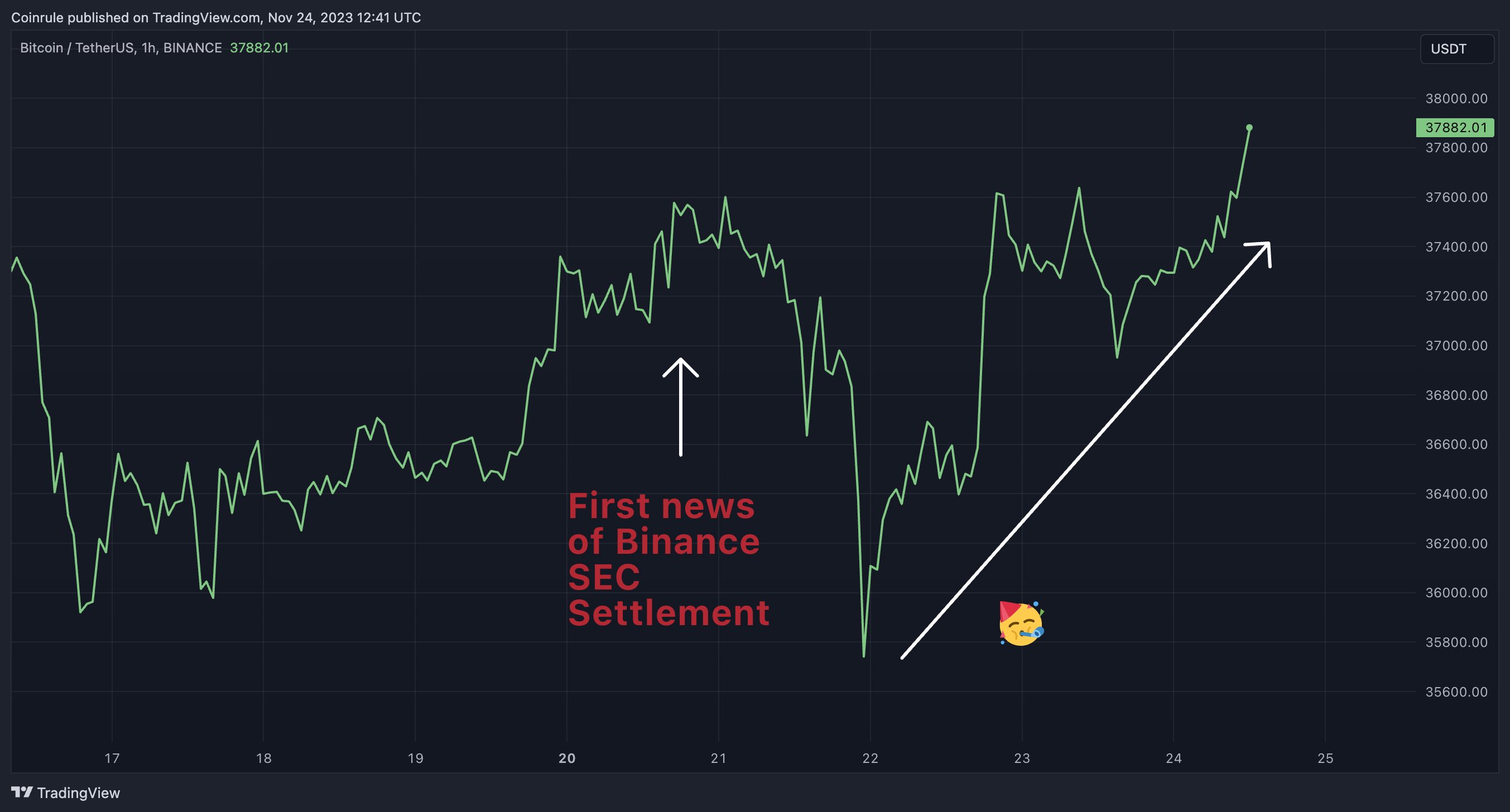

Sell The News

A popular market saying advises to buy the rumour and sell the news. Much of the debates prior to the Bitcoin Spot ETF approval centred on the question whether the eventual approval will turn out to be such a sell the news event. With Bitcoin’s drop to below $40k, after a brief peak when it touched $50k, the ETF rally has clearly run out of pace. At least in the short-term, the ETF approval turned…