Weak Hands: Bitcoin Market Faces Setbacks

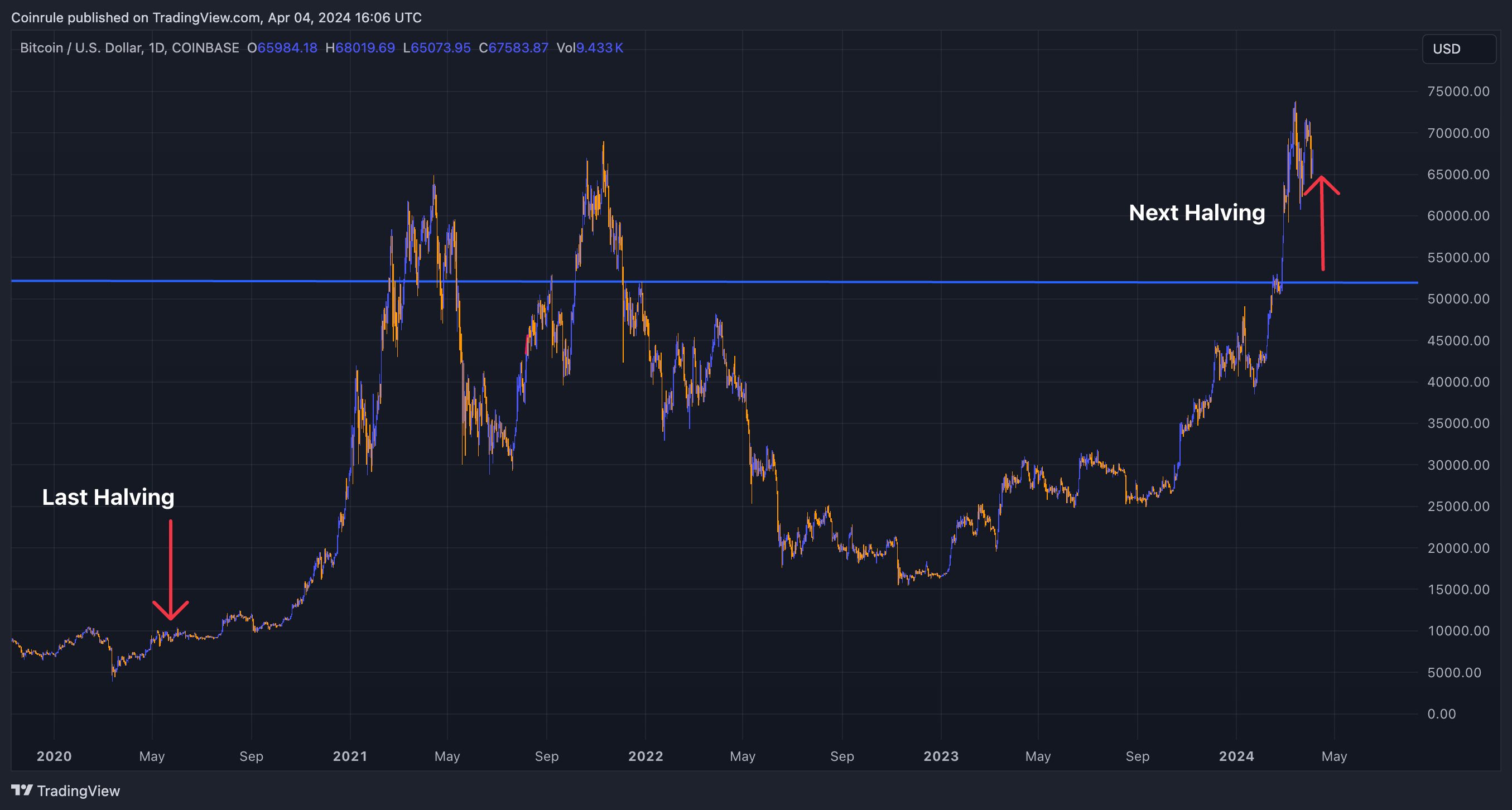

After rallying to a new all-time high in March, the bitcoin market had looked without momentum for weeks. New catalysts such as an Ethereum ETF approval look very unlikely. The launch of new Bitcoin and Ethereum ETFs in Hong Kong has not attracted meaningful volumes. The much-anticipated announcement of the Eigenlayer token in the Ethereum ecosystem led to more disappointment than excitement. On the downside, increasing US government crackdowns against crypto privacy tech and decentralized…