ETH 2.0 is here! Yesterday, at around 3AM EST, Ethereum’s long-awaited transition from Proof-of-Work to Proof-of-Stake took place. Prior to the event, many were left wondering what the impact of this important occurrence would be on the market. Would a successful merge lead the way to a more bullish market outlook? Or would a failed merge lead to further capitulation and turmoil?

At first glance, it appears the merge has been successful. This event will shift the Ethereum blockchain over to new Proof-of-Stake validator nodes which will require staking 32 ETH in order to become a validator on the network. For an investor, holding ETH is now more attractive due to the fact that it is now deflationary. This means that Ethereum is now the highest market capitalisation deflationary asset on the planet. The transfer off the legacy Proof-of-Work system is proposed to lead to around a 99% reduction in the energy consumption of the network. In short, this will make Ethereum much more efficient and allow for significant strides to be made towards crypto’s environmentally sustainable future. Additionally, with the current ESG narrative in investing, this improved efficiency could attract new institutional investors to the world of crypto who may previously have avoided the sector in order to maintain a green image.

Another important implication of the merge is that the number of ETH tokens issued as block rewards will significantly reduce. Prior to the merge, around 13,000 Ether were mined each and every day. Now, this number will reduce to approximately 1,600 Ether per day. This is another bullish implication of the merge as there will be significantly less selling pressure on Ethereum from miners selling their rewards.

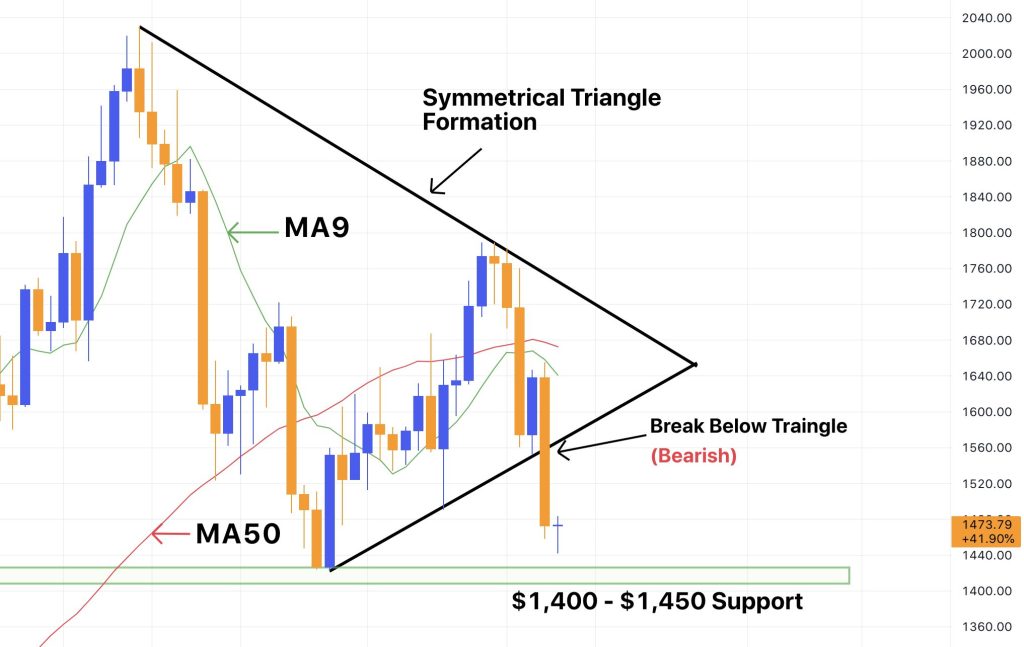

From a technical perspective, it first appeared that the market already had this event priced in as in the first few hours post merge, we didn’t experience any significant volatility that many were expecting. On the daily timeframe, there was a clear example of a symmetrical triangle pattern. Bulls were eagerly watching this chart as a breakout above this triangle could have lit the way for new range highs. Many were expecting a breakout above this triangle as MA9 and looked poised to cross above MA50 which would have marked a strong buy signal. However, in the end, the bears got their way as the the triangle pattern broke down and we crashed into back below $1,500 causing MA9 and MA50 to diverge. Bulls will be hoping that we can get some respite towards the $1,400 – $1,450 support range. The reason for the drop is largely unknown however many speculators believe that it was caused by traders offloading the ETH they had previously bought to speculate on the fork. Another reason could be that the price was previously propped up by traders purchasing or borrowing extra ETH in order to claim extra Ethereum as we transitioned to Proof-of-Stake. Now, these traders are selling off this excess ETH causing prices to fall to the current lower demand level.

Check out the chart on TradingView here.