Am I too late? That’s what every new crypto investor is wondering in 2021 after a spectacular bull market that pushed the price of many coins higher by more than 10x in less than one year. To better answer this question, first, we need to understand where the price of cryptocurrencies could go. In particular, we will try to formulate an Ethereum price prediction for the next ten years.

Ethereum is the second-largest cryptocurrency by market cap after Bitcoin. With impressive community backing and exceptional blockchain technology, Ethereum’s future looks bright. The idea of Ethereum was introduced back in 2013 by Vitalik Buterin. Along with his co-founders, including Cardano founder Charles Hoskinson and Consensys founder Joe Lubin, Buterin launched a crowdfunding campaign in 2014 when they sold the native token of Ethereum through an ICO (Initial Coin Offering). By the end of the ICO, Ethereum’s team had collected about 17 million US dollars.

Since 2014, the value of the Ethereum network has grown to over $300 billion. While other protocols try to replace Ethereum, it is still one of the most robust and most popular blockchain Smart Contract platforms. Its value comes mainly from the hundreds of different applications that run on top of it. If you’re interested in this crypto platform and want to know about Ethereum price prediction by 2030, this article is for you.

Current Environment

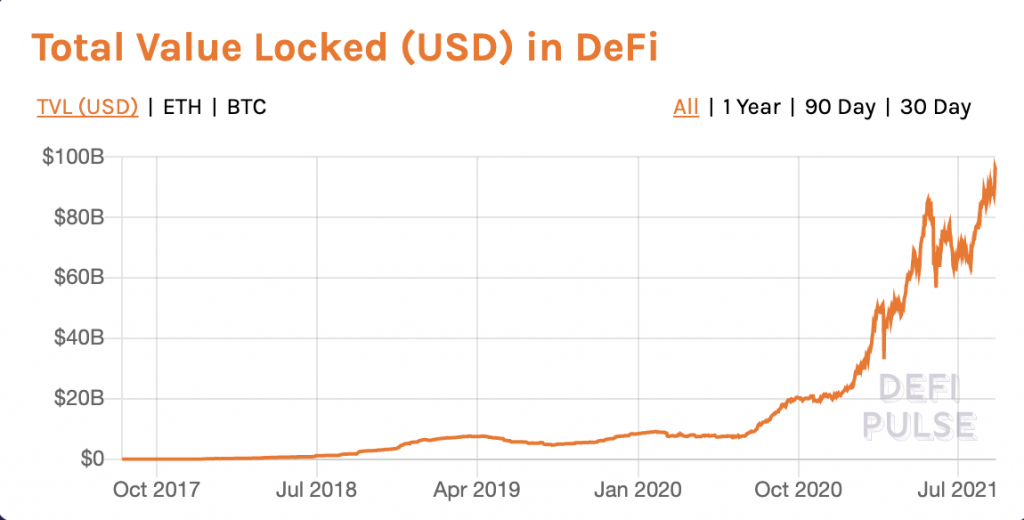

DeFi projects on Ethereum have gathered billions in ‘Total Value Locked’ (TVL) and the interest of institutional investors. People choose the Ethereum network to build on and invest in because of its strong community and the many practical use-cases. Decentralised finance applications built on the Ethereum blockchain allow users to borrow funds, lend funds, provide liquidity as market-makers, stake, send, pay and even buy insurance, all in a privacy-friendly, fully decentralised way. DeFi projects have removed the need for intermediary parties such as brokers and banks on many transactions and allow users to earn passive income in many different ways.

DeFi projects are an incredible bullish catalyst that has helped drive the growth in Ethereum’s price. The platform currently hosts well over 200,000 ERC tokens and powers numerous other types of cryptocurrencies across DeFi alone.

Despite the rise of competing Smart Contract Blockchains such as Solana or Avalanche, Ethereum’s ecosystem today is still synonymous with decentralised finance. Many would argue that because of the platform’s strong community, running of thousands of Smart Contracts and annual transactions in the trillions of dollars, Ethereum has intrinsic value. In May 2021, Ethereum’s price increased by a staggering 180 percent when a bull run commenced. It reached its all-time high value, which was $4,174 per coin.

Future Scenarios

The future scenarios of Ethereum are also promising because of the current and upcoming development plans.

Ethereum 2.0

The developers behind Ethereum are working on the platform’s second generation known as Ethereum 2.0. It is to be released soon, and it aims to solve the problems that the platform is currently facing, which are:

- Transaction scalability

- Sustainability

- Disk space

The upgrade will change the consensus mechanism of the platform from Proof of Work to Proof of Stake and, at a later stage, also introduce sharding technology. Currently, the Ethereum Blockchain can only manage to complete around 30 transactions per second. With the current high usage, gas costs have also been going through the roof. It’s said that Ethereum 2.0 will be able to complete a whopping 100,000 transactions per second. With these points in mind, there have been predictions that the coin can reach $10,000 US dollars by 2025.

Ethereum 2.0 is already being accompanied by so-called Layer Two scaling solutions for Ethereum. Platforms like Polygon, Optimism, Arbitrum, Fantom, Starkware and others use technologies like Sidechains, Roll-ups and Zero-Knowledge Proofs to allow fast and cheap transactions that are still tied to the Ethereum ecosystem or blockchain. These technologies either use ‘shared security’ benefitting from Ethereum’s many nodes or use their node infrastructure, as in the case of Polygon, to validate transactions.

DeFi Adoption

If you don’t already know, institutions worldwide are entering the DeFi world and adopting decentralised protocols because of their many benefits. According to Yahoo Finance, the decentralised finance industry has grown by 20 times in only 11 months. Total Value Locked has multiplied by eight times since early 2020 to over $80bn today, according to DeFi Pulse. It has attracted tens of millions of individual users across the globe as well as leading financial organisations. As of the first quarter of 2021, multiple world-famous companies such as Mitsubishi UFJ Financial Group, Citigroup, HSBC, Barclays, JP Morgan, SBI Holdings, Signature Bank, and more are working on blockchain-related projects. Meanwhile, VISA is using the Ethereum blockchain to settle transactions in the USDC Stablecoin.

Private organisations and some government institutes are also adopting digital currencies and blockchain technology because of the opportunities they bring to the table.

- Twenty-three international and government bodies, including the European Central Bank, Japan, Singapore, France, and Australia, have already launched their pilot projects. The European Investment Bank used the Ethereum Blockchain to issue bonds.

- The government of 13 countries across the globe, including Hong Kong, China, and Brazil, are in the middle of development.

- The government of 24 countries, including Canada, the United Kingdom, and the United States, are performing research work actively for Central Bank Digital Currencies.

While governments might opt to use their own Blockchain technology instead of relying on Ethereum, the broader message is that the technology is being adopted. The rising tide could lift all boats even further.

Corporates Allocating Reserve Funds in Ethereum

Ethereum has also started appearing on the balance sheets of many companies, just like Bitcoin. Other than corporate reserves, companies are also using Ethereum cryptocurrency as their working capital. Earlier this year, the CME (Chicago Mercantile Exchange) Group launched ETH Futures, which offers tools to mitigate the risk of volatility for institutional traders. Besides that, a social media and software application, Meitu, also listed on Hong Kong’s stock exchange, disclosed that it had purchased about $22 million worth of Ether coins.

Some companies have also integrated Ether-based apps, which only shows the emergence of the platform. Ethereum continues to impact tractional businesses and organisations. The appearance of Ether on the balance sheets of companies will increase as more and more companies have started using decentralised applications. The many teams and developers working on Ethereum continuously add improvements to the cryptocurrency to facilitate digital processes. It’ll eventually add another layer to Ethereum’s value proposition.

In simple words, Ethereum has become a technology play as well as a store of value. These are some of the main reasons institutional investors are becoming increasingly interested in this decentralised platform.

ETH as a Legal Tender

The adoption of the most popular cryptocurrencies, including Bitcoin and Ethereum, in Central America, is rising. Panama has introduced a bill to legalise Ethereum and Bitcoin, and there are about 111 different states in the world where the law recognises Ethereum. For example, a Chinese court has declared Ethereum as legal property by saying that it has an economic value. El Salvador has recently introduced Bitcoin as a legal tender, although the price of both Ethereum and Bitcoin plunged dramatically on the same day of the announcement.

ETH price prediction

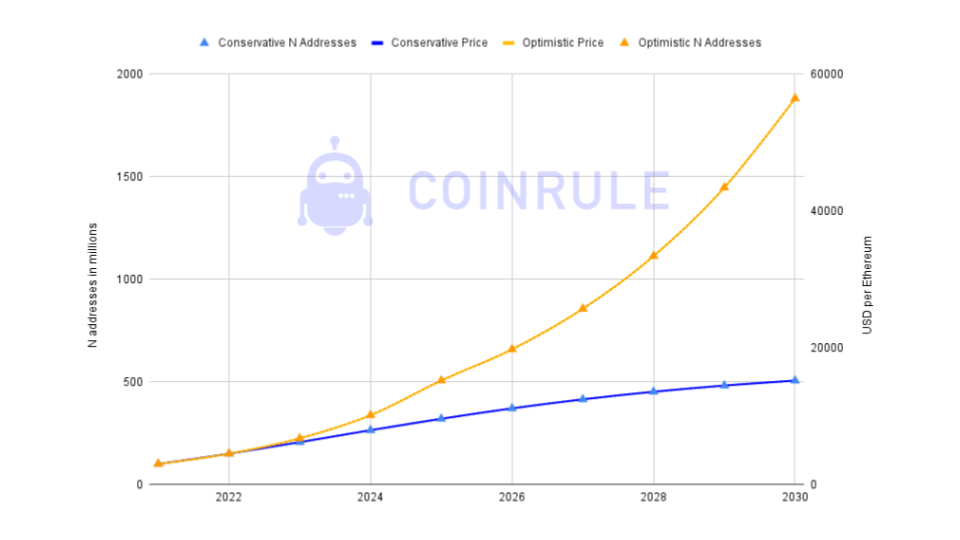

Predicting the future price of a cryptocurrency is always tricky. Ethereum price growth over the years has been following the increase in the activity of the network closely. You can gauge the activity in terms of transactions and active addresses.

In particular, a very similar rate of growth applies both to active addresses and the ETH price.

Once you identify one of the main drivers for price growth, it becomes easier to predict the price in 2030. The following chart shows two scenarios.

The first assumes a slowing growth over the years. Active addresses have grown by 50% every year since 2018. The conservative Ethereum price prediction assumes that the growth slows by 25% every year until 2030. That places the price of Ethereum somewhere around $20,000.

On the other hand, a more optimistic Ethereum price prediction would assume a growth more in line with the adoption rate of the Internet between 2000 and 2010. The calculation assumes a growth of 50% until 2025 and 30% until 2030. That would place the price north of $50,000.

As you can see, the Ethereum Blockchain has unprecedented potential. These are not even the most bullish price predictions for Ethereum. Forty-two senior experts and cryptocurrency specialists estimated that the price of Ethereum could reach a staggering $71,000 by the end of 2030.

Whatever the price of Ethereum will be in 2030, investing in Ethereum and in cryptocurrencies in general still represent an exciting opportunity with asymmetrical risk like no other assets. The potentials return still more than compensates for the volatility and the downside risk.

The ride is still long. Invest safely!

DISCLAIMER

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies.