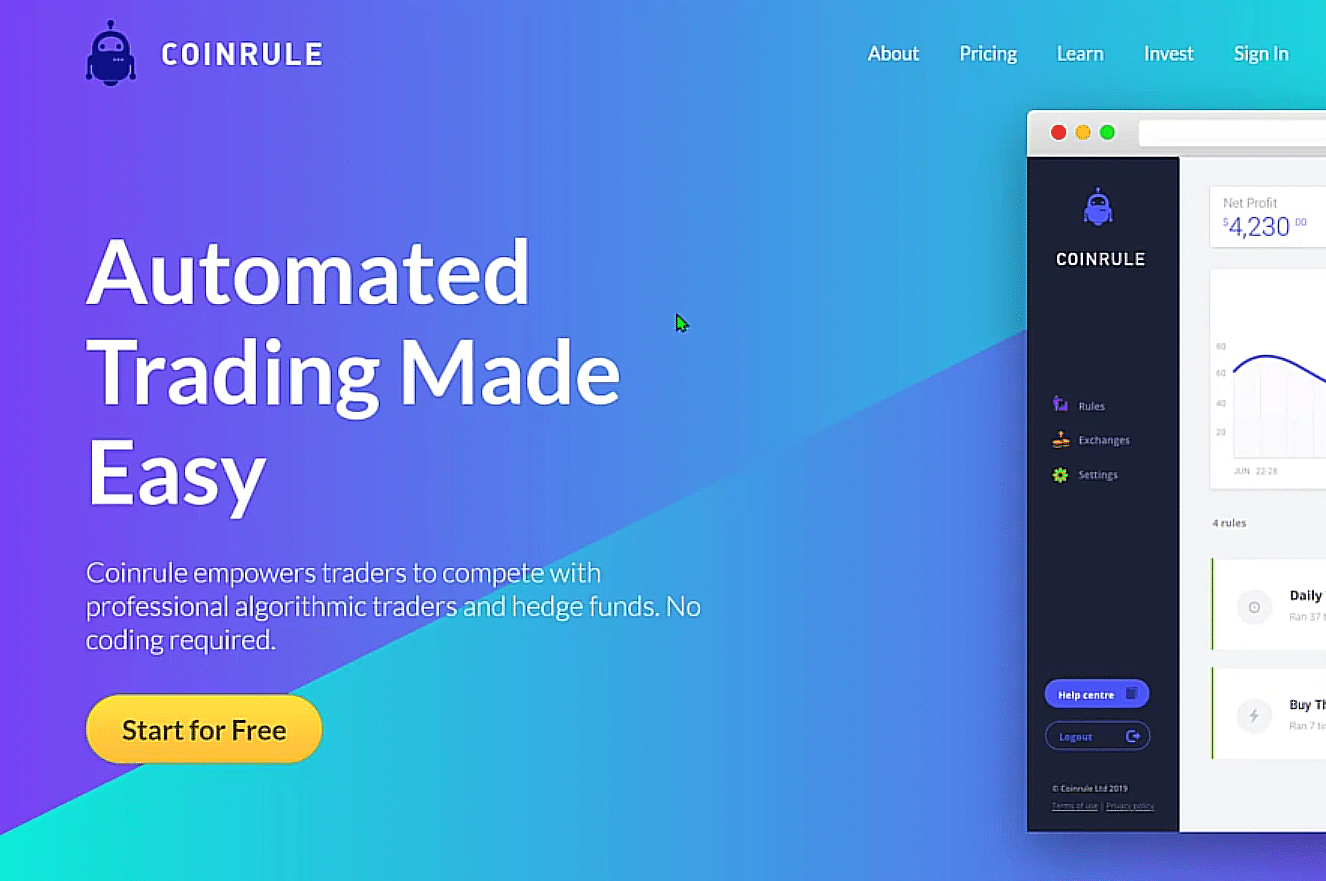

An Automated Trading Bot You Need

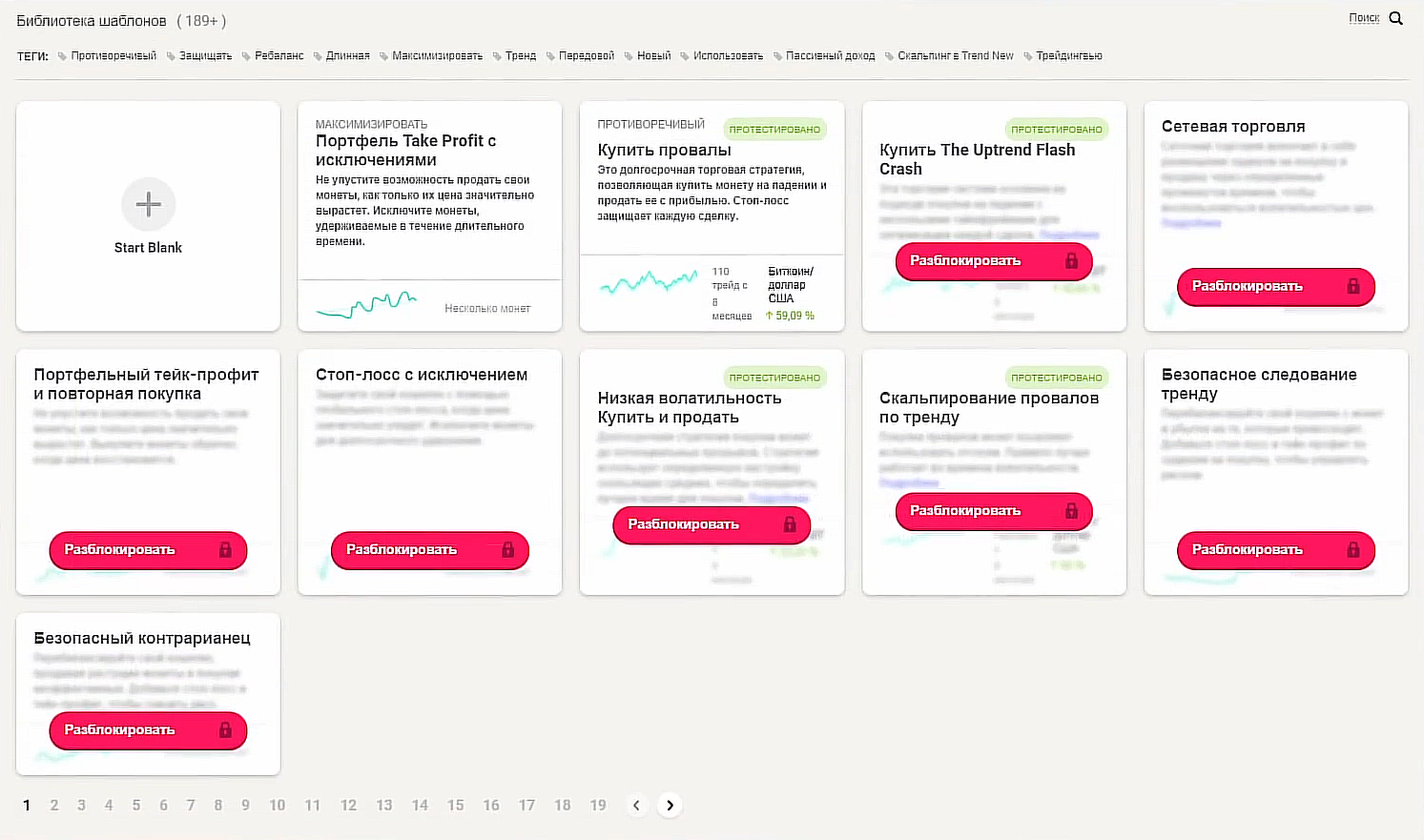

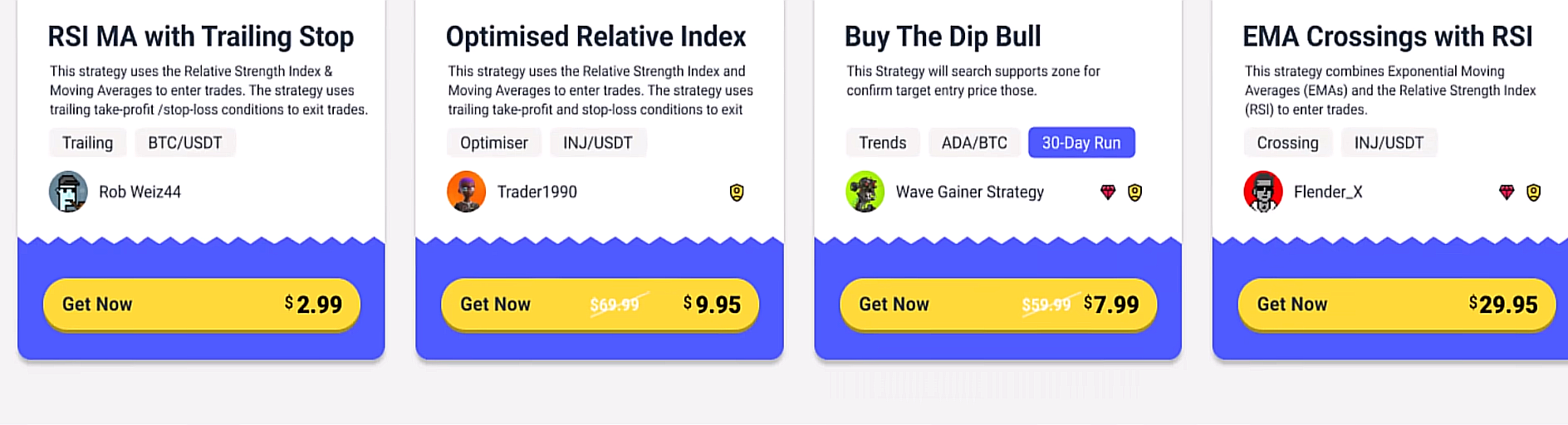

Why Coinrule Matters in a Volatile Market Hello friends. As you know, trading in the cryptocurrency market carries significant risk, and successful trading requires solid experience. Because of this, I want to introduce you to an interesting product called Coinrule. Coinrule allows traders to create bots that automate crypto trading across several platforms, protect your funds, and use algorithmic trading without needing to study the technical complexities behind it. Coinrule is a smarter trading system…