News that US Law Enforcement have seized 94,000 Bitcoin worth $3.5 billion that had been stolen in a Bitfinex hack back in 2016 could have easily spooked the markets.

Not only does it once again bring cryptocurrencies into the spotlight in relation to hacks and frauds, but the expectation is also that US authorities will auction off the seized Bitcoin right into the market. Yet, over the last days markets have continued to rally.

So are we full-on bullish again?

A few things are happening here. Markets have bounced from their January losses and in absence of major news on Federal Reserve rate cutting, war in Eastern Europe or a return of COVID lockdowns, cautious optimism has taken over.

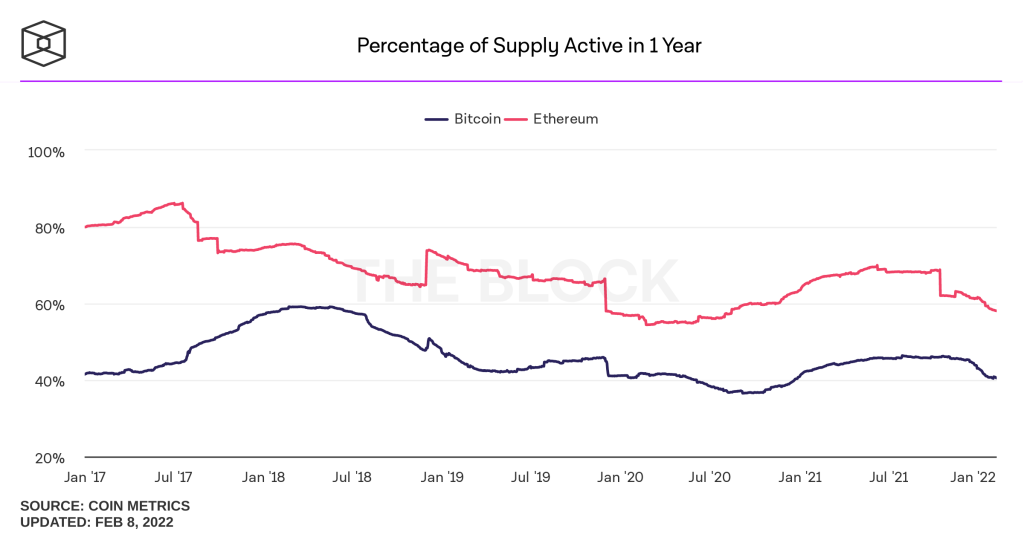

More importantly, even with 94k extra Bitcoin on the market, as the chart above shows, an ever growing amount of Bitcoin is simply not active but sitting in cold storage.

Institutions or larger buyers accumulating BTC are not looking for quick flips but for multi-year holds. Ethereum’s active supply has stayed relatively unchanged given that ETH is required for gas fees, NFT purchases and DeFi applications.

However, Ethereum’s total supply is now shrinking following the introduction of EIP-1559. Over 1.8 million ETH have already been burnt.

The Ethereum 2.0 merge will further drive the narrative of ETH as a yield-generating asset. Even BTC, in its wrapped version, can be used to earn yield in DeFi applications. Given both BTC and ETH’s nature as productive, yield-generating assets, market participants might be learning that this is not your typical equity holding.

The result is that price dips are bought up quickly. That does not mean that we will not see choppy markets over the next months or even a retest of bottom lows in the $20-30k range for BTC.

But if news like the Bitfinex suspect arrests can emerge without major market impact, it might be a good time to remember how strong the bigger picture looks for our industry.