At Coinrule, we work every day to deliver to our users the best tools to improve their trading performances.

Today we are happy to announce a major upgrade of our trading engine, the direct integration with our connected exchanges via WebSocket.

What does that mean?

So far, we relied on a third-party data provider that was passing on aggregate prices of all coins. Aggregate prices are less volatile and are a good option for medium to long term trading strategies.

But what if I want to jump into a price rise promptly or react quickly to a sudden drop? In those situations, the aggregate price is not the best source to trade the move properly.

Here comes the solution. We are now able to retrieve in real-time all the price updates from each exchange with no significant latency. Every trade is now accurately checked by our trading bot. This update will enable two main significant improvements for your rules:

- Your conditions can be triggered immediately when the selected price is traded on the market.

- If the rule activates with better timing, also your orders will get executed exactly accordingly to your trading plan.

How do our price triggers work?

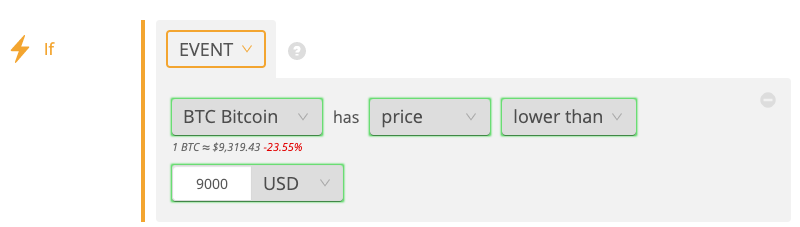

There are three different ways to set up your conditions based on prices.

First, you can define a specific price level below or above which the rule will activate and send an order to the market. This is very useful, for example, when you want to accumulate your coins at reasonable prices, or when you want to set up a stop loss on your coins.

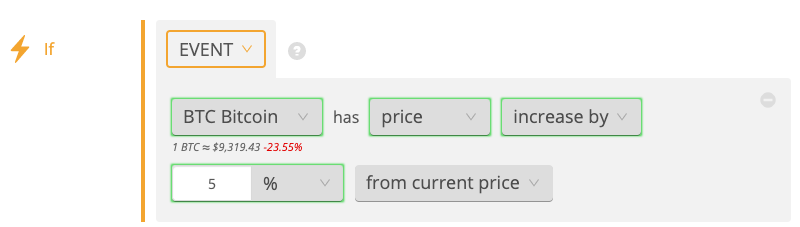

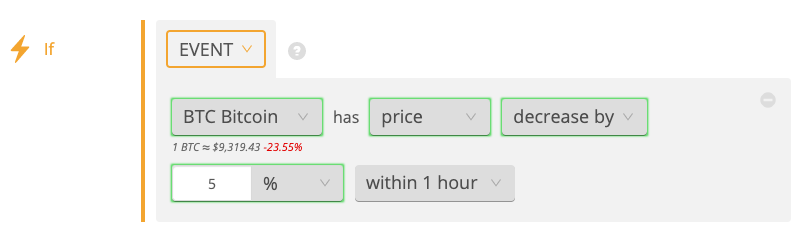

Alternatively, your rule can be triggered by a percentage price move. To meet all the different traders’ needs, there are two ways to set up a trigger based on a price percentage.

From Current price. When you select this option, we take a snapshot of the current market price, and this will be the static reference to calculate the price increase or decrease. This option makes mainly sense when the market doesn’t have a clear direction. In this case, for example, you can buy when a specific price drop happens and then sell when the price rebounds.

Let’s take another example. If you expect a breakout, but you don’t have a clear idea of which price will ignite the uptrend, maybe setting up a price percentage can help you implement your trading idea quickly.

Within a selected time frame. When the market is trending (both lower or higher) it would be more appropriate to reset the reference period to follow the price appropriately.

For example, when selecting from the dropdown “within one hour”, the bot will take a snapshot of the current market price every hour and then compare the following prices with that reference. Set this parameter according to the time frame of your trading strategy.

More extended time frames make sense when you are planning a long-term strategy, the shorter ones, instead, allow you to catch fast price moves like a sudden price drop or a spike.

Many users asked for this upgrade, and we are now thrilled to have accomplished this delivery to meet their requests.

This is one of those technical upgrades that won’t be visible, but you will undoubtedly notice and appreciate the renewed efficiency of our rules!

Create now the best Coinrule automated strategy ever!

Trade safe!