It has been a wild ride, indeed. Starting from the bottom in March 2020, the total market capitalization has grown by over 20 times. What to expect now?

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Chuck Prince, Citigroup CEO – July 9th 2007

This infamous quote may seem to work perfectly considering the current market conditions.

Despite higher volatility on the downside in 2021, the trend of the crypto market capitalization has been growing steadily since 2020. The valuation traded most of the time within the green channel while having a brief deviation to the upside at the beginning of 2021. That was a sign that the market was over-heated, and that led eventually to a broader correction.

Projecting the retracement Fibonnaci levels of the up move from 2020 to early 2021, the correction found solid support at the 0.5 level and then at the 0.23. That’s what you would expect from a healthy trend which is rebuilding momentum. Today the market is hovering around the previous all-time high levels. Should that hold, a new strong leg on the upside is likely.

The market is still in a bull cycle, and therefore you need to keep in mind two key elements.

First, the more crypto prices consolidate in the channel, the more likely the market will experience a new blow-off move. As time passes, the magnitude of this move could be larger. As the channel’s top gets higher and higher, investors and traders will set their targets accordingly.

As a rough estimate, the target will be around 150% in one month, and in three months, it would be 250%.

On the other hand, never forget that the higher is the rise, the harder is the fall. We are likely at a mature stage of the bull market, which means that even if a 200% upside looks appealing, that comes with a downside risk of 70-80%. In this regard, the divergence on the RSI looms like a dark ominous cloud over the market.

It becomes increasingly important to set your targets and comply strictly with your plan. Rotating part of your portfolio gradually into higher quality coins and stable coins will protect your capital when a more severe correction hits the market.

“Let the music play” is the new mantra. As a reminder, the music stopped three months after Prince’s quote when the housing market bubble popped. History may not repeat but often rhymes.

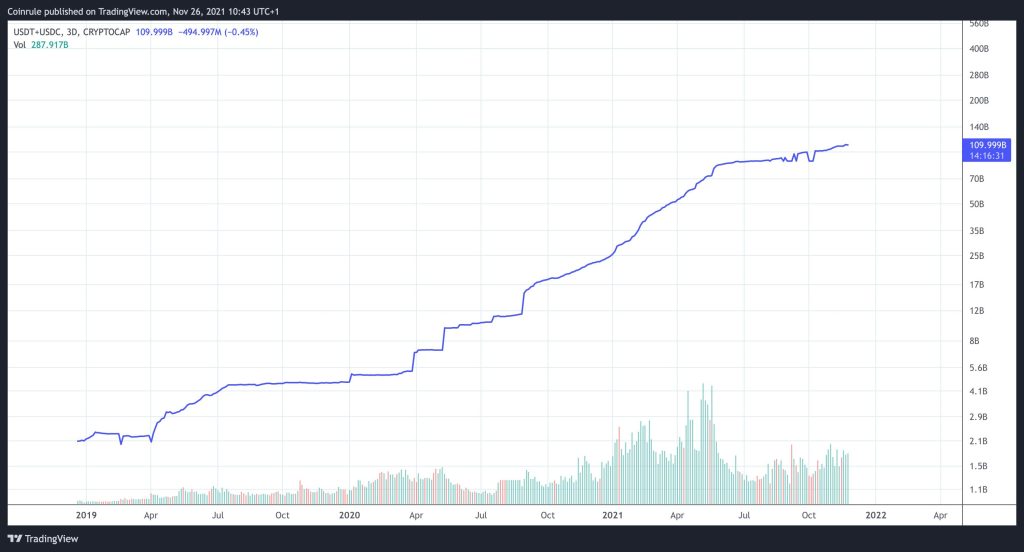

Bonus chart: stable coins are the elephant in the room. Investors are not paying enough attention to the magnitude of growth of stable coins over the last couple of years. USDT and USDC alone have a valuation of over $110 billion, not including other similar USD-pegged coins like BUSD, USDT, and DAI.

All this liquidity is on the sideline and could represent significant fresh new capital inflows for cryptocurrencies. On the other hand, as the market structure develops more and more reliance on stable coins, they become a potential single point of failure of the system. Meanwhile, it seems like most of the liquidity is seeking low-risk interest from DeFi protocols more than trying to chase speculative opportunities.