The start of each new year comes with the opportunity to analyse what you have achieved in the previous one, and to set up goals for the new year. If you are reading this, then chances are that you realise that there is a certain margin of improvement for you to become a better trader or investor. Well, it’s the right time to set up some goals for this new year in Crypto and improve your trading systems. Here are some trading tips to avoid the most common mistakes crypto traders make.

2020 looks like a promising year for cryptocurrencies, so why not approaching it in the very best way to catch the best of it?

Here are some resolutions you should absolutely include in your Crypto not-do-do list.

1) Avoid risking more money than you can afford to lose.

You may already have this in your mind, but you can never stress enough how important it is to have clear rules on money management in your strategies.

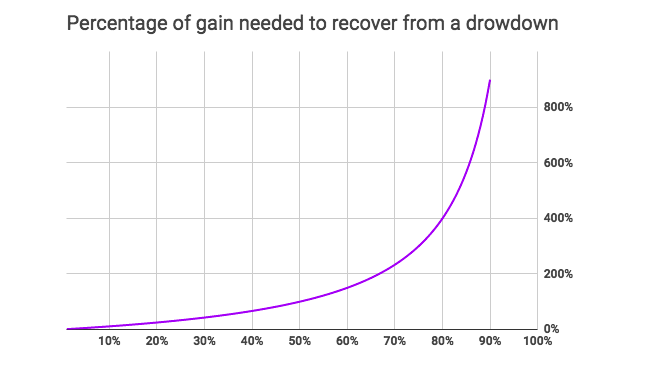

That applies not only to the overall capital you decide to invest. You also should make sure that none of your trades could cause such a loss that would destroy your entire portfolio. Remember, it takes a 25% profit to balance a 20% previous loss, and a 100% gain to break-even from a 50% price drop. If you see it from this point of you, it gets clear how not losing money is an even higher priority to making money itself.

The higher the exposure is, the more you could feel pressured and stressed. The idea of losing more money than you can afford would compromise your decision process and directly impact your trading system.

One tip could be to start trading with very low amounts and then increase the size of the orders gradually. Don’t rush into large profits too soon. Be cautious. Trading is a marathon, don’t quit after a few miles!

2) Never act without a clear trading plan.

Would you be able to do your daily job without a schedule or any structure? All the human activities, one way or another, must be organised and should work according to a more or less defined plan. Trading is no less subject to this general rule.

In a previous article, I defined step-by-step, which would be the elements that every trader or investor should take into account before making his or her investments decisions.

First, you need to analyse market conditions and understand the peculiar aspects of the asset you are going to trade. Also, at this stage, it would be crucial to assess which would be the variables that could have an impact on the asset you are going to trade. Predicting these factors in a clear way gives you a better understanding of the “big picture” you are going to play in.

You have to set the strategy you believe can represent the best fit for the trading scenario you defined in the previous step. It’s worth noticing that the Four-Season rule doesn’t exist and a trading plan could return high profits in some periods yet produce losses in other. Not only is it important to know how to implement a plan, but it’s essential to recognise when to use it. Just like you know when it’s more appropriate to use a screw or a hammer.

When you chose your strategy, one additional step would be to backtest it so you can make the final adjustments based on results coming from historical data. Tweaking and optimising some parameters could improve your results significantly.

Finally, you are ready to run your strategy on the market!

3) Don’t try many different trading strategies.

Getting lost in the number of available strategies is also among the most common mistakes crypto traders make. There are dozens of technical indicators nowadays available to traders, only to include those most popular. There are endless possibilities of strategies that traders could implement.

You should stay focus on a limited number of trading strategies observing carefully how they work, and what returns they yield. Bear in mind that the first results might not provide definitive evidence on the reliability of the strategy.

As we said, if the rule produces a loss, that doesn’t necessarily mean that it’s a poor strategy. Maybe the timing was wrong, and you could still use it in different market conditions. Also, no trading strategy has a 100% rate of success. Assessing a strategy too early without a proper analysis could be misleading.

Additionally, trying out many strategies could lead you to trade more than necessary. Overtrading is a common mistake, especially for newbies. Know your trading strategies better, leverage their strengths and improve their weaknesses!

4) Don’t follow blindly someone else’s trading advice.

Given the massive flood of news we are exposed to every day, it’s common to receive trading pieces of advice or investment suggestions from many different sources. You can get trading signals and price targets through tweets, Telegram groups, and comments in forum discussions, just to name a few.

You should filter these ideas to focus only on those that could be actually useful for you. There are two main aspects to take into account:

- Not all trading ideas you will read or see are produced by experienced traders. There is no guarantee that there could be a sound basis backing that trading strategy.

- Even if the strategy has a solid foundation, it does not mean it would be savvy for you to apply it blindly.

Each trading strategy comes with specific considerations related to the position sizing, risk management, time horizon of the investment and target profit. Often, all these variables are not explicit and most of the time you get an entry price and a target price. In the best case, you also get a stop loss level, but there could be other aspects that you are still missing and that could be essential for the success of the plan.

5) Don’t allow feelings to ever lead your decisions!

By their own nature, humans tend to be driven by emotions and feelings. These elements are by far the worst enemies for a trader.

Every cryptocurrency trader has a different reaction to the same price movement. Fear, despair, euphoria and greed are feelings that each of you experiences even within the same day. This roller-coaster of emotions will have a negative effect on your ability to make rational decisions.

That’s why trading bots, like those you can build with Coinrule, have the potential to improve your trading results significantly if you are already an experienced trader, or it can provide an easier way to get into trading as a beginner.

One of the best ways to overcome the risk to be overwhelmed by our own emotions is to follow strictly all the previous tips presented in this article. Implementing a precise risk management approach and laying out a rational trading strategy will help you improve your trading performances significantly.

Avoid the 5 common mistakes crypto traders make and you are on a path to success in 2020! Ready to put in place all these tips? Create your automated trading rule now!

Trade safe!