The crypto market offers a variety of trading opportunities and is available 24/7. The volatile and fast-paced nature of cryptocurrency can make it difficult to keep up with price changes. That’s where automated trading strategies like the grid bot come into play. In this guide, we will explore everything you need to know about using a grid bot effectively in 2025, helping you to streamline your trading strategy and maximize profits.

Key Insights

- A grid bot is an automated trading tool that places buy and sell orders at set intervals within a predefined price range. It takes advantage of market volatility by executing trades consistently, helping traders maximize profits from both upward and downward price movements without manual intervention.

- Grid bots work by creating a series of price levels, or grids, within a defined range. As the price fluctuates, the bot automatically buys low and sells high at each grid level, capitalizing on small market changes. This strategy works best in sideways or slightly volatile markets.

- A grid bot helps traders automate repetitive tasks, reduce emotional decision-making, and maximize returns from price fluctuations. It’s a great tool for both beginners and experienced traders, providing round-the-clock trading efficiency and minimizing the need for constant monitoring.

- To get the best results, select an appropriate trading pair with high liquidity, set realistic grid parameters, and monitor your bot’s performance regularly. Using tools like Coinrule allows traders to customize their grid strategies for various market conditions and automate their crypto trading efficiently.

What Is a Grid Bot?

Grid bots are automated trading tools that execute buy and sale orders in a specified price range, at intervals pre-defined. It creates grids of orders above or below a predetermined price to try and profit from the market fluctuations. This strategy is particularly effective in markets that move sideways or within a predictable range.

The concept behind grid trading is simple: buy low and sell high repeatedly within the grid’s range. By automating this process, traders can take advantage of small price movements without constantly monitoring the market.

How Does it Work?

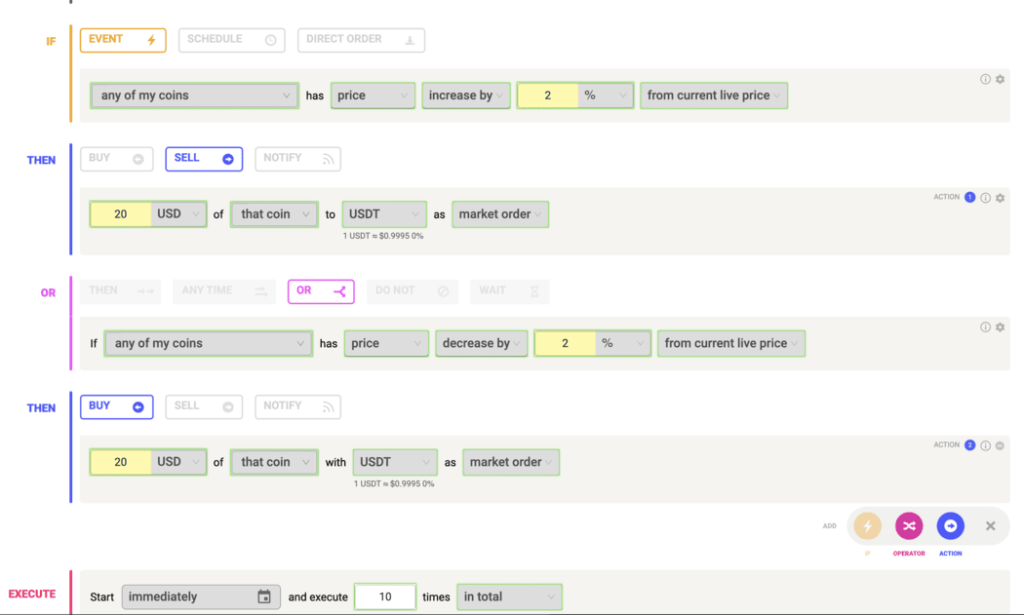

A grid bot divides a price range into multiple levels or grids. At each grid level, the bot places buy and sell orders. When the price hits a certain level, the bot automatically executes the corresponding trade. Here’s how it works step-by-step:

- Define the Price Range: Set upper and lower grid limits.

- Determine Grid Levels: Choose how many intervals or levels you want within the price range.

- Place Orders: The bot places buy orders below the current price and sell orders above it.

- Profit from Fluctuations: The bot will continuously buy low and sell high in the grid.

For example, if you set a grid bot with a price range of $1,000 to $1,500 and five grid levels, the bot will place buy and sell orders at intervals within that range. Every time the price fluctuates between those levels, the bot will execute trades, locking in profits.

Benefits

It offers several advantages for both beginner and experienced traders:

1. Automation

Grid bots automate the trading process, allowing traders to profit from market fluctuations without constantly monitoring the market.

2. 24/7 Trading

Since crypto markets never close, a grid bot can trade around the clock, ensuring you don’t miss any profitable opportunities.

3. Emotion-Free Trading

Automated trading removes emotions from decision-making, helping traders stick to their strategy without being influenced by fear or greed.

4. Works Well in Range-Bound Markets

A grid bot excels in sideways markets. This is when prices fluctuate between a certain range, without any obvious upward or downward trend.

5. Risk Management

Can help manage risk by spreading orders across multiple price levels, reducing the impact of large market swings.

How to Set Up

Setting up a grid bot requires careful planning to ensure it aligns with your trading goals. Follow these steps to configure a grid bot effectively:

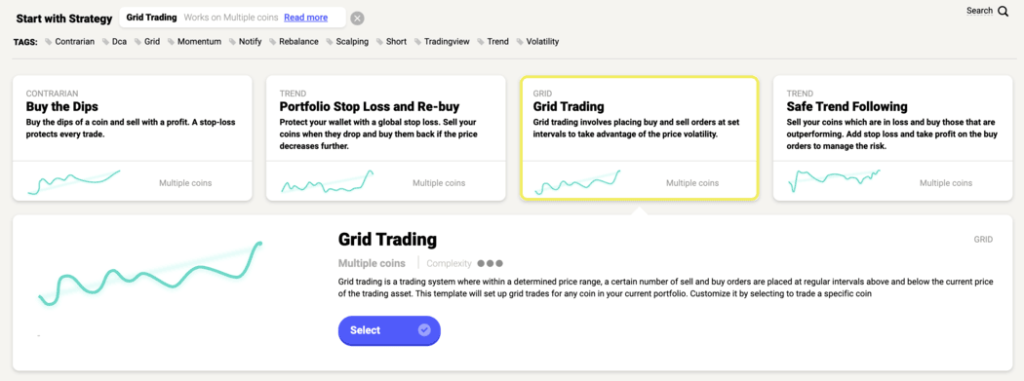

Step 1: Choose a Reliable Platform

Select a trading platform that offers grid bot functionality. Platforms like Coinrule provide easy-to-use grid bot tools with customizable settings.

Step 2: Set Your Price Range

Decide on the upper and lower limits of your grid. The range you select should reflect your risk tolerance and the market analysis.

Step 3: Select the Number of Grids

Decide how many grid levels you want within your chosen range. More grids mean smaller intervals between orders, resulting in more frequent trades.

Step 4: Allocate Capital

Assign a portion of your trading capital to the grid bot. Ensure you have enough funds to cover all the buy and sell orders within the grid.

Step 5: Monitor and Adjust

Monitor the performance regularly once it is up and running. Adjust grid levels and price ranges as necessary to adjust to market conditions.

Best Practices for Using a Grid Bot in 2025

To maximize the effectiveness, consider these best practices:

1. Start Small

Begin with a small portion of your capital to test the bot’s performance before scaling up.

2. Choose the Right Market Conditions

Works best in range-bound or sideways markets. Avoid using it in highly volatile or trending markets without proper adjustments.

3. Use Stop-Loss Orders

Incorporate stop-loss orders to protect your capital from significant market downturns.

4. Regularly Review Performance

Even though a grid bot automates trading, it’s essential to review its performance regularly and make adjustments if necessary.

5. Combine with Other Tools

Enhance your grid bot strategy by combining it with other technical analysis tools and indicators to improve accuracy.

Risks of Using

While it can be highly effective, it’s essential to understand the risks involved:

- Market Volatility: Sudden price movements can impact the bot’s performance, especially in highly volatile markets.

- Incorrect Configuration: Setting unrealistic price ranges or grid levels can lead to losses.

- Liquidity Issues: Low liquidity in certain markets can cause delays in order execution.

To mitigate these risks, ensure you have a solid understanding of the market and configure your bot carefully.

Conclusion

The grid bot is a powerful tool for traders looking to automate their crypto trading strategies and profit from market fluctuations. By setting predefined buy and sell orders within a specific price range, grid bots can maximize profits in range-bound markets while minimizing the emotional impact of trading.

Platforms like Coinrule make it easy to set up and manage grid bots, even for beginners. With the right setup and risk management practices, a grid bot can be a valuable addition to your trading toolkit in 2025.

Start leveraging automated trading with a grid bot today and take your crypto trading strategy to the next level.

Follow Our Official Social Channels: