There is a Chinese curse which says “May you live in interesting times.” – like it or not, we are living through such times. The fear of COVID-19 ignited a global Coronavirus market crash in 2020. No asset seems to be safe anymore. What to buy and how to protect your portfolio in such uncertain times?

We are officially in a (legacy) Bear market.

The stock markets worldwide dropped at rates never seen before. This Coronavirus market crash already outpaced even the Great Financial Crisis in 2008. Back then the prices saw a more gradual drawdown. That is a very fascinating example of how the euphoria can turn quickly into a widespread panic selling.

Economies all over the world going into complete lockdown provide the perfect example of an unexpected black swan event. That refers to the event that no investor is taking into account in his trading strategy. When this happens, it completely changes the current and future scenario and requires new assessments for asset allocation.

Looking at the long-term chart of the SP500 Futures, we can notice that the 200 MA market clearly shows the divide between periods of Bear and Bull market. Last week the value of the index that gauges better than anyone else the state of the global economy broke this key level, ending, technically speaking, the longest Bull market of all times.

How long can it last?

In 2008, it took around one year from the price to breach the 200 MA and to reach the bottom. Of course, considering the magnitude of the current initial sell-off, it may take less to start a recovery. On the other side, the more severe drawdown might also indicate that this time the events unfolding could affect the economy even harder.

The truth is that no investor has a crystal ball to predict the future. These are the times when technical analysis can provide only little guidance, but it’s essential to keep an eye on the fundamentals. Currently, markets are pricing the lockdown of entire Europe and some areas in the US. Likely, investors are not yet considering the option of complete paralysis of the US economy. It’s still early to imagine footage of empty streets all over 50 states in the US. That’s what’s happening in Italy and other countries like Spain and France.

If that would happen, the consequences could be really ugly. Just as a comparison, during the worst recession since 1929, the US GDP fell at an annualized rate of 6.3% for three quarters, before starting its recovery. A complete shutdown of the economy could likely cause much worse figures. Early forecasts see the US GDP fall around 20-30% in Q2 2020 alone.

What can we expect after this Coronavirus market crash?

The panic spread quickly among investors. Before the first significant outbreaks in Europe, the general mood of the market was very complacent, and the Coronavirus seemed like a problem confined to China and nearby regions. When it was clear that the situation would have had a significant impact on China’s economy and other economies were about to suffer the same damages, the panic selling started a real Coronavirus market crash.

The drop ignited a rush for safety, but no asset class managed to provide the role of safe haven.

Even the gold price plunged. Investors tried to sell whatever liquid asset to raise cash and liquidity. The crypto market experienced no less stress. The market still perceives cryptocurrencies as a risky investment and times of uncertainty pose significant selling pressure on prices.

Central banks stepped in with a massive coordinated action to inject liquidity to arrest the panic. These bold and proactive actions likely will bring short term relief in the markets. Yet, volatility is here to stay for quite a long time, new outbreaks and news about the development of the pandemic will cause further stress.

During the next phase, investors will assess the outlook accurately and will rebalance their portfolios accordingly. That will generate further turbulence among the asset classes.

The key element to keep an eye on will be the release of data about the state of the global economy. Unemployment, debt, and default rates are all doomed to increase. Nevertheless, the scale of the increase will dictate the long-term effect of this crisis.

Which asset classes could outperform?

The theory teaches us that in times of crisis, investors tend to sell risky assets, such as stocks, to rebalance their portfolios in bonds, gold or cash. This time the reality could be slightly different.

Bonds are currently not the safest option as they have historically been. And that’s because of three main reasons:

- Ten years of ultra-accommodative monetary policies inflated the valuation considerably. Trillions of Dollar worth of fixed income instruments already trade with negative interest yields.

- The level of indebtedness of both corporates and government is at all-time high values, which is atypical for pre-depression times.

- Inflation is not in sight in the short term, but eventually, unprecedented liquidity injections will have consequences on price levels in the long-term. Longer-dated bonds (those not yet trading at negative rates) should underperform with such expectations.

What about gold?

The safest asset by definition underperformed in these early stages. The sharp price drop in the stock markets urged investors to raise as much cash as possible to cover losses and very likely also positions in gold were caught in this vicious cycle. Again, no inflation expected soon is not pushing investors to hedge from that risk by buying precious metals such as gold. Nonetheless, gold could be a reliable option for the long term, when inflation concerns arise.

Cash is king.

In times of uncertainty, those that hold liquidity usually are those able to protect their portfolio better and can catch the best opportunities. In particular, the Dollar is by far one of the best-performing assets among the legacy asset classes. The dollar-index jumped in the past days to values close to 20 years-high.

This trend will likely continue for the foreseeable future as a widespread shortage of Dollars is hitting large corporations. This issue is so meaningful that the FED had to introduce swap lines with other major central banks to prevent the situation from further deterioration.

How to take advantage of these opportunities?

The good news is that also for you trading crypto nowadays it’s relatively easy to diversify your holdings across different asset classes.

Gold, for example, has historically proved to represent a solid hedge in troubled times. You can easily invest in gold using PAX Gold, which is tradable on Kraken. A coin pegged to the price of a troy ounce of the precious metal and backed one-to-one to real bullions.

Speaking of stable coins, they already surged in interest in 2019, and likely their role in the ecosystem will strengthen further in the future.

There are plenty of options to hold digital Dollars — Tether, DAI, USDC, BUSD, PAX USD and more. What is very interesting is that in a world where interest rates are moving into negative figures, holding these coins and depositing them allows investors to achieve significant returns.

Passive income strategies are very popular, and investors can decide to use centralized or decentralized facilities according to their preferences and degree of trust towards the different protocols. The recent crypto market crash served as a severe stress-test, especially for the decentralized protocols. Market volatility is still the single biggest threat to lending platforms, but as always, the market never provides returns without any risk involved. All you should do is to pick an investment with the best risk/reward profile according to your preferences.

Renewed volatility in the FX market

Apart from the Dollar, keeping an eye also on other Currencies could provide interesting opportunities. Central banks are on the move, the race to devaluation has started, and new currency wars will take place. All this will ignite volatility and, as you know, that generates the best opportunities.

It’s probably not a coincidence that Kraken exchange recently introduced FX trading, adding nine currency pairs with more to follow in the future. That means that soon you will be able to diversify your holding into many different currencies also via Coinrule.

What about Crypto?

The crypto market took a severe hit last week. The general risk-off shift impacted cryptocurrencies hard. The relatively low liquidity worsened the drop and liquidations on leverage positions accelerated the downtrend.

The valuation of the broad crypto market fell back to key long-term levels. Looking at the crypto ecosystem alone, that could represent a buying opportunity to accumulate more. However, the broad economic landscape is very uncertain and could affect prices for more extended periods.

Since February, the correlation between Bitcoin and stocks has increased, and it’s now relatively high. Bear in mind, that the value is currently at around 0.1, which is still a relatively low correlation compared to other traditional assets classes. The notion of crypto as a hedge to a crisis of the legacy system seems to be not happening just yet. After all, that is reasonable as cryptocurrencies are not a broadly acknowledged asset class for investors.

It is better to keep an eye on this in the coming weeks to see if the perception of investors shifts as new events unfold.

The best strategies for these challenging times

Coinrule can help you get through these uncertain days, turning the stressful short term volatility into opportunities.

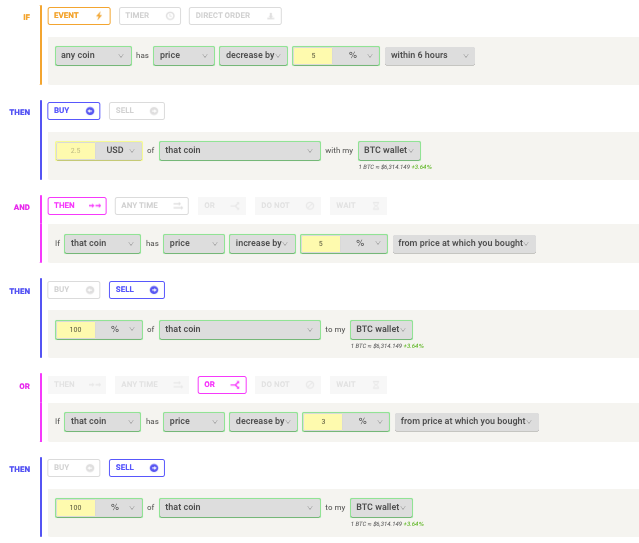

Rules like this allow you to catch small price moves without building large positions that can expose you to significant losses in case of sharp drawdowns.

Instead, if you see this as a good buy opportunity and you are willing to trade in a longer-term time frame. You could accumulate more of your favorite coins. In our template library, you will find many examples of setups that fit different trading styles.

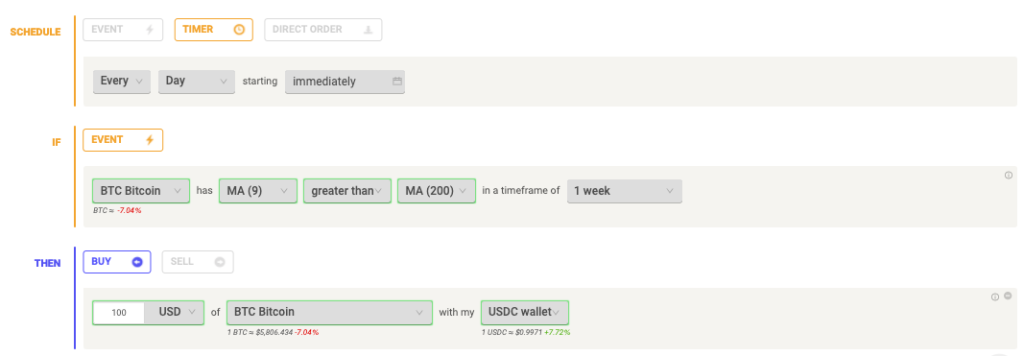

Bonus tip: the weekly 200 MA for Bitcoin’s price provided support during the 2018 Bear market and is still playing a crucial role these days. Coinrule added technical indicators to the trading engine in the past weeks, and you could use them to build a rule like the following.

Of course, never forget to add a stop loss to your trades to protect yourself from unexpected losses.

Rethink your investment strategy

The new global economic scenario requires a new assessment of the risk of your portfolio and an in-depth evaluation of the positioning in the months to come.

Cryptocurrencies are probably the asset class with the best risk/reward profile for the future. The broad concept of crypto was designed precisely for periods like this. This Coronavirus market crash will be the real stress test of its underlying philosophy. Moreover, crypto teams are well-positioned to continue their operations remotely with no discontinuities. Even if our team is spread across four different countries, no quarantine restriction is impacting our development process.

The single most threatening element is that cryptocurrencies experienced multiple crypto bear markets but never a legacy broad bear market. Keeping an eye on how the correlation between Bitcoin and stocks evolves will give a clue about how investors will actually perceive cryptocurrencies’ risk.

Meanwhile, the best way to react to this Coronavirus market crash is to diversify your portfolio. Add new defensive asset classes like gold, currencies and stable coins to your wallet to reduce the overall risk.

In times when adapting to new scenarios and acting proactively makes the difference, Coinrule also takes the challenge and is becoming a multi-asset trading platform.

Stay tuned…

and trade safe!

DISCLAIMER

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. You should independently verify all information in my post. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware that trading cryptocurrencies involve a significant degree of risk.