As the Crypto Bull Market enters its more mature stage, it keeps attracting new investors and traders FOMOing into the frenzy. Newcomers are willing to pay high prices because of the expectation that the trend will still grow on the upside. That’s potentially a perilous situation as it’s easy to lose control over the Crypto market cap’s valuation. Why does this really matter?

When investing in cryptocurrencies, you should be well aware of the difference between a coin’s price and its market cap. The strongest of Bitcoin’s selling points is that there will only ever exist 21 million coins. Investors can relatively easily assess Bitcoin’s Blockchain’s aggregate value multiplying the price of a coin by the total future supply. That’s why Bitcoin is the most expensive and valuable cryptocurrency on the market.

What is the market cap?

Market capitalization is an indicator that measures and keeps track of the market value of a cryptocurrency. The market cap is an indicator of the dominance and popularity of cryptocurrencies. In January 2021, the Bitcoin market cap reached an all-time high and had grown by over $400 billion compared to the summer months. The Crypto market cap currently sits at more than 1 trillion U.S. dollars. Market capitalization is calculated by multiplying the total number of Bitcoins in circulation by the Bitcoin price. The Bitcoin market capitalization increased from approximately one billion U.S. dollars in 2013 to several times this amount since its surge in popularity in 2017.

How total crypto market cap evolved

It is important to note how the total Crypto market cap has evolved over the years. As cryptocurrencies gain popularity, we can see exponential growth in the crypto market cap of all cryptocurrencies as a whole. Bitcoin is not the only coin in the spotlight, the asset class as a whole has been gaining popularity with both retail and institutional investors, aiming to take part in the next generation of technology.

Price misconceptions looking at only price

Looking at the price of Crypto does not tell you the whole story.

Many novice investors enter the space and see coins that have a price below 1$ as an opportunity, hoping that one day it will reach the price of $10,000, making them rich. However, this is not the case; looking at the price only gives half the story. If there may be 1 Billion of those coins available, this means that for it to reach 100 dollars, it would have a market cap of $1 trillion, comparable to the current Bitcoin’s market cap. The question would be, is such valuation justified? Is it reasonable that this coin is valued as much as Bitcoin?

For many crypto projects, achieving a 1 trillion U.S Dollar market cap in the short term is close to impossible.

Is Ripple under-priced?

A typical example of this is Ripple. Previously, when Ripple held the 3rd place spot according to market cap, many new entrants to the market would see it as a great deal, compared to the hefty price of Bitcoin and Ethereum. However, if you take a deeper look into Ripple’s token economics, you would realize that with a total supply of 100 Billion, Ripple would need to achieve a market cap of 1 trillion to have a price of 10$.

Looking at the price as an indicator of value is misleading. Comparing the price of Uniswap against the price of Cardano, you would believe that Uniswap is more valuable. Upon closer inspection, you would realize that this is not the case, since Cardano network is valued at double Uniswap despite only having a price of $1.4 compared to the 30$ of Uniswap.

Dogecoin on the way to $1

Another similar fallacy would be Dogecoin. In recent months, DogeCoin has gained popularity with Gen Z on social media, stating that Dogecoin can reach 1$. However, when looking at the circulating supply, you would quickly realize that for DogeCoin to get to $1 it would need a market cap of $129 Billion. Meaning it would have a market cap equivalent to Cardano, BNB, Polakadot and XRP combined.

Quite a valuation for a meme-coin…

Where can the Crypto market cap go from here?

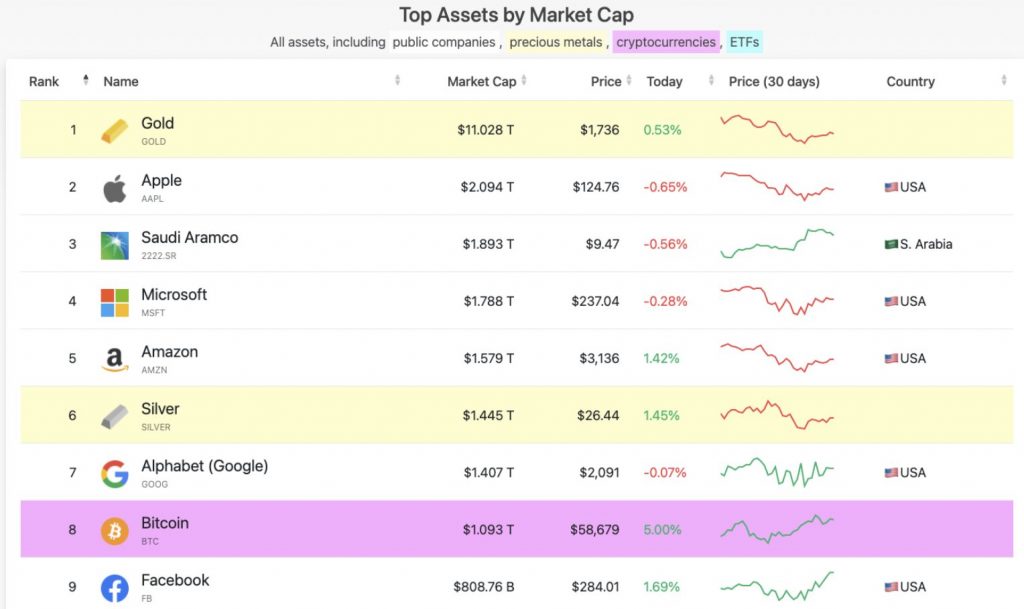

Comparing Bitcoin with the most prominent store of value, Gold. Bitcoin is slowly making its way up to the top of the leaderboard. Already surpassing the biggest banks in the world and some of the world’s most prominent companies. Going forward, as the popularity of Bitcoin grows, and the shift between the analog generation to the technologically versatile generation “Gen Z”. We will see the Bitcoin market cap growing closer and closer to that of Gold, with hopes of surpassing it one day in the distant future.

Looking at some of the world’s largest companies compared to the market cap of BTC, we see that Bitcoin has already surpassed many prominent institutions such as Berkshire Hathaway and Facebook. This does not come as a surprise with the ever so growing popularity of Bitcoin. While the most valuable companies in the world run their business in a relatively stable economic environment, Bitcoin represents a whole new asset class with more potentials that still need to be discovered.

It’s worth noticing that you need new methodologies to value cryptocurrencies, as the traditional frameworks don’t apply anymore. You can read more about how to value a coin.

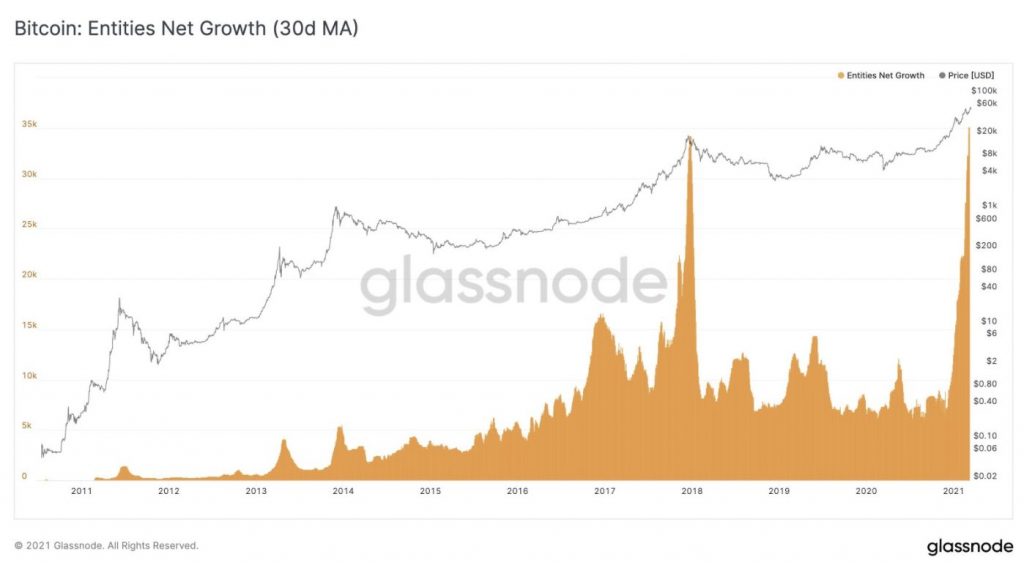

On-chain data shows that the number of participants in the Bitcoin network is unprecedented, exemplifying the mainstream adoption is coming.

Using Market Cap with Coinrule

To capture profits and optimize your trading strategy, you can use the market cap to filter out coins you want to trade on Coinrule. Market behaviour has shown that Medium cap cryptocurrencies tend to ride the trend later than large-cap Crypto’s. Creating a trading strategy to uniquely capture these opportunities can be done using the market cap filter on Coinrule, and an example can be seen below.

The rule above is structured to ride the uptrend on Mid-cap coins, to capture some of the growth that trickles down when Bitcoin increases in value. This setup can be adjusted to work with any indicator such as moving averages or price.

Create your rule now!

Final Remarks

- Market capitalization is an indicator that measures and keeps track of the market value of a cryptocurrency. Market cap is used as an indicator of the dominance and popularity of cryptocurrencies.

- In recent years, the crypto market cap has evolved drastically in both size and distribution. The market size has more than doubled, while the distribution between Bitcoin and altcoins continues to grow.

- Price Misconception is common, price standalone does not give adequate information regarding the company’s value. One may look at market capitalization to get a clear picture of how the market values the project.

- A prominent example of a company with a low price but a large market cap would be XRP. Despite having a low price of $0.45, XRP has a large market cap of roughly 20 Billion USD. Meaning that while people consider it to be cheap or a small project, it is in fact, a developed and prominent project.

- The market cap of Bitcoin continues to grow, coming closer to that of Gold, surpassing many major commodities and 400 Billion away from the market cap of Silver.