The last 48 hours have been some of the craziest hours the cryptocurrency market has ever experienced. This comes after FTX, the 3rd largest cryptocurrency exchange behind Binance and Coinbase, paused user withdrawals and announced they were seeking to raise funds to avoid bankruptcy. What makes this more surprising is that in January 2022, FTX had raised funds at a $32 billion valuation.

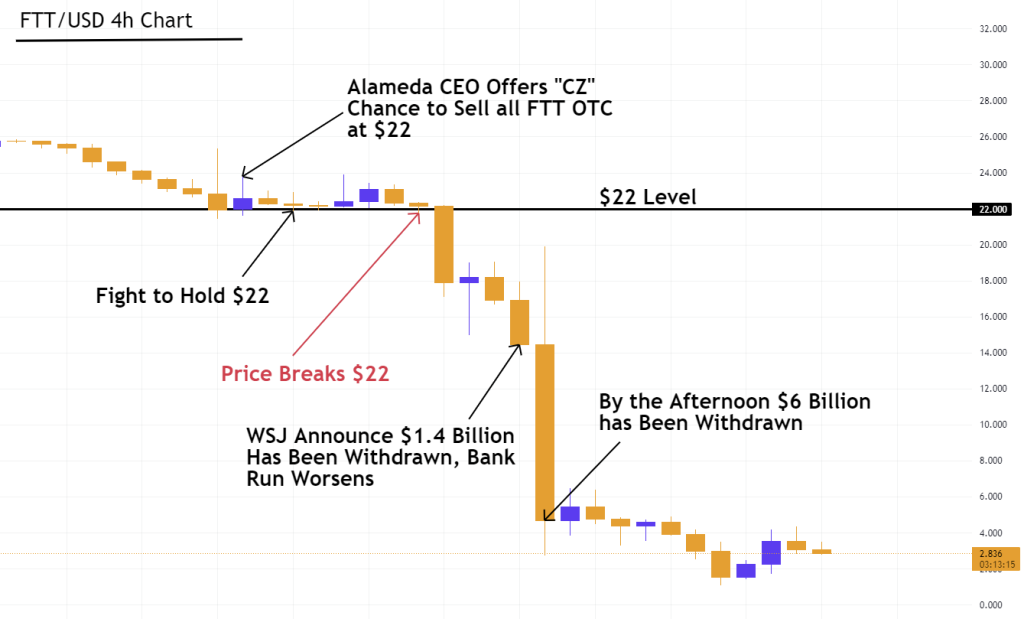

These events began to unfold on the 2nd of November when a leaked Alameda Research (a principal trading firm with very close ties to FTX) balance sheet was published on Coindesk. This balance sheet raised concerns after showing the company held a large amount of illiquid altcoins including $2.16 billion of locked FTT (FTX’s native token). It seems possible that these coins were collateral assets that Alameda used to take out loans in USD backed stablecoins and other cryptocurrencies. When this data was released on the 2nd of November, the total undiluted market cap of FTT was $3.35 billion. Ultimately, this meant that any significant sale of FTT on the open market would push the price significantly lower and likely result in margin calls for Alameda who would have to sell some of their FTT to maintain their loans and avoid liquidation. Subsequently, on November 6th when Binance announced they were liquidating $580 billion of FTT in their treasury, this is exactly what happened.

On Tuesday morning, The Wall Street Journal reported that FTX had seen approximately $1.4 billion withdrawn, by the afternoon this had reached an astounding $6 billion. Later that afternoon, many people’s fears were realised when FTX paused withdrawals. It has since been discovered that FTX is seeking to raise $8 billion to meet outstanding withdrawal requests. Many are left wondering why there is a $8 billion black hole in user funds with many hypothesising that some of these funds were used to fund margin calls for Alameda after the price of FTT plummeted. The only hope for FTX is now to raise funds in order to honour these requests. However, since Binance backed out of a proposed acquisition last night, this is looking increasingly difficult…

Either way, whether FTX survives or collapses entirely, this event will provide governments and regulators with plenty of ammunition to demand new regulations on cryptocurrencies and associated companies. The contagion effects on projects that hold their treasury funds on FTX and other crypto firms that have exposure to either Alameda or FTX can hardly be measured at this point. Either way, this sudden crash of a ‘poster-child’ of the industry is a major disaster for the whole market.

In slightly better news, U.S. CPI Inflation came in soft at 0.4% M/M and 7.7% Y/Y, slightly lower than expected. In the short term, this is bullish for risk assets and seems to have slowed down the FTX-triggered crash. However, it remains to be seen if this will have any significant lasting impact on the cryptocurrency market in the medium-term given the FTX news.

Check out the chart on TradingView here.