The Waiting Game: Markets Anticipate Fed Rate Cuts

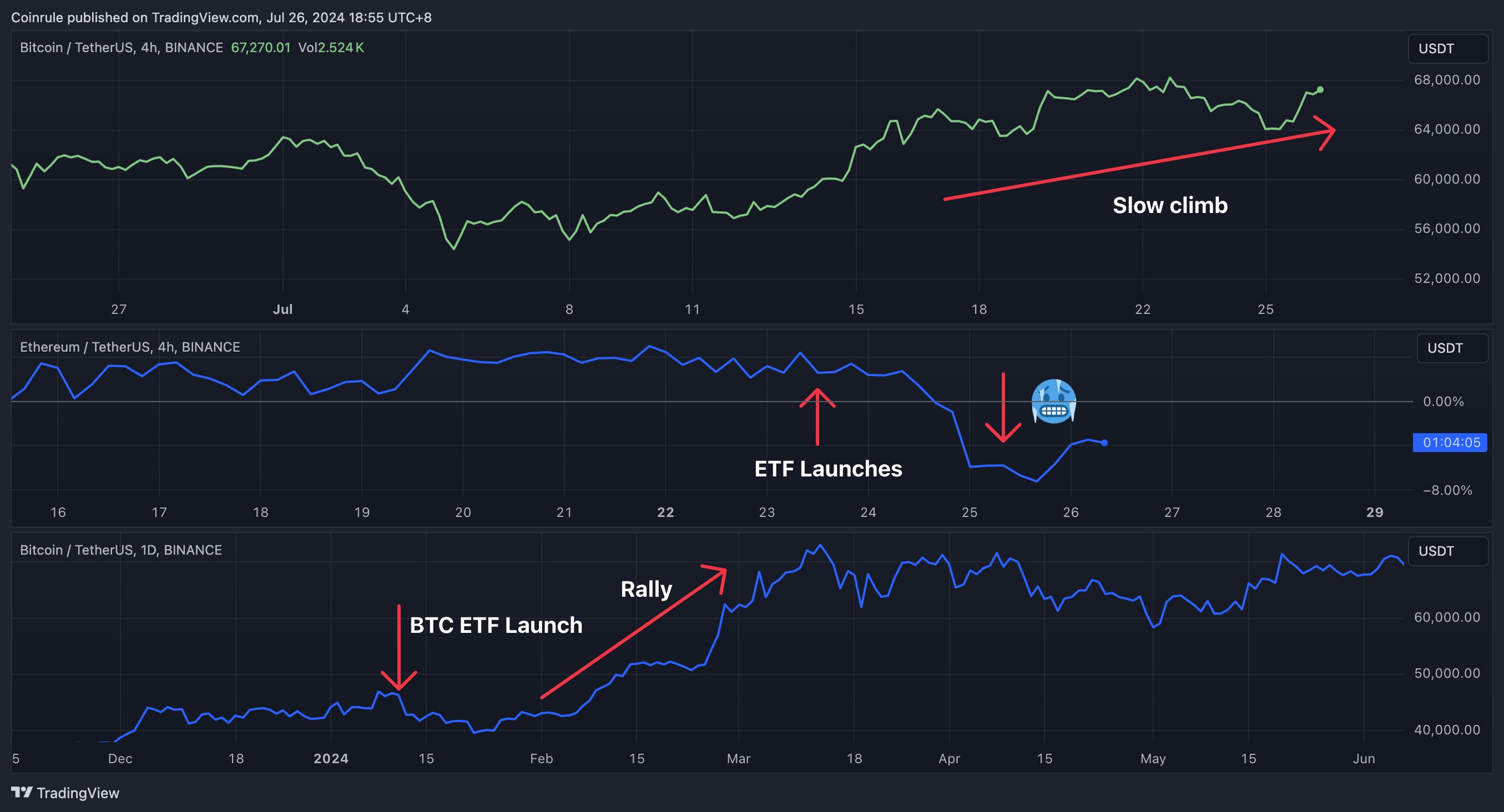

Markets across the globe are in a state of limbo, as investors anxiously await the Federal Reserve’s next move on interest rates. With economic uncertainty growing and the crypto market following traditional markets into a downward trend, the anticipation of the Fed rate cuts has kept traders on edge. The current market setup can be described as ‘Waiting for Godot’. But in contrast to the Samuel Beckett play, markets are awaiting the Fed rate cuts.…