Since the start of January, most leading macro markets have experienced a reversal around their 38.2% Fibonacci retracement levels. However, BTC has shown resilience and fought the cross-asset sell-off. This divergence is likely driven by the fact that there has been over $1 trillion in net liquidity added to the market since the bottom in October, primarily driven by the People’s Bank of China and the Bank of Japan, helping to off-set the damage the Fed is doing to risk-on assets such as the crypto market. Considering BTC tends to be somewhat of a liquidity sponge, it tends to outperform other assets when there is a boost in liquidity. However, the jury is still out on whether BTC’s performance indicates the end of the bear market for crypto or a temporary outlier. Despite BTC’s recent outperformance, it’s still catching up to significant rallies in other markets between Q4 2022 and Q1 2023. An important note is that the S&P 500 has never seen a bear market bottom before the unemployment rate began to rise, and this is yet to be the case. Furthermore, the yield curve is currently the most deeply inverted it has been since the 1980s, ultimately signalling that long-term interest rates are lower than short-term interest rates. An inverted yield curve has been a perfect predictor of the last seven recessions since 1960, ultimately implying that it’s likely the market isn’t out of the woods yet.

When yields and risk assets diverge, historical patterns suggest that other assets quickly catch up to the sell-off. Although yields have moved exponentially since last month’s CPI data, markets expect them to stabilize at last year’s high levels. It would likely take very hot inflation data and a significant rate hike following the next FOMC meeting on the 22nd of March to trigger the next leg lower for risk assets. Until then, BTC is expected to continue ranging, waiting for its next cue.

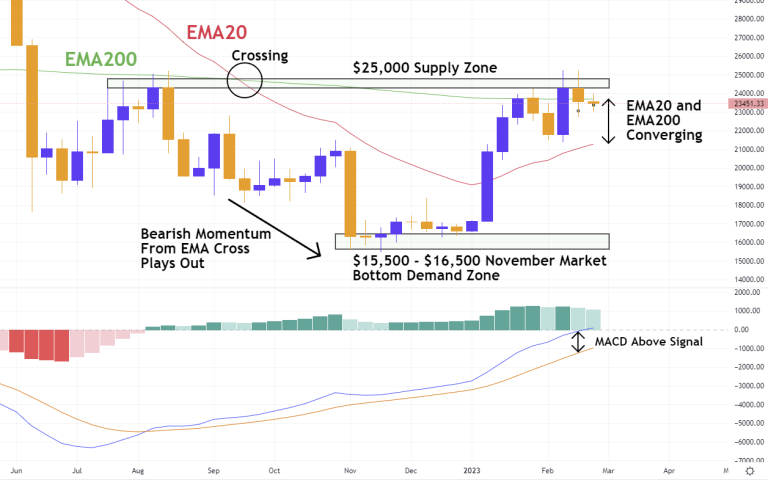

From a technical perspective, it is clear from the weekly chart that Bitcoin has been trading between two significant demand and supply zones. The bulls will be hoping for a weekly close above the $25,000 supply zone, which would light the way towards the massive $28,800 to $30,000 resistance, the Head and Shoulders neckline. An important contributor to the bullish scenario is that EMA20 and EMA200 are beginning to converge, with a potential cross in the coming weeks. The importance of this should be considered, as EMA20 crossing below EMA200 back in September accurately predicted short-term market direction. Bears will rejoice at the fact that many traders believe that a final Elliot Wave 5 sell-off is to come. This would likely result in a break below the $15,500 – $16,500 November market bottom.

As we advance, all eyes will now be on the CPI data releases. U.S. CPI data on the 14th will likely dictate the outcome of the rate decision of the FOMC on the 22nd. Volatility will be high around these dates, so caution should certainly be exercised, especially in leveraged positions.

Check out the chart on TradingView here.