We have outlined many times how important it is to backtest an automated trading strategy before launching it.

A backtesting tool makes the trader more confident about the likely result of his strategies and allows a detailed analysis of the historical performances of the rule. That gives the possibility to improve it, expecting even better returns in the future.

As announced a few days ago, we started a partnership with Kaiko that will be our data provider for our new Backtesting tool.

The Coinrule Tech team is currently working at full speed, developing the infrastructure needed to run such an important and powerful feature. Of course, we want to make sure that everything works well enough to provide the most precise possible results when testing your rules.

Meanwhile, we had the chance to test some of the more advanced rules our users will be able to create with our new rule page. Here are some preliminary results.

We started backtesting a Trend-Following strategy:

If price increases by 2% in one hour, BUY.

THEN if price goes up 4% SELL.

The stop loss is set at 1% from the entry price.

The first coin we used to test the strategy with was Litecoin, trading it versus Bitcoin in a period starting 1st of April to 6th of July. The strategy resulted in a loss of -18.42 %. It could sound like a bad result but, compared with the return of Litecoin in Bitcoin terms, the rule actually over-performed the buy-and-hold strategy by 8.16%.

Using Binance coin with the same automated trading strategy in the same period, the results were slightly better, with an overall loss of -8.36% but overperforming “the market” by 21.78%.

In the last three month, almost all Altcoins underperformed Bitcoin significantly, so the trend-following strategy was likely not the best one to take advantage of market conditions. On the other side, noticing that an active strategy can still over-perform versus passively holding the coins in your wallet should be interpreted as an encouraging result.

That considered, we decided to test a Contrarian strategy, taking advantage of price dips to buy. The parameters were as follows:

If price decreases 5% in one hour, BUY

THEN if price increases 7% from the buy price, SELL

The stop loss is set at 2% from the entry price.

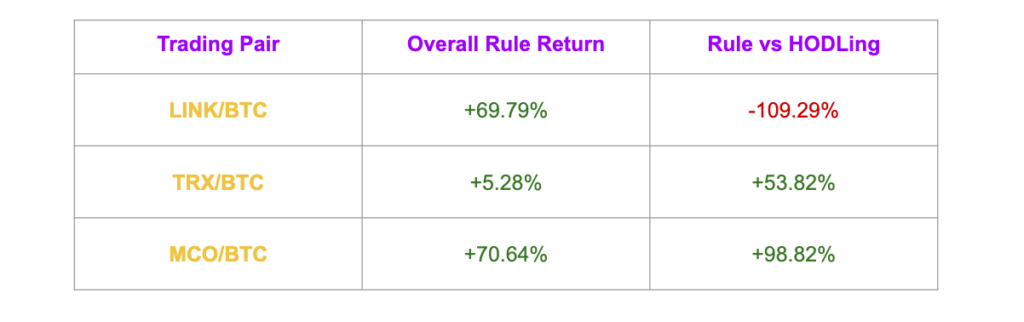

The rule was tested with three different coins during the last three months and here are the results of the Backtest:

Any conclusion we can get from this first round of test? The new rule page will significantly improve the effectiveness of our rules with enhanced features and more options available to the traders.

We can’t wait to release them to our great Community!

Stay tuned and trade safely!

The Coinrule Team!