Ethereum’s rise from the ashes over the past two weeks has demonstrated why you should not underestimate bear market rallies. Prior to its explosive surge, covering over 50% in a week, the second largest crypto asset was tracking bitcoin’s moves closely. Now it appears to be the one leading the rest of the market and showcases the market’s shift to a more risk-on stance. Last week saw the second week of inflows to Ethereum crypto funds, investors predominantly being institutional investors, totalling $5 million. This is a major shift compared to the past three months where there were 11 consecutive weeks of outflows.

The catalyst for Ethereum’s upside is assumed to be the news relating to the Ethereum Merge which includes the transition from a proof-of-work to a proof-of-stake consensus mechanism. A timeline was spoken during an open developer call, detailing the Merge could be expected September 19th. The Merge will result in Ethereum becoming deflationary due to annual issuance being slashed by 90%. This increasingly supports the narrative that ether is a growing store of value. Investors have caught onto this prospect, leading to the asset being argued undervalued as future supply is diminished.

Overall, the market’s strength has been impressive, especially considering the higher-than-expected 9.1% CPI data prompting potentially further future rate hikes from the Federal Reserve. However, something to keep in mind is the ferocity of bear market rallies being created by short sellers getting squeezed. This leads to them being forced to buy back their short positions to prevent further losses causing further buying pressure – resulting in another cycle of short sellers buying back.

Last week centralised exchanges recorded their lowest trade volumes since December 2020, leading to order book liquidity thinning and volatility being heightened – creating the perfect storm for a short squeeze. On Monday, Ethereum’s move to over $1,600 saw liquidations totalling nearly $500 million within a 24-hour period.

However, Ethereum has increasing competition to be the chain leading the pack, in terms of global crypto adoption. In relation to active addresses, Solana has been dominating the battle for layer one supremacy. In June, Solana registered 32.23 million active addresses compared to Ethereum’s 12.93 million.

Over the past several weeks we have been seeing the question: How will crypto attract 1 billion users over the coming years? This has been answered with crypto-native phones – the first to be announced was Solana’s Saga followed by Polygon and HTC. These devices will be specifically designed to interact with decentralised applications, with the user experience of dealing with self-custody wallets and signing for transactions being substantially improved. Additionally, the current app store high fee infrastructure, which disincentives developers to build apps, will be overhauled with Solana’s Mobile Stack. This could lead to improved decentralised applications with further use cases, better refinement and increased accessibility – causing more people to participate in crypto.

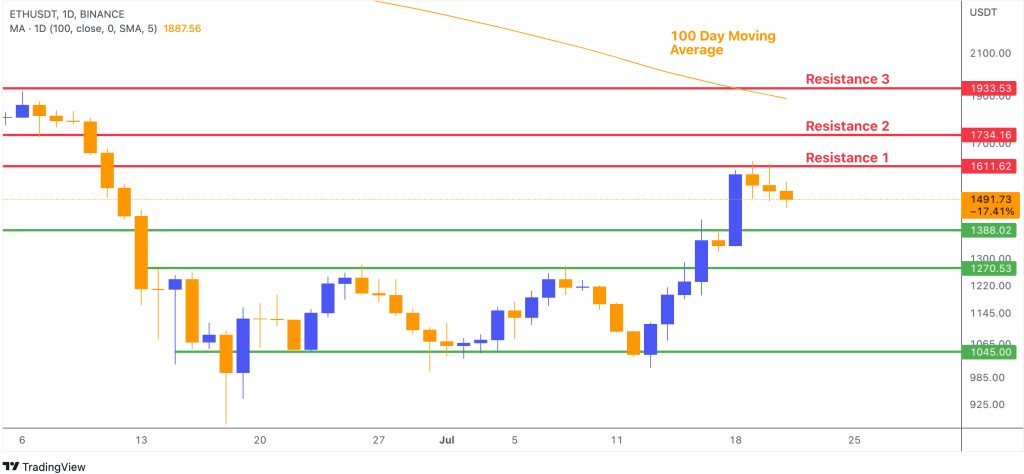

From a technical perspective, Ethereum has broken out from the month-long range of $1,050 to $1,250 and is facing resistance around $1,600. The true test will be penetrating the $1,700 key level that marked the summer 2021 lows. The 100-day moving average also looms around $1,900 and will be another test if there is sufficient demand to outweigh the uncertain macroeconomic environment and continue on our upward trajectory. If rejected from this level the move could be rendered a bearish retest of our once strong support and we could retrace lower back into an area of demand.

News of Tesla liquidating some of their bitcoin position is not helping the bulls. Their earnings report detailed they sold 75% of their bitcoin holdings during Q2, totalling $936 million, at an average price of approximately $29,000. However, Musk emphasised this is not an indication of bitcoin’s fragility but rather Tesla improving its liquidity in light of Covid shutdowns in China and other economic factors.

Reaching the fabled $1 Trillion total crypto market cap level is a strong indication of the resilience of the sector. $1 Trillion is also the market cap of silver, and when compared showcases how small crypto is relative to other asset classes. There are many bullish catalysts on the horizon for crypto, the Ethereum Merge, the Bitcoin Halving and crypto native mobile devices potentially accelerating global adoption to 1 billion users and beyond. Will these tailwinds be able to fight the macroeconomic headwinds of the likely incoming increased interest rates and recession?

The past week has shown promising signs, but the real test will be if bitcoin can reclaim and hold the 200-week moving average – continuing to make higher lows. If you are long-term bullish on the space the reverse clause of whatever is ahead should be appreciated. Rejection and a return to lower prices meaning more time to accumulate at lower valuations, or more positively, the market recovering and portfolio values appreciating.