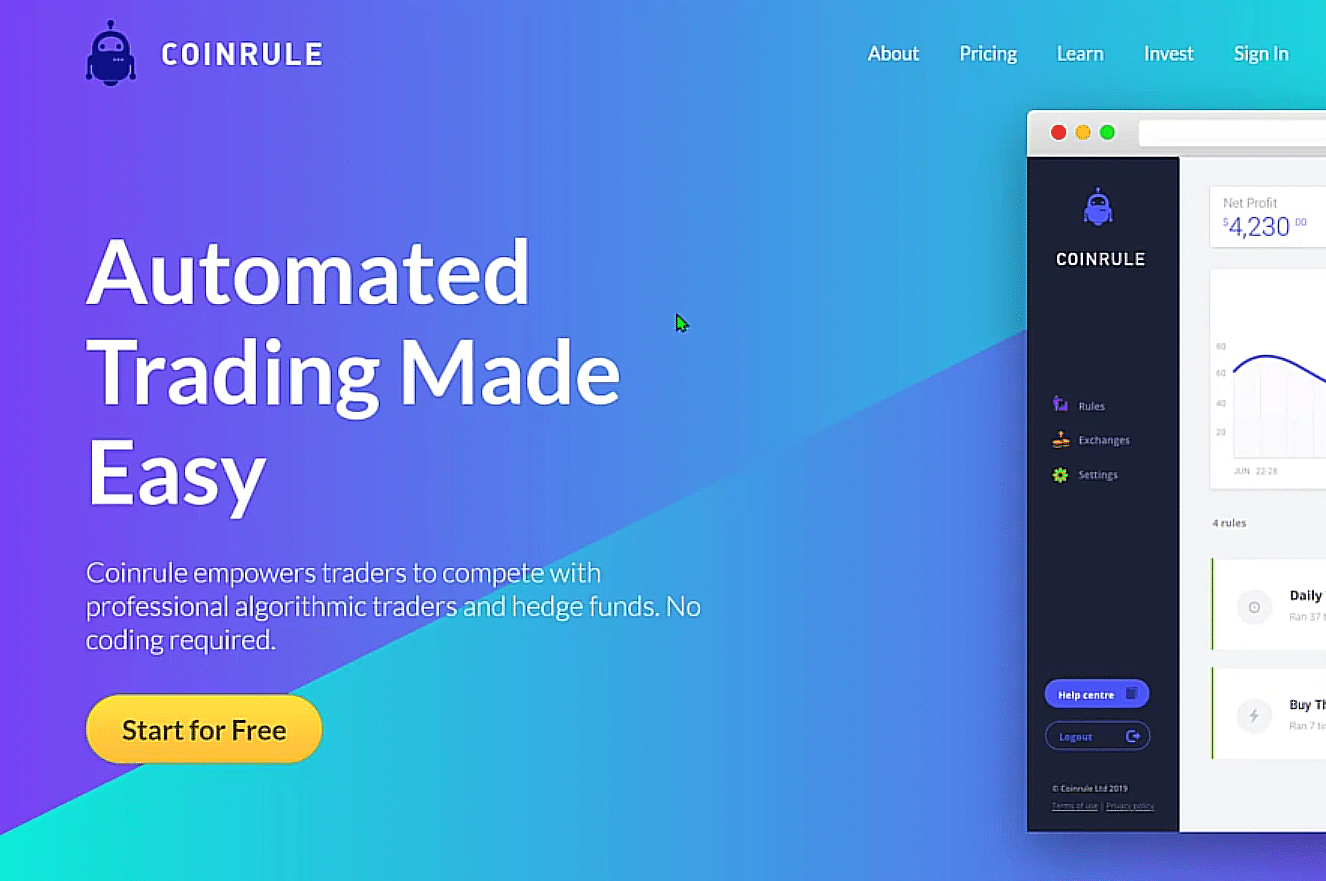

Automate Your Crypto Day Trading with Coinrule

Introduction to Coinrule Hey guys, welcome to my channel. How are you doing today? I hope you’re well. My name is Crypto Yogi and we are going to discover Coinrule today. Coinrule lets you automate your investments across multiple platforms to protect your funds and catch the next great market opportunity, offering algorithmic trading without having to learn a single line of code. Coinrule is a smarter system for trading because it adds alternative automation…