Welcome to the crypto bull market 2021. Are you looking for the next opportunity? Don’t miss these top 10 cryptocurrencies to buy.

The market moves at the speed of light, and it’s impossible to follow each price move. The good news is that you can use Coinrule to manage your portfolio 24/7 with no stress. In this article we reviewed the best trading strategies that can work well in the crypto bull market 2021.

You can accumulate the best cryptocurrencies, take profit or rebalance your portfolio according to the daily market volatility.

Now that you know what the best strategies are, aren’t you curious about what are the top 10 cryptocurrencies to buy in 2021?

Crypto biggest trends

In 2017, the ICO frenzy was the primary catalyst for the crypto bull market. The development of the DeFi ecosystem warmed up the Altcoin market during the summer of 2020. The market may look irrational in the short-term, and prices rising exponentially pose create doubts that this could be a new bubble. But when you look at market cycles from a larger perspective, you can identify new emerging forces and trends driving the prices.

Once the frenzy passes, investors will re-allocate their funds to the most solid coins, supporting their price. Identifying the trends of the market will help to spot the best coins to add to your portfolio.

These top 10 cryptocurrencies to buy give you a significant edge in the future.

DeFi

There is no question that Decentralized Finance is one of the biggest trends in crypto today. At the moment, there are more than $40 Billion locked up in decentralized finance applications—the most prominent portion sitting in decentralized exchanges and lending platforms.

Uniswap (UNI)

Uniswap is a fully decentralized on-chain protocol for token exchange built on Ethereum. It uses liquidity pools instead of order books. Using Uniswap, anyone can quickly swap between ETH or any ERC-20 token. Additionally, users can earn fees by supplying liquidity. Investors can supply any amount. Uniswap has over $4 Billion in tokens locked on the platform, the largest amount on any Decentralized exchange.

Why it’s hot

Before Uniswap, the lack of liquidity was the main problem affecting decentralized exchanges. Introducing an innovative mechanism based on liquidity pools, liquidity providers now have the incentive of locking their coins to earn passive income. The business model has proven to be solid. Now that more exchanges are enforcing more strict regulatory processes involving KYC and geo-limitations on trading activities, decentralized exchanges will offer an attractive alternative for crypto investors.

Enzyme (MLN)

Asset management is a trillion-dollar industry. Enzyme has created a protocol to migrate the asset management industry to Blockchain technology. Enzyme is bringing the traditional finance world to DeFi, with on-chain asset management that enables users to retain custody of their assets while investing with portfolio managers.

Why it’s hot

As traditional finance migrates to DeFi, this will be a game-changer for how people can invest their money. Enzyme significantly lowers the asset management industry’s entry barriers, adding transparency and democratizing the entire process. The time of black boxes and fixed returns is behind us now.

Enzyme deserves a spot among the top 10 cryptocurrencies to buy as it’s a unique project with minimal competition.

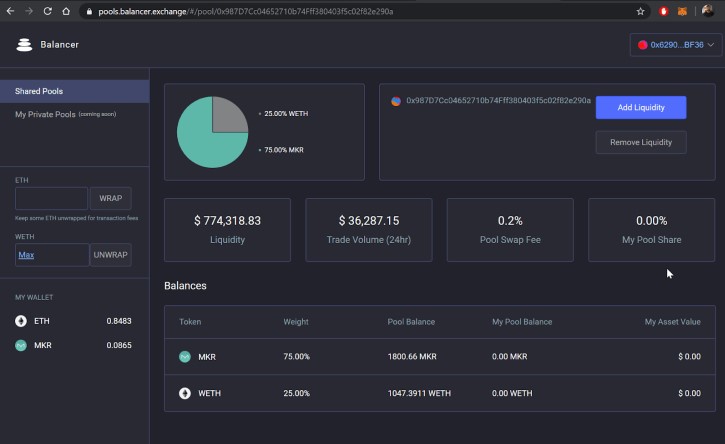

Balancer (BAL)

Balancer is an automated market maker. It reduces the cost and slippage between trades of various cryptocurrencies. It is the decentralized replacement for the traditional market maker, a third-party entity that provides liquidity to trade assets. Balancer uses pools that are collections of user-supplied funds used to prove liquidity to trades and transactions. Liquidity mining has become a popular topic in the world of DeFi, and BAL has been doing this exceptionally well, becoming the main topic of conversation.

Why it’s hot

Balancer brings the concept of liquidity pools to the next level, allowing liquidity providers to add up to 8 different assets to the pool. Balancer uses advanced algorithms to ensure each pool retains the correct balance of assets even as the prices of the coins in the pools might vary.

Tokenizations and Stable coins

One of the biggest promises of Blockchain technology is to tokenize virtually any asset globally. What if you could buy or sell the fractions of real estate ownership, stocks, credits, or intellectual properties?

Cryptocurrency prices are very volatile, and that scares away the average investor. The neverending debate of whether cryptocurrencies are a good store of value can be quickly resolved by the impressive development and rise of new stable coins. Projects that promise tokenization of global assets must be included in the list of the top 10 cryptocurrencies.

Synthetix (SNX)

Using Synthetix, investors can create their own synthetic assets—called Synths. They are blockchain assets pegged to real-world assets like fiat currencies, cryptocurrencies, and commodities. Their price is tracked in real-time using oracle data feeds, allowing investors to buy, sell, and trade on these assets like the real thing, only without a central body. The protocol enables limitless types of tokenized assets. For example, Synths like sAAPL give investors exposure to Apple’s stock price. If the investor believes that the price is overvalued, he can buy the Inverse Synths, which rises in price when Apple’s price falls.

Why it’s hot

Cryptocurrencies have been so far a small niche in the global financial markets. Tokenized assets will attract new investors to enter the space, bringing new capital and representing a strong catalyst for future developments.

Terra (LUNA)

This is a digital currency with the primary goal to protect users from paying extra hidden fees in the e-commerce world by bringing blockchain technology adoption on a global scale. Terra is a non-collateralized stablecoin and aims to create a diverse crypto ecosystem with assets tied to the US dollar, Chinese Yuan, Euro, and other fiat currencies. One of Terra’s main features is its interoperability on different Blockchain, such as Ethereum, Solana, and Cosmos.

Why it’s hot

TerraUSD is an interest-bearing asset. In a world where zero-interest rates are the new normal, investors’ possibility to hold a USD-pegged asset and gain interest looks very attractive. Leading crypto VCs back the project, such as Galaxy Digital, Coinbase Ventures and Pantera Capital.

Oracles and Data

Smart contracts enabled the true potential of Blockchain technology. But oracles expanded the boundaries of what is possible to build using a smart contract. Data access makes the difference in any business, and crypto-related projects are no exception.

The easier is access to real-time and precise data feeds, the more likely the smart contract will work flawlessly.

Chainlink was among our top 10 cryptocurrencies to buy in 2019, but nowadays new projects are emerging.

Band Protocol (BAND)

Band protocol improves smart contract access data outside of a specific blockchain. Their cross-chain data oracles can collect off-chain data, aggregate it, and then provide it to any number of decentralized apps and smart contracts in a blockchain agnostic way. The aggregated data can be relatively schematic-free, which is part of Band protocol’s power. DeFi and gaming applications information can include personal health care data, real estate documentation, and even travel logs by connecting smart contracts to external data sources.

Why it’s hot

Again the keyword for Band’s success is interoperability. The protocol is built on Cosmos and it is compatible with all major Blockchains. On top of that, Band allows improved cost efficiency and faster response times. The mechanism of Band’s data feeds assures that the data is entrusted and secure.

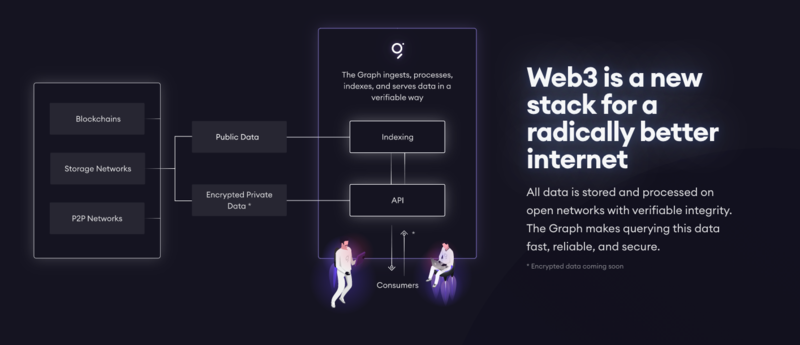

The Graph (GRT)

Just as Google shaped internet search by indexing, Blockchain and Web 3.0 have a similar need as the pre-Google internet did. Basic information like understanding token transactions or accessing user data is complicated to get, creating a demand for indexing and querying information regarding basic blockchain transactions.

The Graph has filled this need. Before Google, there were millions of webpages scattered across the web. Finding data about any topic was very time-consuming and challenging. Retrieving data across blockchain platforms has been one of the most prominent trends in blockchain development.

Why it’s hot

The Graph allows indexing of data on the Blockchain, making the Blockchain’s organizational pattern more efficient and blockchain data access more efficient as-well. As one of the most commonly used blockchain applications, over 3,000 subgraphs have been deployed on The Graph. Nowadays, every application needs API connections to work, and similarly, The Graph will enable countless new dApps in the future.

Collectibles

In 2017, one of the most evident signs of a bubble growing in the crypto ecosystem was the astonishing digital kitties valuation. People were paying them thousands of dollars worth of Ether. At a closer look, that was the expression of a new generation attributing a real value to digital things.

NFT are definitely the next-big-thing in crypto and are a must in any list of top

Rarible (RARI)

Rarible is an NFT (Non-fungible token) platform to secure digital collectibles secured with blockchain technology. Rarible represents a digital NTF platform with a particular focus on art assets. Specifically, Rarible includes a marketplace that allows users to trade various digital collectibles or NFTs.

Users are also able to create these assets which is commonly known as “minting” NFT’s. Various content creators can use this to sell their creations such as books, music albums, or movies as NFT’s.

Why it’s hot

Art’s valuations have been on the rise for years now. The rise of NFTs is just the most natural evolution of the same trend. NFTs make it easy for investors to buy intangible assets like intellectual properties. On the other hand, artists can now access a global marketplace with negligible barriers to entry.

Sandbox (SAND)

Sandbox is a virtual world running on Ethereum. It allows people to build, own and monetize their entire gaming experience. This can be done by owning pieces of land within the game or creating new digital assets such as NFT’s in the sandbox. SAND holders can participate in the platform’s governance in a decentralized manner using a Decentralized Autonomous Organization.

Why it’s hot

Sandbox has accumulated several notable partnerships such as Atari and Crypto kitties. Gaming is a multi-billion global industry, and every project targeting such a large audience deserves attention.

Decentraland (MANA)

Decentraland is a fully decentralized 3D virtual world, where people can own and develop their virtual land. Alternatively, users can walk around and interact with what other users have created and connected with other people exploring Decentraland at the same time. The landscape of the project can include numerous items ranging from static 3D scenery to interactive objects. Each piece of tokenized land is an ERC721 token and is non-fungible, and houses the coordinates of the piece of land it represents. MANA is the native token that fuels the economy of the Decentraland ecosystem. It is an ERC-20 token.

Why it’s hot

Mana was the first decentralized virtual world, and because of that, it has a first-mover advantage over competitors. Think of Decentaland like Second Like 2.0. Given the success that Second Life achieved over the years, the future may be very bright for Decentraland.

Diversifying your portfolio means adding many different coins to reduce the overall risk. In reality, cryptocurrencies have a high correlation, so even having dozens of different coins may significantly reduce the risk.

Buying these top 10 cryptocurrencies represents a diversified exposure to the best crypto trends in 2021 and can add significant value to your portfolio.

DISCLAIMER

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies.