Halloween is that period of the year when streets are full of ghosts and monsters. At a closer look, they are just kids asking for candies. If you look closely at the latest “spooky” Bitcoin’s dip, you will find many bullish elements as well.

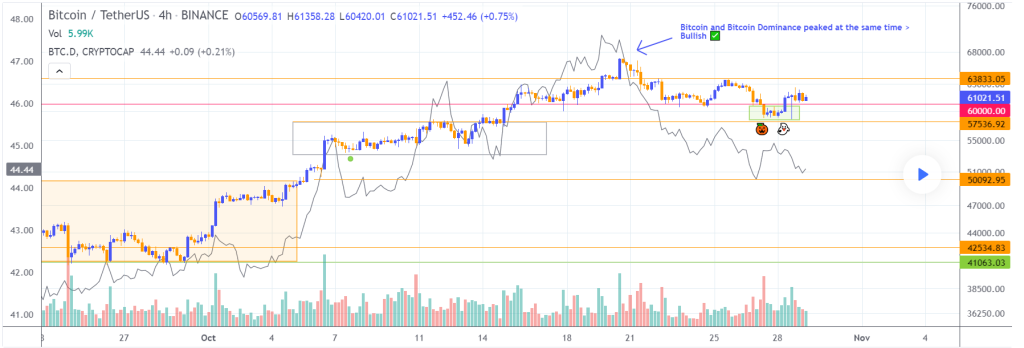

As anticipated, the market was looking for a retest of the first support area . During a retest, the magnitude of the price move does matter! This week Bitcoin dipped below the psychological level of $60,000 just to find another support right above the previous consolidation area.

The price then rebounded back above the breakout level. This kind of price action implies a solid amount of buyer and demand. On the other hand, sellers may not have been satisfied by such a meagre drop from all-time high. Should they manage to push the price to a new lower low, that would open to a more severe drawdown that will allow them to buy back at more convenient prices. The fight is on, and it could lead to a period of sideways moves between $57,000 and $64,000.

What about Alts? They will undoubtedly be those that will benefit the most from this scenario. The rally of Altcoins in BTC prices started precisely at the top of the latest Bitcoin’s run. As the trend began to weaken, investors and traders rotated back their allocation in Alts.

How long will this Alt-party last? Time will tell. Meanwhile, it’s worth continuing to keep an eye on the Bitcoin Dominance chart compared to Bitcoin’s price. This is the single best indicator to optimise your portfolio allocation and boost your returns in times of lower volatility .