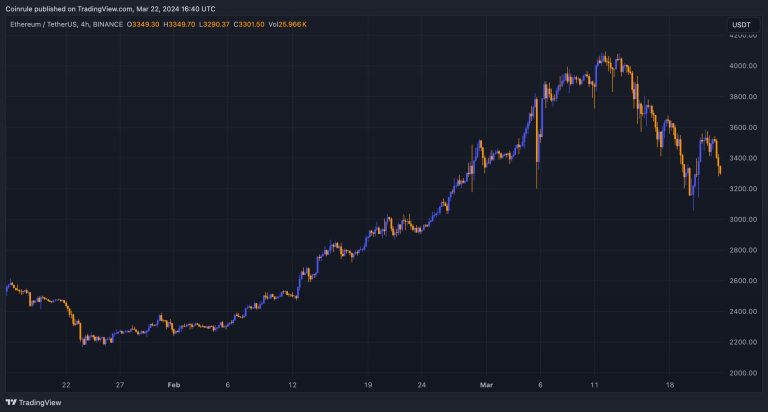

Ethereum has had some very turbulent weeks. For one, its price has finally been rallying. After months of underperforming versus new-narrative chains like Solana, Ethereum had started to steadily approach its All-Time High. One of the drivers of the excitement: The Dencun upgrade was introduced last week. The upgrade reduced the transaction costs for Ethereum Layer 2s, such as Arbitrum, Base, and Optimism. Transaction costs on Ethereum Layer 2s can now, in theory, start competing with Solana costs. The popularity of Coinbase’s own Layer 2, Base, grew substantially over the past week, even causing an outage of Coinbase’s Smart Wallet.

Another positive news is the excitement around a possible Ethereum ETF. One of the applicants, Fidelity, has added Ethereum staking to its ETF application. If the SEC accepts staking, then funds that stake will likely be able to charge no fees for their Ethereum ETFs. They would then subtract the yield of staking from the return on the fund. This would be a big deal. However, the odds of an ETF approval in May are dropping fast.

This comes in the wake of what is the bad news: the SEC has been issuing subpoenas to crypto companies including the Ethereum Foundation. Clearly, the organization sees its last chance to put decentralized finance back into the box approaching. The case mainly revolves around Ethereum’s switch to a “Proof-of-Stake” consensus algorithm which, supposedly, makes it more similar to an investment contract and therefore to security. Luckily, the SEC has a poor track record when it comes to taking crypto companies to court. Nonetheless, this has somewhat dampened market enthusiasm.

But in what is maybe the most long-term exciting news for Ethereum, BlackRock filed a document with the SEC last Thursday for an Institutional Digital Liquidity Fund called BUIDL. Securitize will act as the fund’s broker. The funds investment strategy is to invest in tokenized assets on Ethereum. The fund’s wallet on the Ethereum blockchain holds 100 million USDC available for investment. Currently, there is no information available on the exact investments that will take place within the Ethereum ecosystem. But that the largest asset management firm in the world openly sets up a fund on-chain is massively bullish.

Ethereum’s price has moved up and down along with the news over the past weeks. Is there still hope that the ETF deadline of May will be met with BlackRock’s near-perfect ETF approval track record, and BUIDL being launched on Ethereum? If yes, expect Ethereum to go directly to the moon. Either way, we’ll find out in 63 days.