Bullish Enforcement

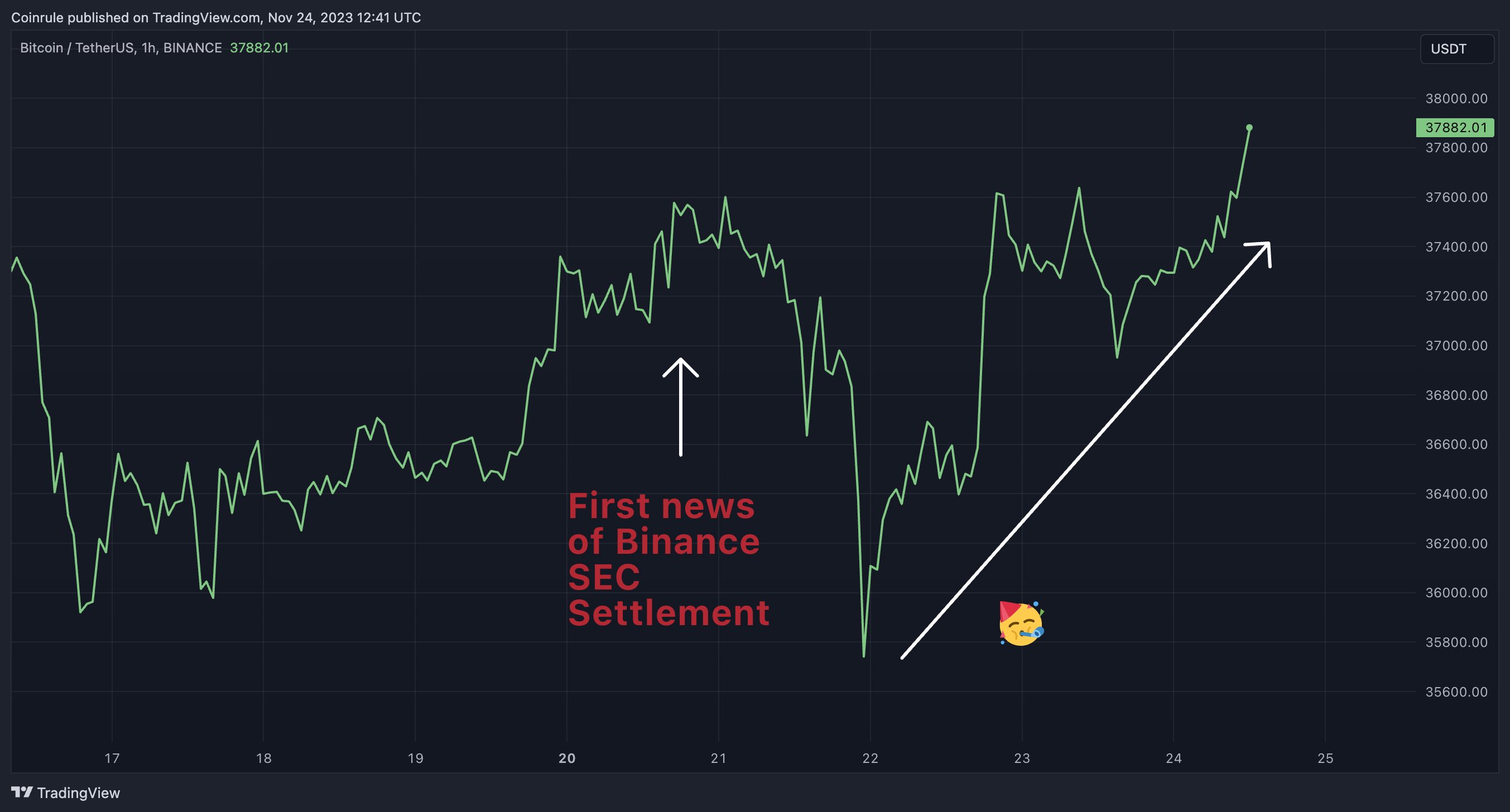

After nearly a year of swirling rumours, the threat of US regulatory and criminal enforcement against Crypto’s biggest Exchange Binance was still hanging over the market. These rumours can now finally be put to bed. The US Justice Department fined Binance $4.3bn in penalties and forfeitures. The exchanges’ iconic CEO CZ pleaded guilty to money laundering charges and has stepped down from his position. Markets quickly reacted to the news. After an initial drop, bulls…