Unleashing a ripple through the crypto market, the recent XRP ruling by Federal Judge Analisa Torres represents a revolutionary stride forward for the crypto industry. This unprecedented landmark decision—the first judicial ruling since the SEC’s seminal lawsuit against Ripple in 2020—has etched an innovative pathway for digital assets, establishing a distinct classification for the sales of XRP and other altcoins. However, the court ruling was not a clean sweep for XRP; the asset fell short of meeting the third criterion of the Howey test, relating to the common enterprise requirement. Therefore, sales to sophisticated buyers, such as hedge funds, were deemed as unregistered securities sales. Meanwhile, in a promising twist for retail enthusiasts, the sale of XRP to retail customers via exchanges escapes the securities tag. This exciting turn of events paves the way for new growth opportunities, carving out a future where institutional and retail crypto involvement can coexist under regulatory clarity. In terms of market impact, the ruling is expected to lift the veil of securities overhang from ETH and other altcoins, potentially leading to an upward trend in prices. However, the legal battle is not over yet, as the SEC is likely to appeal the parts of the decision where its motion was denied. This process could take several years, during which the current ruling will stand.

In harmony with the recent XRP ruling, a promising macroeconomic landscape is emerging, with key economic indicators such as the US Consumer Price Index (CPI) recording a cool 3%, its lowest point since March 2021. This undercuts the anticipated 3.1%, hinting at a steady deceleration of inflation. Similarly, the Bank of England is celebrating a significant victory, with their CPI figures falling comfortably to 7.9%, beneath the predicted 8.2%. This downward trend in inflation, largely fueled by a record 23% annual fall in fuel prices, serves as a beacon of hope for investors and traders. Despite a 25bps hike being all but confirmed for next week, this fall in fuel prices also potentially paves the way for the Federal Reserve to temper interest rate hikes later in the year, steering the economy closer to pre-pandemic stability and the Fed’s goal of a 2% inflation rate. However, amid this promising progress, lingering concerns over labour market tightness and wage growth continue to cast a shadow that threatens to complicate inflation control efforts due to a potentially pricier workforce.

On a more upbeat note, equities markets have received a healthy boost from the stellar earnings reports of tech and banking giants, such as Netflix and JP Morgan, adding a further layer of optimism to the financial landscape. Ordinarily, a correlation between these markets might be anticipated, yet current data suggest these two sectors are pursuing autonomous paths, showcasing one of the least pronounced correlations between the crypto market and big tech equities. This divergence offers a compelling hedging opportunity. Should a downturn be expected in one of these markets, traders could take a short position there while assuming a long stance in the other.

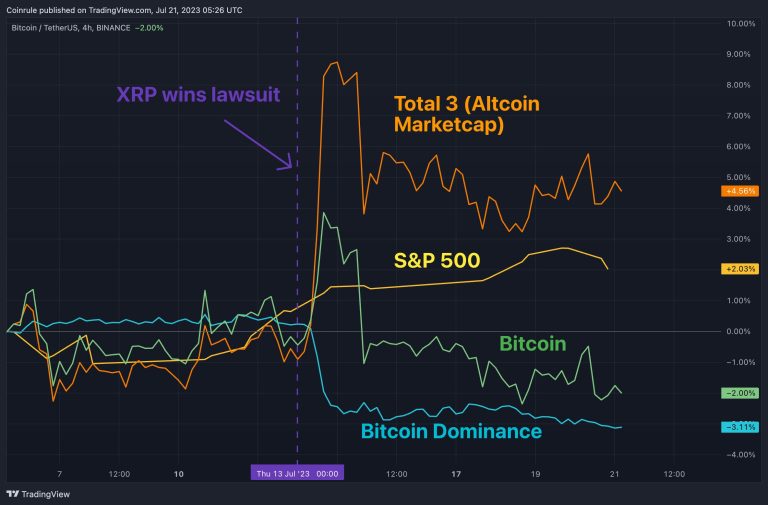

Viewed through a technical lens, the above chart displays that Bitcoin and Altcoins are carving distinct trajectories, signifying a notable transition in investor sentiment from Bitcoin towards Altcoins. This transition is underscored by a marked reduction in Bitcoin’s dominance in the wake of the recent XRP announcement. While this has triggered an optimistic relief rally for Altcoin proponents, it remains critical to recognize that the broader Altcoin market continues in a downward trend.

In this riveting landscape of crypto and macroeconomic evolution, the road ahead promises to be one of both challenge and opportunity. The recent XRP ruling marks an epoch in crypto regulation, unfolding a world where retail and institutional engagement coexists under the umbrella of increased regulatory clarity. Meanwhile, the broader economy paints a picture of tentative optimism with cooling inflation and buoyant equity markets. Yet, a clear divergence between crypto and traditional markets has emerged, making for a fascinating interplay for savvy investors. Furthermore, the ongoing shift in preference from Bitcoin to Altcoins provides intriguing investment prospects, even amid the broader Altcoin market’s downturn over recent months. As we move forward, these nuanced dynamics promise to shape the financial landscape, presenting us with a future replete with unforeseen potentials and novel financial architectures.