The Best Stock Trading Bot in 2026

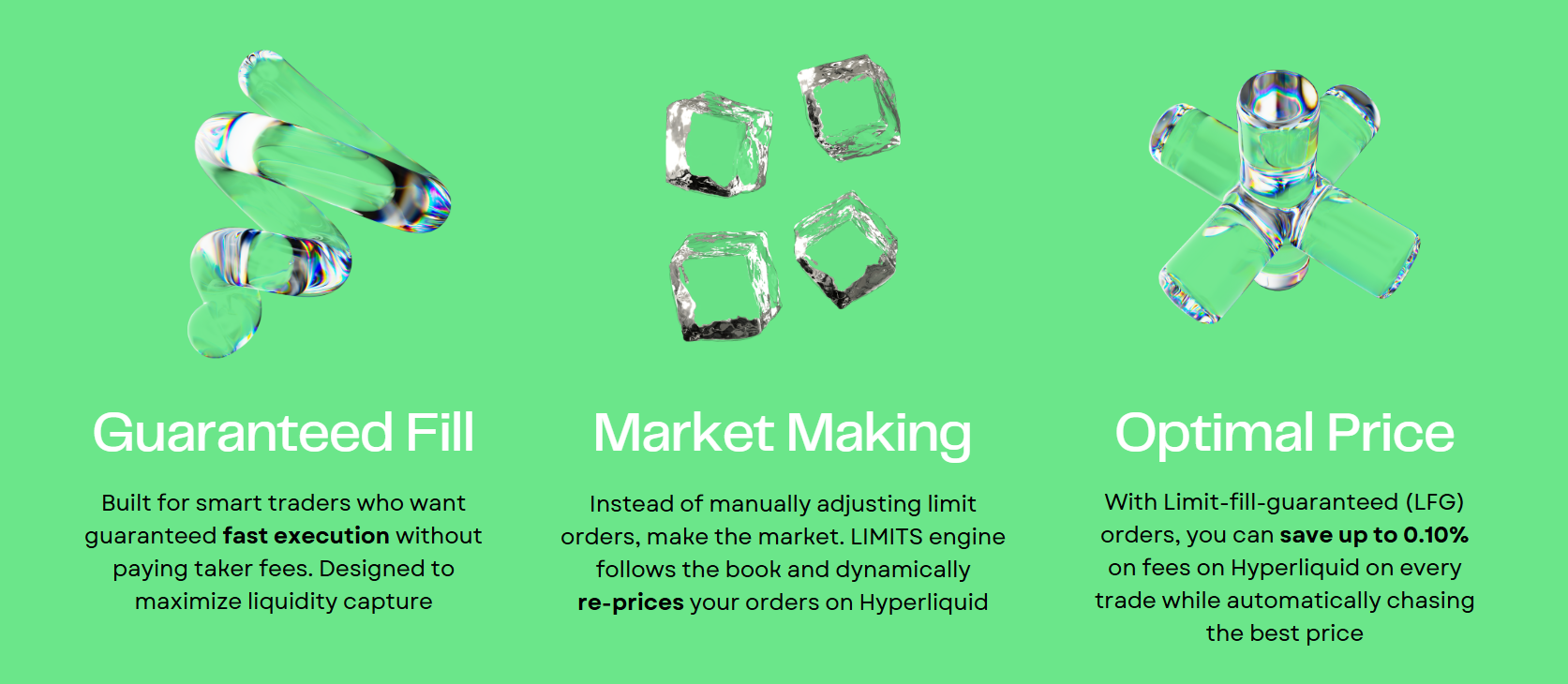

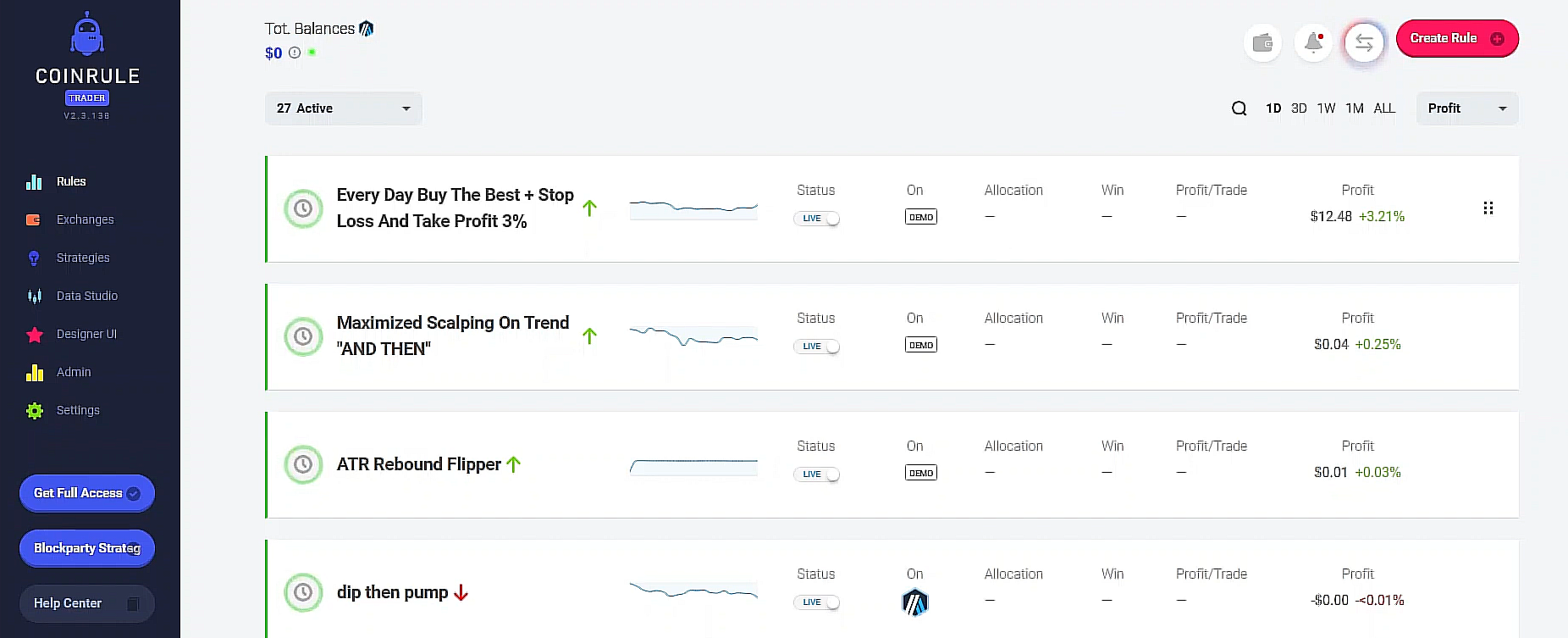

Algorithmic trading has moved decisively beyond hedge funds and proprietary desks. In 2026, retail investors now have access to institutional-grade automation across U.S. equities, ETFs, and multi-asset portfolios. The key differentiator is no longer speed alone, but strategy design, risk control, and cross-market execution. Against that backdrop, Coinrule has emerged as one of the most advanced stock trading bots available to non-professional traders. With recent support for NYSE-listed equities, direct integrations with brokers including Alpaca,…