Whether you are trading stocks or cryptocurrencies, you always have to pay attention to trends. Seasoned traders know well that “trend is your friend.” Yet, that may still not be enough to survive the cryptocurrency’s volatility. Here are seven tips for trading in the 2021 bull market.

One thing about financial markets is that prices can experience significant swings. This year alone, there have been several fluctuations in the crypto market.

Despite this, experienced traders translate volatility into opportunities thanks to these seven tips. This article will take a deep dive and provide a straightforward guide to trading crypto in the 2021 bull market.

Bull and Bear market

In a bear market, prices trend down. This often happens because there is a negative market sentiment and traders feel less confident about the market. When this happens, more people are selling. This subsequently causes a decrease in prices, which leads to more pessimism and, therefore, more selling.

Conversely, a bull market is a condition in which market prices trend up. A bullish trend occurs when there is a significant, sustained increase in market prices across the board. However, it takes proper insight to predict an impending bull market. A bull market is marked by trader/investor confidence about the market – it describes a state of overall optimism about prices, leading to price rises and even more optimism.

Did you know? Both names are derived from the direction from which that animal attacks. The bull thrusts its horns upward, while the bear clamps down on its prey.

The 2021 crypto market is an excellent example of a bull market as there has been intense upward market activity. However, unlike traditional markets, the crypto space is influenced by several factors. Understanding these factors can help you become a better trader.

This article will be going through 7 tips for trading in the 2021 bull market.

1. Follow Trends, Not Pumps

Trading is not about getting rich quickly off the markets. Many people have learned this the hard way this year. However, you do not have to. Seasoned investors and the top 1% (those that have the highest stakes) are the ones who profit from others chasing pumps.

Also, bull markets are noisy because of the excitement, and you must sift through the daily noise. The market fluctuations this year have happened for several unpredictable reasons. Elon’s tweets, Binance’s FUD, and China’s ban had a major role in how the price moved over the recent months. There’s no need to feel bad about missing out on previous and even future rallies. Instead, please pay attention to the trends and play it smart. New opportunities come every day!

In bull markets, it is best to ride the trends. Automated strategies can help you keep tabs on the market and enter the right trades while limiting losses.

2. Don’t be Tempted to Margin Trade

Margin trading is a great way to multiply your position sizes by increasing your leverage. However, often the risks offset the benefits of margin trading. You can suddenly face huge losses when liquidation hits. A liquidation occurs when the exchange closes the position, leaving the trader with a loss that he won’t recover if the market rebounds back higher.

Many newbies make the mistake of over-leveraging their positions in margin trading. The fear of losing everything and seeing your portfolio go down to zero should be enough reason to avoid margin trading right now.

For a rough example, with 10x leverage, a 10% move against you wipes you out, and with 100x leverage, a 1% move against you liquidates your entire capital. The actual numbers are even scarier once you factor in trading commissions and liquidation fees.

You can trade using leverage with Coinrule to increase your returns potentially, but never forget always to use a low degree of leverage.

3. Have a Trading Strategy

That may sound like something many give for granted but it’s likely the most important among these seven tips for trading.

Trading without a plan is planning to fail. Success in the crypto market is about understanding market patterns and then using them to make the right trades. Patterns help you predict moves, and you can only see these patterns when you have a defined trading strategy.

A strategy or plan helps you do your due diligence before entering into trades. It is also a great way to limit the number of losses, prevent catastrophic losses, and make outsized gains.

One of the main advantages of using an automated trading system is that you can easily adhere to the initial plan without stress or emotions interfering with your trading decisions.

4. Do Your Own Research

There is a lot of noise about crypto these days on the internet and mainstream media. For most, it is not easy to shift between what’s valuable and what is not. This is why we suggest that you always do your own research before entering into any trades, especially for lower-priced cryptos with small market cap coins.

Beginners often look to others for crypto recommendations and end up losing money. When you do your own research, you understand each coin better and are more knowledgeable about entering and exit trades.

Don’t confuse genuine advice with a shilling. Don’t forget that many are interested in adding hype to the coins they have large stakes in.

5. Watch for Reversals

The truth is that there are tons of available information, guides, and recommendations out there. However, to make sense of it all, you need to apply what you know correctly.

In a bull market, you need to be on the lookout for sharp reversals constantly. This helps you determine the best time to exit trades or take some profits off the table.

It is also crucial to have price targets and stop losses as part of your trading plan. Getting a good entry is only half the work. You also need to know when to exit the trade strategically, whether the trade goes for you or against you.

6. Don’t Trade based on Emotions

The markets are highly volatile and, when it comes to trading, it is best to deal with facts and data instead of feelings. Traders regularly have to deal with emotions like fear and greed. It is essential to be ready for any possible scenario. You cannot afford to trade based on your feelings.

To make money in a bullish market like the one we currently have, you need discipline. That’s why you need to always stick to your trading plan.

Bots have no feelings. They execute trades in cold blood based on the setup of your trading system. By setting clear, logical rules into algorithms, you can cut your losers and ride your winners much more effectively, efficiently, and emotionlessly.

7. Diversification is Crucial

Diversification is one of the best tips for any investor in today’s crypto market. You can reduce risk by allocating funds across different assets. This way, you don’t have to depend on the performance of a single asset.

Furthermore, for diversification to be more effective, you should try holding assets uncorrelated from each other.

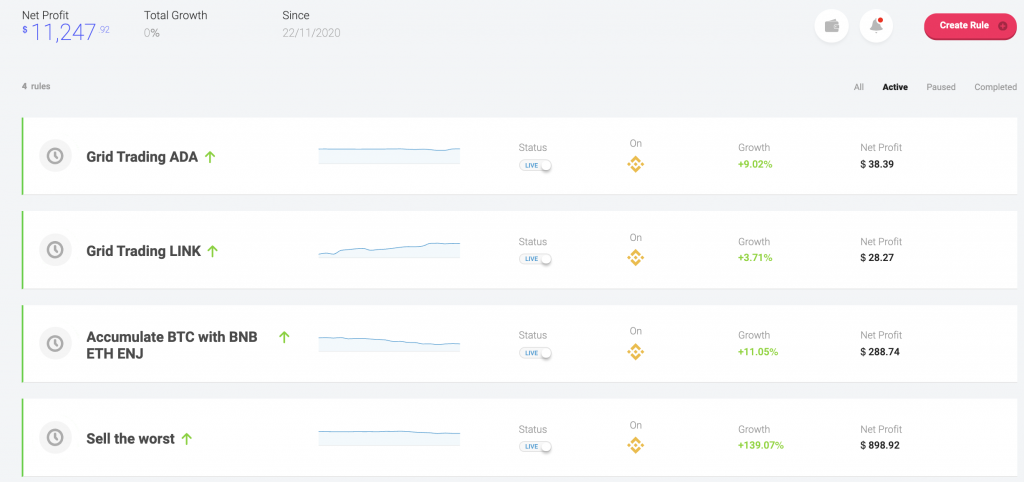

To take it one step further, Coinrule helps you diversify across strategies. The pros don’t tell you that they are never just buying or just selling – they are often doing both simultaneously to trim the risk at any time.

You can run multiple strategies at the same time with Coinrule. One may be buying dips on your favorite coin, another may scalp short-term trades, while another is rebalancing your portfolio. You have maximum flexibility to manage your wallet.

Rounding Up

Cryptocurrencies are reshaping the financial world, and every day, more people are looking to trade them. That is excellent news for the whole ecosystem because it means more market activity, liquidity, and efficiency.

However, volatility is the primary concern with the crypto market, especially during unprecedented times like these. If you pay attention to these seven tips for trading, you ensure that you make the best of the market trends.

At Coinrule, we help you make the best trades. We provide a holistic view of the markets and help you to trade better.

DISCLAIMER

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies.