How I Made 115k in 2 months using Coinrule

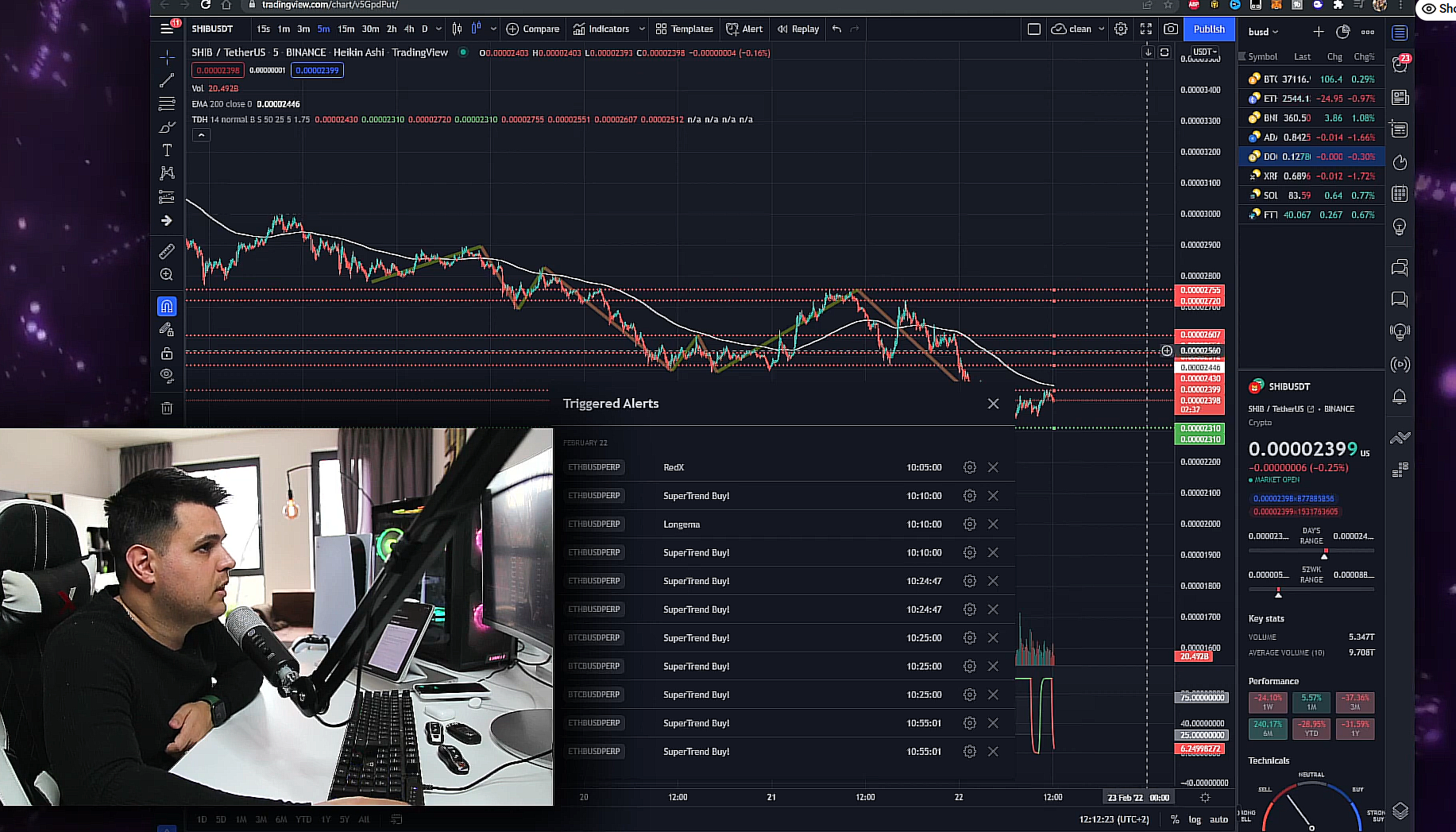

Coinrule Introduction and Background I have some experience with automated crypto trading. As you can see here, I made one hundred and fifteen thousand dollars using 3Commas, and I’ve just refreshed it to show the numbers. I’ve also seen a lot of videos pop up online claiming to show how you can make money from crypto bots, so in this video I want to show you how using a product that is actually easy to…