?

Nowadays financial ecosystem poses many constraints for users. Regulations and compliance requirements limit the access to services for millions of users. Decentralised finance defines all those peer-to-peer applications running on a blockchain allowing users to invest, lend or borrow their assets. Unlike traditional finance systems managed by centralised bodies, DeFi has no censorship and minimal verification requirements. These programs are available to anyone with an internet connection.

Defi platforms are highly programmable, immutable, and interoperable. They are also permissionless and transparent, making them better than fiat currencies that lack most of these features.

Protocols like Uniswap, Compound, Aave and others have radically changed the crypto ecosystem proving that Vitalik’s original vision can translate into real use cases that will change the world.

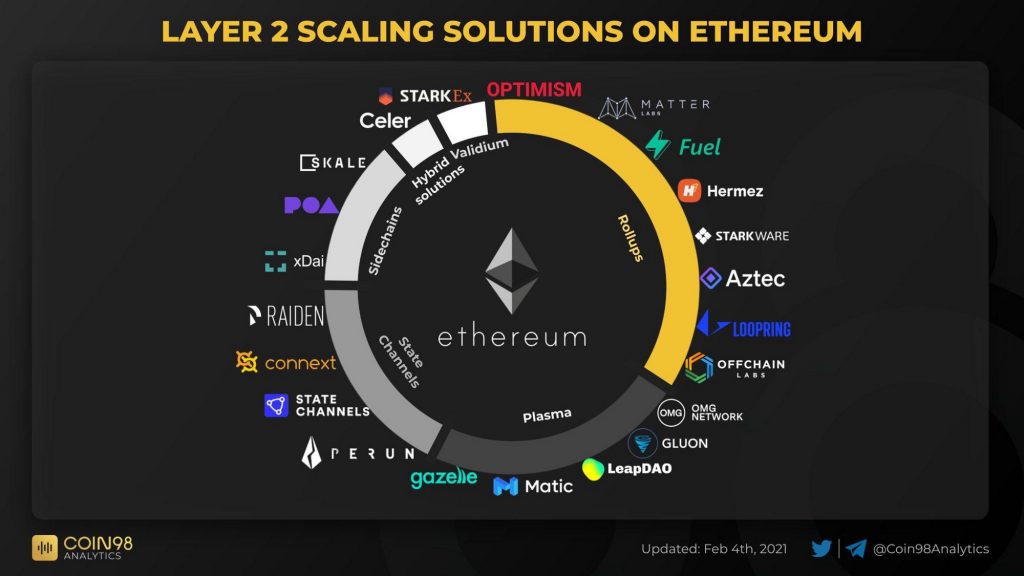

Ethereum Scalability and Layer 2 Solutions

Even with its massive success, Ethereum still faces some issues. Like all blockchains, one of Ethereum’s main problems is scalability. As the ecosystem evolves, several solutions are already in place to guarantee the scalability of performances with low transaction fees. 2021 was the year of layer-2 protocols, such as Polygon.

Layer 2 solutions allow scalability by handling transactions outside the Ethereum mainnet while still leveraging the robust security of the main network.

Some argue that the scalability concerns lay at the core of how Ethereum works. The Ethereum nodes approve transactions based on a secure yet resource-consuming process know as proof-of-work. Validating transaction based on complex mathematical gives the network a high degree of security but also leaves a significant environmental footprint. A shift to a proof-of-stake consensus algorithm would guarantee better performances, lower fees and a lower environmental impact. That’s the plan of Ethereum 2.0, which is already at an advanced stage.

The open question is whether this radical change will impact the security of the network or not.

Contrary to Ethereum, the Cardano team built the network using a proof-of-stake consensus mechanism to face scalability challenges since day one.

What is Cardano?

Like Vitalik Buterin anticipated the limitations of Bitcoin’s network, Charles Hoskinson understood quickly that Ethereum could not handle a global scale of the network the way it was designed.

Hoskinson was among the first developers to work on Ethereum. Then he started to build Cardano as an improved protocol. Hoskinson realised that he could improve on Ethereum while avoiding its main weaknesses. Cardano is a decentralised blockchain developed through evidence-based methods and peer-reviewed research.

Cardano offers robust smart contracts using an advance delegated proof-of-stake (DPoS) consensus mechanism. That is designed to be energy efficient and facilitate fast transactions with close to zero transaction fees. Another main difference between Ethereum vs Cardano is their coins supply. Cardano will only have a maximum of 45 billion coins in circulation, which contrasts with Ethereum’s unlimited supply.

Although Cardano’s launch took place in 20217, there was minimal development in terms of apps compared to Ethereum since then. That is mainly because smart contracts are not yet deployed on the mainnet. Yet, it currently ranks as the fifth-largest cryptocurrency by market cap. Investors have high expectations from the project, which have gone through a cumbersome development process over the past four years.

Cardano Development So Far

Cardano has been a work-in-progress project for four years now, and the roadmap is going through five distinct phases, namely:

- Foundation (Byron era)

- Decentralisation (Shelley era)

- Smart contracts (Goguen era)

- Scaling (Basho era)

- Governance (Voltaire era)

Cardano has already gone through the Byron and Shelley era (which introduced the proof-of-stake consensus algorithm) and is in the beginning stages of the Goguen era. Cardano recently announced the Alonzo hard-fork to implement smart contracts into the network and pave the way for decentralised applications. The system update is expected to go live sometime in the third quarter of 2021, and it’s raising a lot of attention on Cardano.

Cardano vs Ethereum, Which Should You Buy?

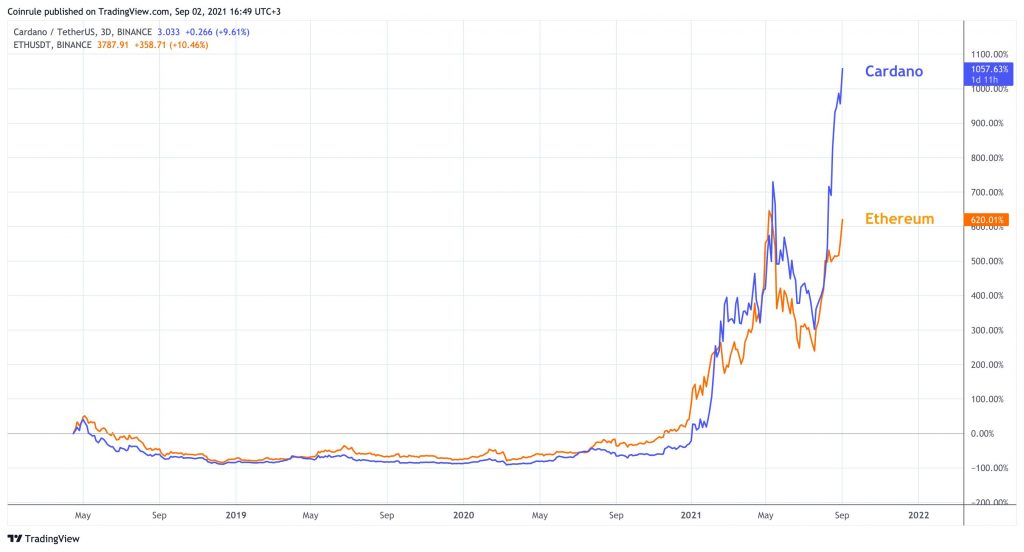

Both Ethereum and Cardano are promising projects that are likely here to stay in the crypto ecosystem, but which one is the better investment?

While it seems like a matter of Ethereum vs Cardano for many investors, about which of the two will win over the other, the reality may be different. Ethereum might be currently a safer alternative considering its wide adoption, its first-mover advantage and the fact that most other DeFi applications run on the Ethereum blockchain.

That being said, Cardano is an interesting option for investors looking for more upside potentials, especially if the time horizon of the investment is long-term. Of course, with more potentials returns also come higher risks. The roadmap Cardano has to go through to reach the full capability it has been promising for years is still incomplete, and many uncertainties are ahead. Cardano’s adoption has been relatively slow, but there is no denying that the platform has huge margins for growing.

Final Word

The crypto ecosystem has seen an impressive development in the past year, with many projects emerging as main players. As Polkadot, Binance Smart Chain, Atom, Terra, and Avax (to name a few) will develop further, it’s likely to expect more interoperability among these networks. The winner between Ethereum vs Cardano will probably be the network that will better connect with other ecosystems.

Whether you choose to invest in Ethereum or Cardano, you should realise that cryptocurrencies are a highly risky investment, so you should take your time to research both coins and consider their value proposition before making your choice.

Ethereum vs Cardano looks like a choice between the old vs the new. But while the old has the possibility of renewing itself, the new may become old in trying to reach its full capabilities.

In the end, you should assess your risk tolerance and invest accordingly!

DISCLAIMER

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies.