Crypto tax reporting can be a cumbersome process due to the high volume of transactions and multiple wallets involved for a given user. To make things easier, Coinrule has partnered up with CoinLedger, the highest-rated crypto tax software, to bring free tax reporting capabilities to our users.

All Coinrule users who signed up prior to December 31st, 2023, will receive an email with a link that will enable you to claim your free CoinLedger tax reports for the year.

How do crypto taxes work?

In most countries around the world, crypto is considered a form of property. When you generate income from selling or earning crypto, that income is subject to tax based on your personal income tax rate.

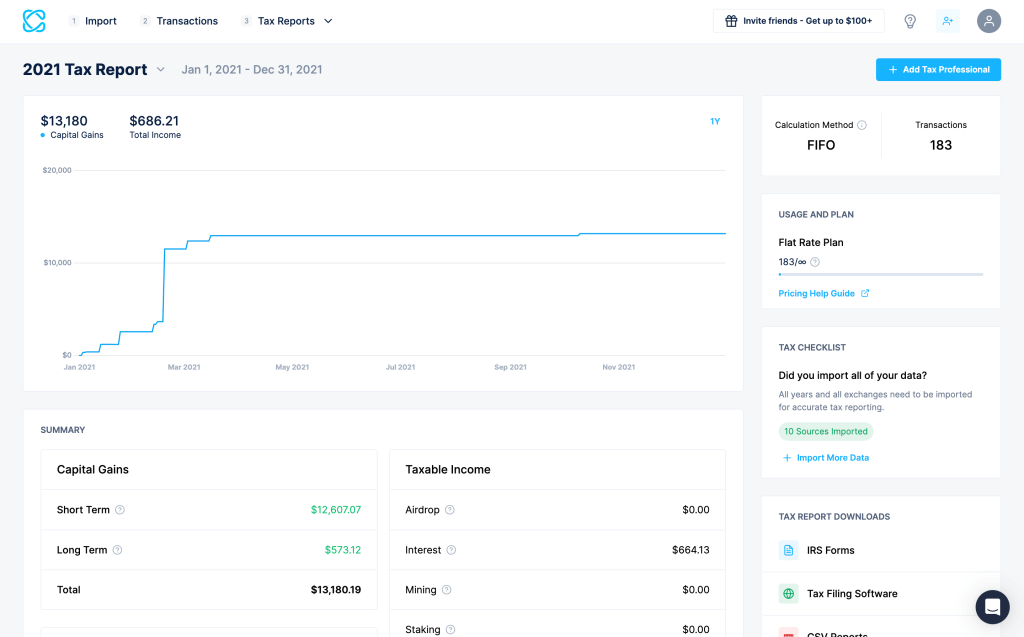

Capital Gains

When you sell or otherwise dispose of your crypto, you incur a capital gain or loss based on how the price of your crypto has fluctuated since you originally acquired it.

Ordinary Income

When you earn crypto, whether that’s from staking, mining, or a job, you incur income taxes based on the fair market value of the crypto at the time it was earned.

For deeper analysis of how crypto taxes work in your jurisdiction, you can reference these crypto tax guides.

How to use CoinLedger to automate your crypto tax reporting

CoinLedger is a leading cryptocurrency tax software company that has partnered with Coinrule to facilitate simpler tax calculations and reporting. You can follow the below steps to automatically generate your gains, losses, and income tax forms from your crypto transactions.

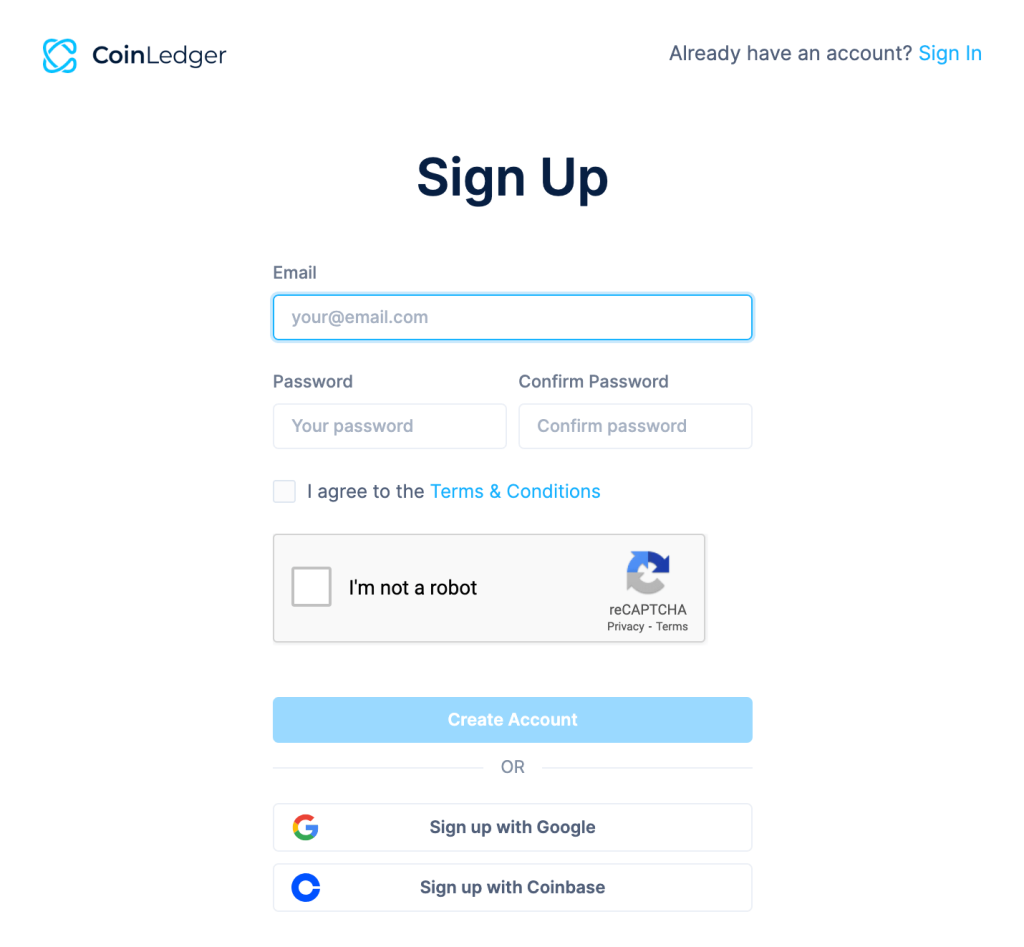

1. Create a free CoinLedger account by clicking the sign up link you received in an email from Coinrule

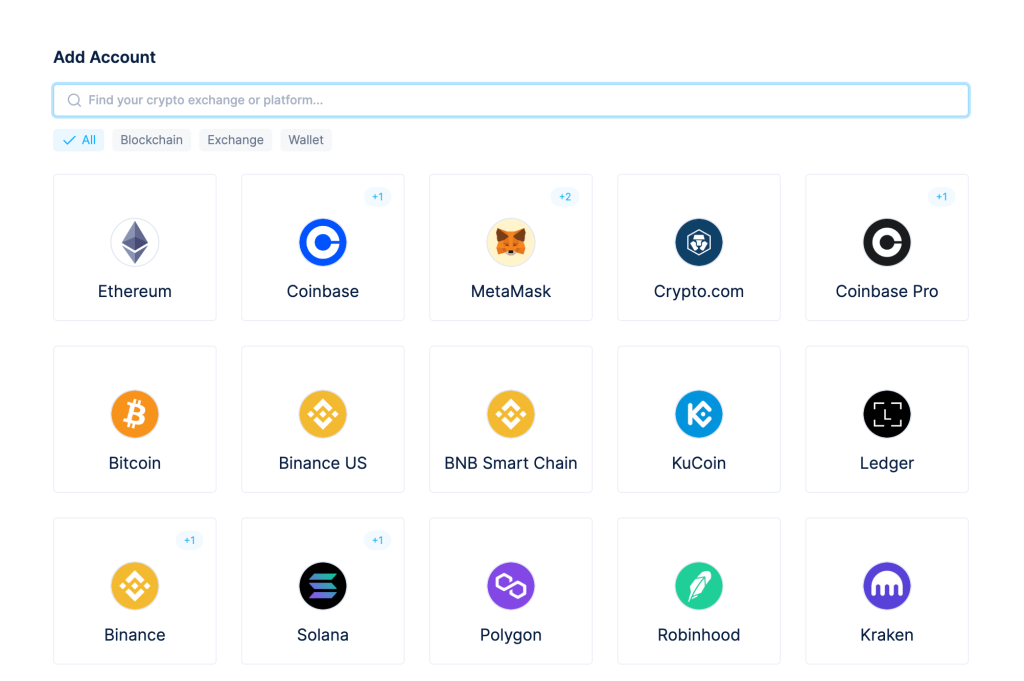

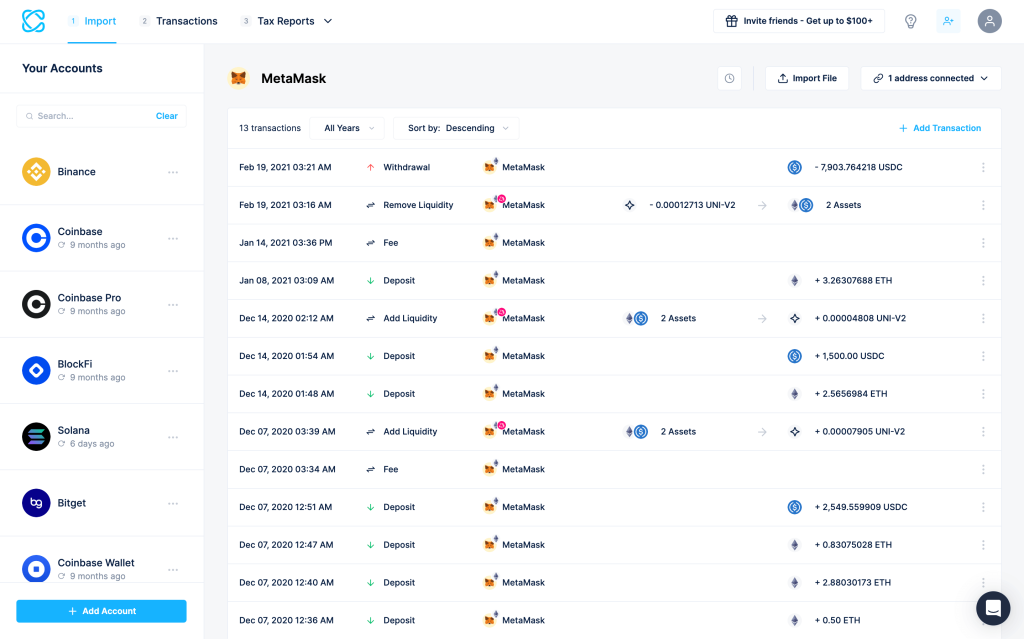

2. Add all wallets and exchanges you use to CoinLedger

3. Import your historical transactions by connecting your exchanges and entering your wallet addresses

4. Generate your tax reports with 1 click

And that’s it! Once you have imported your historical transactions to CoinLedger, you will be able to generate and download 2023 tax reports completely for free!

If you have specific tax questions regarding your situation, the CoinLedger team is happy to help! They can be reached at help[at]coinledger.io.

Frequently asked questions

What is CoinLedger?

CoinLedger is the highest rated cryptocurrency tax calculator and portfolio tracker used by 500,000+ investors all over the world. Founded in 2018, the platform automates the entire crypto tax reporting process.

Can I use the platform to calculate my taxes from Coinrule?

Yes! As a result of our partnership, Coinrule users can use CoinLedger to generate free tax reports for the 2023 year.

I have thousands of trades, can CoinLedger still handle my tax reporting for free?

Yes! CoinLedger has the ability to support users with hundreds of thousands of trades. Tax reports for 2023 are free to Coinrule users.