Cryptocurrency trading mostly resembles ideas of profits and capital growth. However, in reality, this comes with volatility and risk. Crypto markets are erratic, continually fluctuating in price. Many newcomers may get baffled when, after a sustained price increase, eventually the trend reverses. So, why are cryptocurrencies down?

We will introduce how markets work and other factors that escalate trend reversals, such as leverage and liquidation, to answer this question.

For more tips about how to get started with cryptocurrency trading, you may also find this article interesting.

In the past 6 months, Bitcoin gave the impression that the only possible direction was upward, posting regularly new all-time highs. As the price action unfolded recently, the latest breakout looked pretty weak, and it’s now reverting quickly. Traders have been buying the dips just because that is all they had to do for six months to capitalize on profits. The RSI gives a clear picture of the current strength of the trend. It is weakening at every new leg up.

How markets work

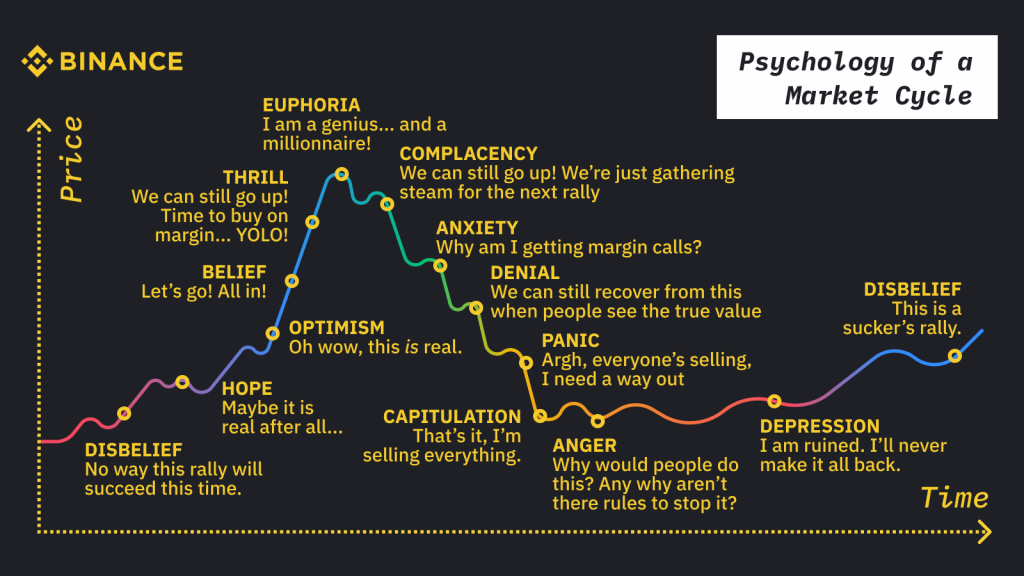

When participating in a free market such as crypto, several types of investors affect how markets work. Patient long-term investors tend to accumulate. Slowly, but steadily, the price starts to pick up. Whales and large investors re-allocate their portfolios, increasing the demand without affecting the supply much. Subsequently leading to a price breakout, encouraging more fresh capital to flow. The new capital inflows lead to the price skyrocketing, causing investors to be less price sensitive. Since the price seems never to go down, investors increase leverage and capital at risk.

Once the exuberance reaches excessive levels, the price reverts, leading to the liquidation of those with high leverage. Here supply overweights the demand pushing prices lower. The correction begins to accelerate, and those that were over-exposed panic sell, causing the price to collapse. Short-term traders sell speculating on the price action, while long-term traders accumulate gradually more aggressively on drops. When the selling pressure decreases as sellers offloaded the most leveraged position, the cycle can back from the beginning.

Leverage and liquidations

Many traders use leverage to increase the size of their positions and increase the returns on their trades. Leverage is when traders use their tokens as collateral to increase the size of their position by borrowing funds from the exchange. This technique can magnify gains, however, it also magnifies losses and increases the overall risk of the market. When traders employ high degrees of leverage, and the market moves against them, the exchanges close at market the positions where the margin is not going to cover anymore the losses, triggering liquidations. When the market moves are extreme, more traders are liquidated at once, pushing the price down even lower.

Excessive leverage is one of the main reasons why cryptocurrencies are down today.

A recent example would be when Bitcoin’s price dropped by 22% from February 21st to 23rd, which led to the liquidation of approximately half a million trades worth a total of $4.4 billion across all crypto exchanges.

Historical reference

Bitcoin’s history is not a stranger to sudden price drops in the range of 20-30%. In December of 2017, Bitcoin set a new all-time high of $16,638; this was followed by a price correction of around 25%. Looking at historical references, it becomes apparent that corrections of 20% are not out of the ordinary for a volatile asset such as Bitcoin. Between 2017 and 2018, the price dropped up to 30% 9 times, increasing over 3000% in the same period.

Crypto Market Fundamentals

Looking at the fundamentals of the cryptocurrency market can help traders understand where the market is heading. One important metric that can be considered an indicator for markets’ success is the total value locked in Decentralized Finance Dapps. This currently stands at $38.52B and is continuing to grow. The total value locked in shows the interest in DeFi, and the adoption of cryptocurrencies is growing.

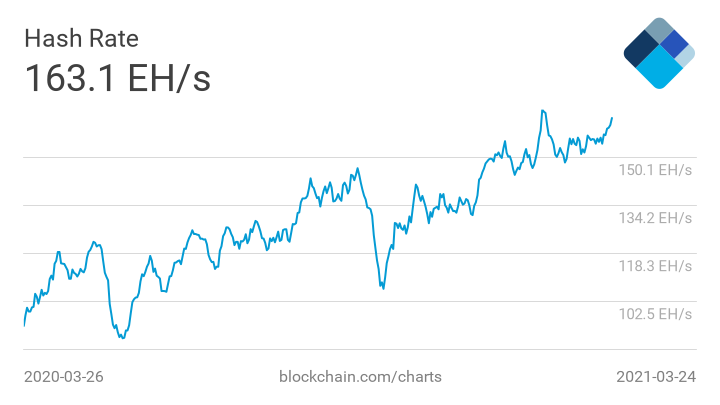

Another indicator is the Hashrate of BTC, which is at the highest ever. This indicates that the Bitcoin network is more secure than it has ever been. Additionally, showing that there are a lot of people mining at the moment. Coupled with the fact that more institutions are entering the Bitcoin market reassures traders that strong fundamentals support the price increase.

Risk Management

Whether it be trading futures or spot, it is always essential to practice sound risk management. During bullish cycles, investors tend to surrender to emotions and begin to believe the asset they are investing in will never decrease in price, regardless of one’s assumptions regarding the cost of investment or their belief in the potential.

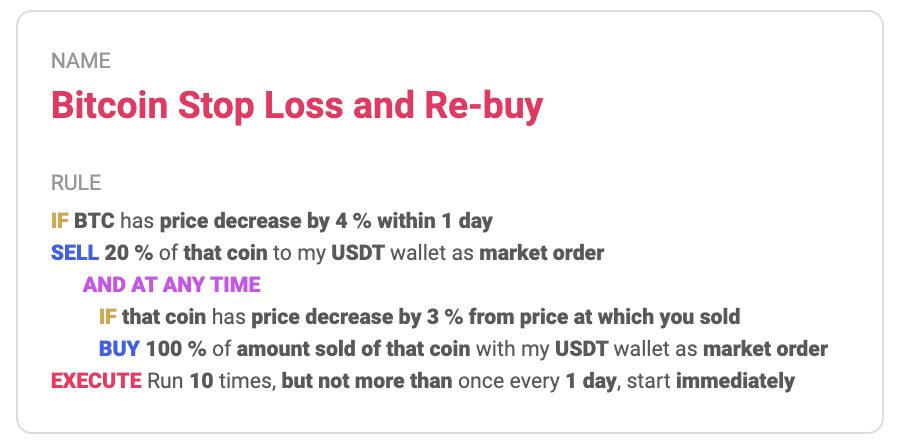

Practicing risk management by only investing what you can afford to lose is essential. The simplest way to protect your funds even in an uptrend is to have a stop-loss in place. A stop-loss protects your funds in the event of a reversal. Another option is to use futures to short-sell cryptocurrencies to profit from the price drop.

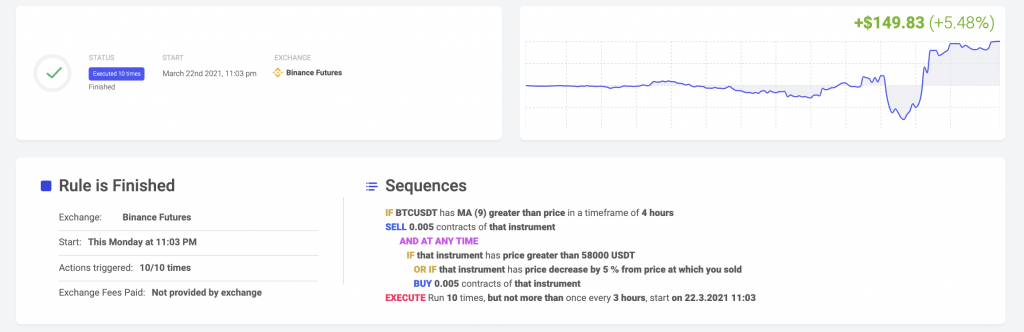

With Coinrule, it’s easy to catch opportunities on the downside, just like when the market trends up.

Take Action when

Understanding cryptocurrency markets allows traders to have strategies in place and take action accordingly. Using a trade automation tool such as Coinrule allows traders to execute their strategies in a prompt and timely manner during market moves. Launching a simple stop-loss or accumulation rule such as the one seen below can be tremendously beneficial during a price reversal.

This rule is set to sell Bitcoin when the price decreases by 4% and then buy back when the price drops further. Thus, protecting your funds and increasing the number of tokens held as well. Rules such as this allow traders to easily and efficiently manage their risk without tracking prices constantly.

Key Takeaways

- Cryptocurrency markets work cyclically, and emotion is a driving factor in the Crypto cycles. As prices increase, investors begin to FOMO into the asset driving the prices up and overleveraging themselves. This eventually leads to a sharp correction where many traders fire-sell the assets and reset the cycle for long-term investors to begin accumulating once again.

- Many traders open positions with high leverage. During sharp market movements, have to close their positions due to liquidations. That pushes exacerbate even more the magnitude of the price drop.

- History repeats itself. Corrections of 20-30% are typical for volatile assets such as Bitcoin. We have seen drops similar to the one we saw several times in previous Bitcoin Bulls cycles.

- Similar to any market, the Cryptocurrency market has its fundamentals. However, the metrics are different from other markets. One such metric is the value locked in Defi, which shows the interest in Decentralized Finance.