Cryptocurrencies and Blockchain promise a new digital and decentralized paradigm for the global economy and our daily lives. While adoption improves every year at increasingly growing rates, Crypto still relies heavily on the existence of efficient gateways with Fiat currencies. Whether you are a seasoned crypto trader, or you are approaching the space for the first time, you will need to fund once in a while your crypto wallet with fresh capital. Then the common question is: what is the cheapest way to buy Crypto with Fiat currencies?

When looking to convert Fiat to Crypto, it is always essential to get the most out of your money, and this can be difficult because most exchanges do charge a hefty transaction fee. Choosing the best option to fund your Crypto wallet consists of finding the perfect balance between the convenience of the cost of the transaction and the supported funding method. The most common ways to fund a crypto wallet are payment cards (credit or debit) or bank transfers.

Beware of Hidden Fees.

Arguably, Coinbase is the most well-known crypto company. When assessing the cheapest way to buy Crypto with Fiat, it certainly is on top of the list of possibilities for a vast portion of investors and traders. Coinbase represents a secure and user-friendly Fiat-to-Crypto gateway. They offer very convenient options for funding the account using bank transfers.

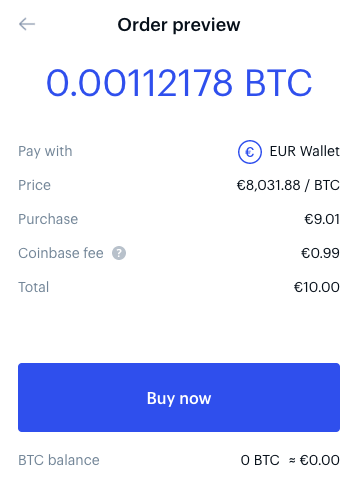

Coinbase’s reputation, however, translates into a premium price of which users are often not aware. Coinbase’s price structure is indeed not as user-friendly as its interface. You can buy Bitcoin with Euro in just a few clicks yet at a relatively high cost. In the following example, I simulated a buy order for €10.

Coinbase applies minimum fixed fees on orders, in this case, €0.99 (equal to about 10% of the order). On top of that, the price at which I would buy Bitcoin is €8,031, which is 0.51% higher than the market price on Coinbase Pro or Kraken (around €7,990).

Increasing the size of the order only slightly smoothes the cost of the transaction. If you purchase $50 worth of BTC, Coinbase charges you $2.51 in transaction fees, approximately 5.02%. Not taking into account the mark-up applied to the price, which increases the overall cost further.

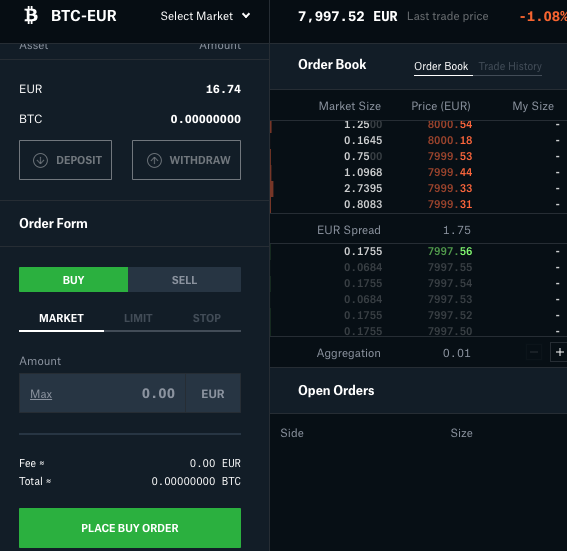

If you use Coinbase, it’s much cheaper to buy crypto on Coinbase Pro. You log in with the same credential buy you have access to much better prices. You trade directly with other traders so you can get the real market price for your coins. If you want to buy immediately select “market” as price parameter and the amount you want to buy. Here is an example of how it would look on the trading interface of Coinbase Pro.

The main difference here is that in the first example Coinbase sells you the coin, in the second, you trade on the exchange with other traders as counterparties. That gives you the possibility of saving a significant amount of money. Other popular options are Kraken and Bitpanda Pro.

What are the best alternatives to Coinbase?

While claiming to be a global company, Coinbase currently covers mostly Europe, North America, Singapore and Australia. That excludes some of the geographical areas that have the highest levels of crypto adoptions. Investors in emerging markets, especially Latin America and Asia, struggle daily with finding the most efficient and cheapest way to buy Crypto with Fiat.

Not All Fiat Currencies Are Equal.

Binance is trying to solve this, regularly adding new currencies as funding options for their wallets. Binance is likely the global exchange that covers the largest number of fiat currencies supported. Here is a list of non-USD Fiat currencies supported. In some cases, Binance allows topping up the accounts using bank transfers directly, but most of the time, the gateway Fiat-to-Crypto works via payment cards, debit or credit.

Funding your wallet via card payments allows the funds to be credited in real-time so that the exchange can settle the purchase of the coins immediately. The main limitation for bank transfers is the processing time, where a transfer can take up to three working days to go through. On the other hand, SEPA transfers within the Euro Area don’t carry any additional cost. The exchange will credit the same amount of funds you deposited. Only in the US, when using a Wire Transfer, the deposit is subject to a fee, usually around 0.05% of the amount.

Nevertheless, especially if you wish to buy Crypto most quickly, card payment is the optimal solution. Of course, that doesn’t come cheap. Processing the payment can be expensive as it involves many intermediaries. On some exchanges, the transaction fees can rise up to 6%. So make sure you can assess the transaction fee before confirming the payment.

For investors looking for seamless user-experience and the possibility of buying Crypto in just a few clicks. Brave Browser has gone above and beyond to provide convenience in the purchase of Crypto. In partnership with Binance, the company launched a new way to buy Crypto directly on the Brave Browser. All you need to do is connect your Binance account and then create buy orders easily by selecting the type of coin you want to purchase. Then you can set the quantity to buy, and the coins will be added to your wallet almost straight away.

Do you really own the Crypto you bought?

Centralized exchanges run on the servers of a private entity. While the coins you trade rely on decentralized technology, you interact with your assets through an intermediary, the exchange.

This brings us to one of the most common phrases used in the world of Crypto: “Not Your Keys, Not Your Crypto” by Andreas Antonopoulos. The quote is suggesting that if you are not storing your private keys, then you don’t have any guaranteed ownership of your coins. The exchange stores all your data, including your Private and Public Key. In other words, if hackers gain access to these keys, they can steal your funds!

Nowadays, global Crypto exchanges have advanced security measures in place to prevent malicious attacks. Even in the unlikely event of a hack often they set up insurances to protect users from losses. For instance, Binance’s insurance fund is so well-known in the crypto industry that its acronym (SAFU) inspired countless memes.

Other than hacking, other cases may lead to a situation where you lose access to your funds. What if the exchange goes bankrupt or regulators freeze the exchanges’ account?

Buy Crypto Directly Into Your OWN Wallet.

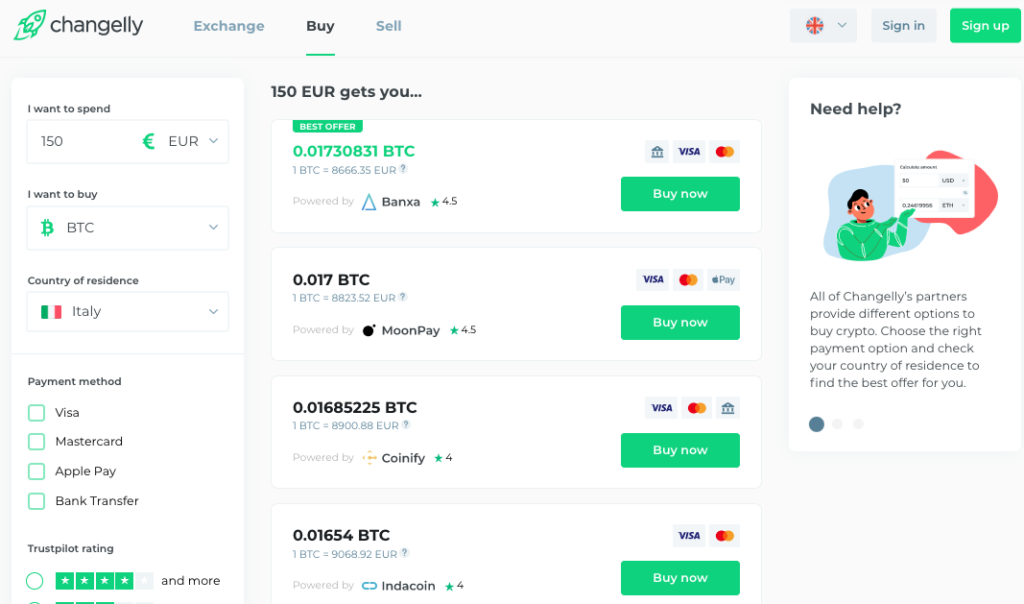

Assuming you are not willing to trade all your coins frequently and security is a top priority for you, buying Crypto and receiving the coins directly into a decentralized wallet may be the best option for your needs. Providers like Changelly rely on a peer-to-peer protocol that sends the coins directly to your wallet, once the payment is complete.

Changelly has partnered up with third-party service providers to process your payments. Before confirming the transaction, you have the opportunity of reviewing the option you prefer based on transaction fees and price offered. In this case, you are the sole owner of your private keys. Therefore, you are your own bank.

Another popular alternative if you want to avoid centralized entities and you are not comfortable with KYC, which stands for Know-Your-Customer, is to buy Crypto on a peer-to-peer marketplace. Regulations worldwide are becoming increasingly restrictive. Each company managing money on behalf of users needs to collect data to track where the funds come from. When companies operate on a global scale, they must abide by the local regulations in each market they work in. However, when using peer-to-peer applications, you don’t require a KYC as the transaction happens between single users.

The most popular platform that offers such service is LocalBitcoins. Buyers and sellers post their price and payment method requests, allowing the maximum degree of flexibility for the transaction. When both parties agree on the terms, the payment is processed, and the seller sends the coins directly into the buyer’s wallet.

Key Aspects To Consider.

When assessing which is the cheapest way to buy Crypto with Fiat for your needs, there are four main aspects to keep an eye on before confirming the transaction.

Funding method

Bank transfers are much cheaper than card payments, yet they are slower. In some cases, you don’t have the rush to fund your wallet; in other instances, you may be willing to pay a premium price for a faster transaction. Moreover, depending on your location, card payment could be the only viable option to pay with your local currency.

Price offered

Pay attention to the price of the asset displayed at the moment of the purchase. When buying directly from an Exchange, such as Coinbase, the platform adds a markup to the price displayed. This price adjustment increases the overall cost of the purchase. The best way to avoid that is to use the trading platform, i.e. Coinbase Pro, where you place your order versus other traders on the same exchange. Only in this way, you will be able to get the real market price for the coin and guarantee the execution at the best rate.

Security

Centralized exchanges store your coins on your behalf. This is the best option if you are going to trade your coins often. Yet, in this case, you need to pay great attention to the level of security that the exchange can guarantee. Reputation is a critical asset in the crypto industry. The alternative for HODLers is to use a decentralized wallet and protect their private keys with methods that fit their own needs.

KYC and ID-verification

Most of the Fiat-to-Crypto gateways nowadays require passing KYC processes and providing your ID for personal identification. If you are not willing to share personal and fiscal private data, peer-to-peer marketplaces are the perfect venues to conduct your transactions.

All roads lead to the same place, while some are more efficient and secure, others are more convenient. It’s always appropriate to assess carefully which of these ways of buying Crypto fit your need to avoid unnecessary hurdles and costs.