The last few months have been a spaceship for those of us lucky enough to be trading crypto. The Bitcoin ETF has been approved. Markets have gone up multiples. Bitcoin hit a new all-time high. Airdrops of newly launched projects like Celestia, Dymension, Jupiter, Ethena and Wormhole have filled the pockets of power users. On top of it all, so-called memecoins such as dogwifhat (WIF) and others quickly rallied to reach millions and even billions in market cap.

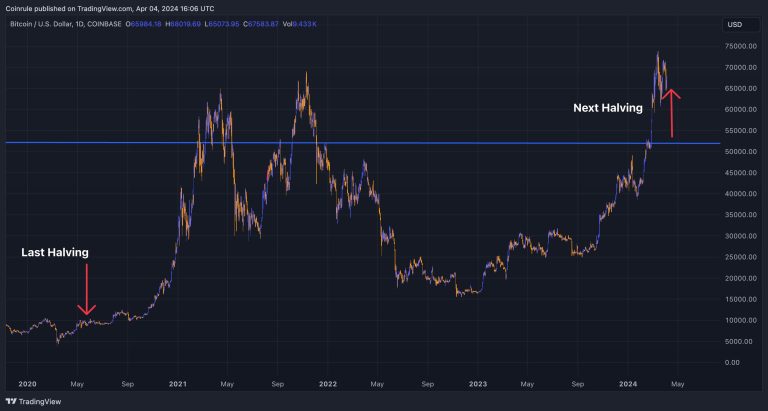

Normally, these kind of crypto rallies happen after a Bitcoin halving, not before. The Bitcoin halving occurs roughly every 4-years and sees the Bitcoin supply issuance rate halve. The next one is happening in April. The average 1-month BTC return after the 3 previous halvings is 4.2%. 6 months post-halving, the average return is 360%. It seems clear that the bull market narrative is bound to continue. Or is it?

There are two opposing views as to what will happen next. Even though the Bitcoin price briefly crossed its all-time-high, it did not stay above it for long. Nor did the parabolic rally continue much further. In the past, once Bitcoin hit an all-time-high it usually quickly ran up well past it. The number every trader has in their eyes is the $100,000 price mark for 1 BTC. One possible view for the next months is that the recent drop to the mid 60s range for BTC might well just be another accumulation period. If the price ranges here, it might break out to the upside after the halving.

if that happens, the assumption is that the market exuberance would continue unstopped for the next few months. As BTC hits higher and higher prices, retail joins the party and the Crypto market cap doubles and triples in the process. Then, as traders become over-leveraged, profit-taking and eventually something in the system breaking stops the rally and incites a new bear cycle. The main difference here would be that this would play out over a shorter time-frame than previous crypto cycles have gone through.

The other view is that the market has already rallied too high too quickly and we are now overextended. If looking at longer time-frames, Bitcoin does appear somewhat overbought. From here, the price could experience its first bull market dip and probably reach the $52k support levels. Buying pressure would then slowly build up from here and the bull market would resume towards the end of the year. This would be the more typical route of Crypto bull markets. Potentially, the highs reached in such a scenario in 2025 would be even higher. But short-term pain would certainly emerge as prices across the board would take a hit. If BTC drops, expect your favourite memecoins to drop much further. It pays to be cautious around the halving.