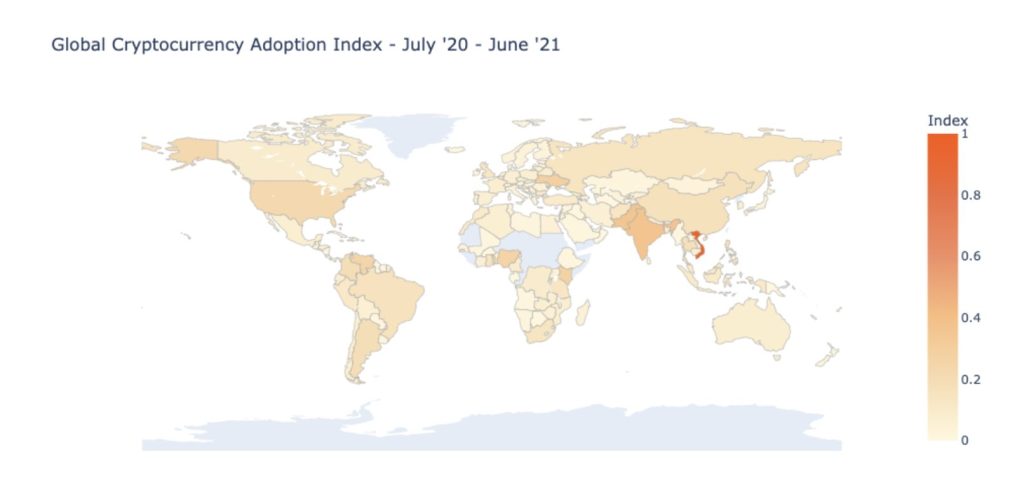

Recently, the adoption of cryptocurrencies has increased rapidly. 2021 Chainalysis Global Crypto Adoption Index shows that worldwide adoption of cryptocurrency jumped over 880%. As a result, the government has developed an interest in monitoring and regulating the cryptocurrency space. Crypto assets improve the economic strength of their holders, and as such, one of the areas of regulation is the crypto taxation of all blockchain-related activities.

With increasing profits coming from many months of sustained price increases, the crypto taxation topic becomes relevant for both traders and governments.

Each country its crypto taxation

Different countries have rules on how cryptocurrency activities should be taxed, and the difference in the applicable regulations shows how they define and treat crypto assets. The majority characterizes them as properties, not as currency, such that any profits realized from the sales or trade are subject to taxes.

The US

For instance, in the United States, profits gained from trading cryptocurrency are subject to capital gains tax. If you purchase goods or services with Bitcoin and the value of Bitcoin spent is higher than what you got it for, you have to pay tax on your spending.

Portugal

However, some countries do not view or try to equate crypto assets as properties or traditional financial assets like stocks and have adopted a more liberal approach to understanding and taxing novel crypto assets.

One of such is Portugal, with one of the most friendly crypto taxations. Portugal views cryptocurrency as a form of payment, i.e., like every other currency and not a financial asset. Thus, profits from trading cryptocurrency are not subject to capital gains tax. The only exception is businesses that receive payments in cryptocurrency as it is subjected to income tax, just like fiat currency payments.

Germany

Another such country is Germany which regards cryptocurrency as private money rather than a property, currency or legal tender. In Germany, residents who have held cryptocurrencies for over a year are tax exempt regardless of the amount. However, traders who hold crypto assets for a shorter time would have to pay capital gains tax unless the transaction is lower than 600 Euros. The rule is different for businesses as they have to pay capital gains tax on the profits from crypto trading.

Belarus

Belarus, on the other hand, takes a very liberal approach to taxing cryptocurrencies. In 2018, the country implemented a new law legalizing cryptocurrency activities and exempting individuals and businesses from paying taxes till 2023. Mining and trading cryptocurrencies are deemed personal investments in Belarus and are exempt from income and capital gains tax.

Malaysia

In Malaysia, Cryptocurrencies are not considered to be assets. Thus their transactions are tax exempt. Here, an important distinction is made between profits derived from active and passive crypto transactions trading. Profits from a trade that is passive, occasional or unsystematic are completely tax exempt. When the trading is active, systematic, planned or part of a profession, the profits are regarded as revenue for income tax.

Different countries have taken different approaches to tax cryptocurrency, so traders need to determine if and how their crypto activities are taxed.

Keeping an eye on how crypto taxation evolves around the world will be an important sign of the whole ecosystem maturing and going mainstream.

Many investors are still pushed back from investing in crypto because of the uncertainties of crypto taxation in their country. This will likely change soon!