For those seeking wealth, trading can appear to be a lucrative activity. However, although many people are interested in trading as a hobby, they cannot/do not want to quit their full-time jobs. In fact, many successful traders trade as hobbyists for one or two hours a day and earn their primary income from other activities.

Such people prefer trading as a side hustle because trading comes with many uncertainties whereas a full-time job provides you with security. If you want to trade at all, there are a few things you should learn. Even trading as a hobbyist requires you to invest a significant amount of time because, if you want to keep doing it, you cannot afford to make rookie mistakes.

So, for those considering taking up trading as a hobby, here are 5 tips that you need to know in order to protect your capital and maximise your profits in the least amount of time.

1. Trade Only What You Can Afford to Lose

Trading is a game of probabilities. No one wins all the time and you will inevitably have to take some losses. Please learn to embrace this because it is not a big deal. In fact, it’s a good thing because the quicker you take your losses, the smaller your losses will be.

To properly manage risk, protect your capital, and stay in the game, all you have to do is never invest more than what you can afford to lose, on any single trade. According to research, most successful traders risk less than 1% or 2% of their trading capital on any single position. That means you cut losers long before they can become significant problems.

Overall, ensure that the money you trade with has no other important obligations like paying your mortgage or your kids’ tuition fees. It should be your extra money. If you don’t have extra money, keep saving until it reaches the safe amount you need to start trading.

Trading can be addictive and needs high discipline levels if you don’t want things to get out of hand. The moment you win, you may be tempted to invest more in your next trade, hoping to get a larger return. This is because risking money and winning gives you a dopamine rush, which makes you want to take bigger risks in the chase for bigger dopamine rushes.

Therefore, ensure that you set your risk budget in advance and then stick to it strictly. Also, initially, avoid anything that has an infinite loss potential, such as leveraged accounts.

2. Learn the Essentials

Trading has its own rules and language. Before investing your hard-earned money, ensure that you know all the rules and market structures. What appears to be a simple task at first glance includes hidden risks, expenses, and consequences.

Ensure that you know the best trading times and conditions, since there are specific scenarios when your strategies will work and they won’t. Since financial markets are highly volatile and public sentiment changes rapidly, ensure that you look at the current state of the market before trading.

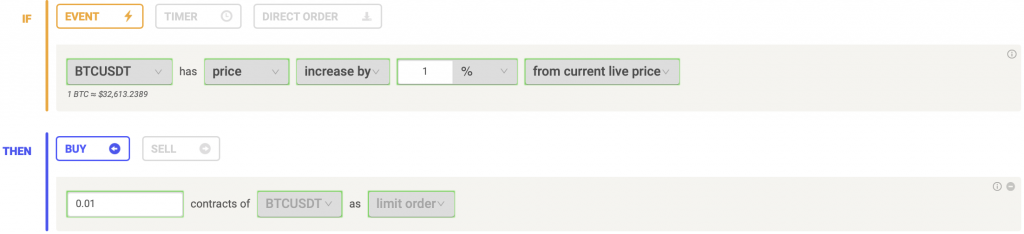

To avoid confusion, it is also important to learn the important terms used in trading, like the different types of orders. These include market orders, stop-limit orders, stop orders, and limit orders, among others. Ensure you know how each of them executes and their advantages and disadvantages. Therefore, when the market does fluctuate, you will know which order types to use and which to avoid, and how to handle your investments and assets like a professional.

Essentially, your risk profile and profit potential will be healthier if you know more about the market. Don’t enter the market blindly if you have no prior trading experience. And watch out for trading commissions charged by exchanges – overtrading is one of the biggest mistakes beginners make.

3. Be Patient

Patience, discipline, and consistency are key if you want to succeed in the financial market. Trading is not as simple as buying and selling. The financial market is very complicated under the surface and there is no magic formula or pill to help you instantly understand it. Therefore, be prepared to put in time to learn it.

It is important to understand that you simply cannot win all trades. Most traders aim to win on about 50% to 60% of their investments. This is more than enough because they earn more on their winners than they lose on their losers. Therefore, you need to be patient before you see results and you need to accept that taking losses is the cost of doing business.

It is also highly advisable to start small if you want to trade as a hobby. It is exciting and rewarding to see your small investments growing with time without compromising your savings or long-term financial objectives. You should not be thinking about trading if you don’t already have long-term financial stability.

Moreover, the financial markets are dynamic. To stay on top of your game, you have to invest your time and keep learning.

4. Know the Risks of Trading as a Hobby

Overall, there are various risks in trading. If you are a beginner who trades in low-volatility/low-risk securities, you may quickly lose your money in transaction fees if you overtrade. On the other hand, you may also lose money by failing to monitor the market regularly, thereby missing out on important moves/reversals.

Different types of investments have different risk levels. Investing in managed securities can provide a steady and predictable income stream. They’re ideal for prudent financial planning because a team of specialists monitors the portfolio and makes decisions daily.

Cryptocurrencies, spreads, pairings, currencies, and Contracts for Difference (CFDs) are popular among hobbyist traders. These vehicles are fascinating because they are volatile. Furthermore, brokers provide leverage and margin, accelerating both gains and losses. Clearly, these come with many risks since you may lose everything in a matter of minutes.

5. Seek Guidance from Reputable Sources

Everyone appears to have trading tips, especially in bull markets. Some of these people and their tips are genuine while most are not. If you are trading a little money for entertainment, you might not be too bothered about the trade’s quality. However, if you have decided to invest a significant amount, it is good to seek advice from reputable sources and, most importantly, to do your own research.

If you want to learn more about trading, start by reading the classics on trading. Then speak with your financial advisor since they can help you figure out the best approach for your personal circumstances. You won’t wake up tomorrow as an experienced investor with an offshore investment portfolio, but that shouldn’t worry you because trading is a continuous learning experience. Your financial advisor can also help you understand how your money may perform better once you’ve established your financial objectives, stability, and long-term investment plan.

It is also a good idea to research cryptocurrencies before investing your money. Coinmarketcap is a highly recommended website where you can get information on every cryptocurrency and token available. The information includes capitalisation, supply, and trade volume, among other things.

Another good way to learn more about cryptocurrencies is to read crypto-related news in major blogs and publications. Sometimes you may find valuable information on social media like Telegram and Quora conversations.

Final Words

Cryptocurrencies have become one of the major vehicles for trading. For some people, trading has even become a hobby and something they spend a few hours a week on. However, before jumping in head first, take time to learn about trading to avoid making losses. Select the most effective exchange and wallet, as well as benchmarking and asset management tools.