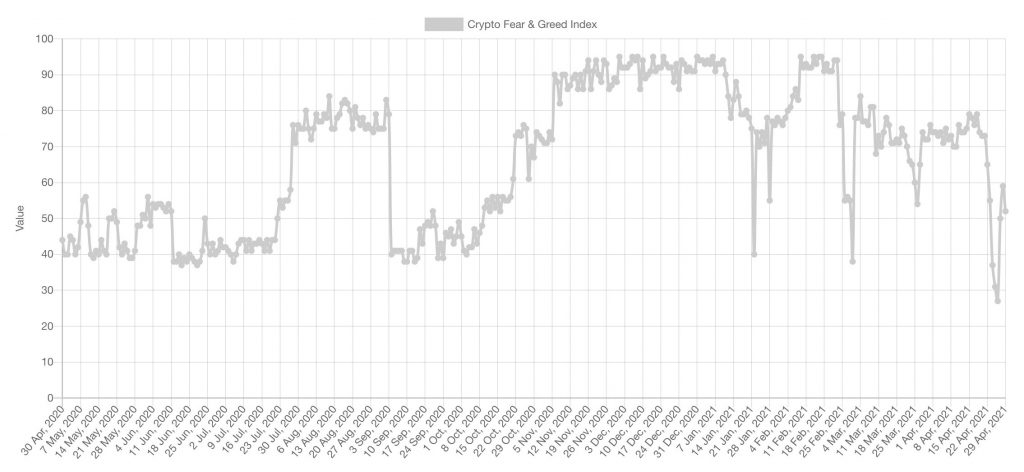

Cryptocurrency markets offer a wealth of opportunities every day. The chance of quickly securing high returns attracts traders and investors. However, the reality is that the Crypto market is also highly volatile, and it’s challenging to navigate all the price ups and downs. The “Fear Of Missing Out” pushes traders to buy into price rallies, while market dips force them to fire-sell their assets in a loss. The Crypto Fear and Greed Index is a very handy tool to scan market conditions to spot the best time to buy and sell Bitcoin or other cryptocurrencies.

What is the Index?

The Crypto Fear and Greed index is a metric that provides a proxy of the state of the Crypto market. By analyzing multiple elements and assigning to each of them a specific weight, the index can say if buying Bitcoin or other cryptocurrencies is currently a good idea or not. Alternative.me publishes the index daily and derives a single score representing all of those sources.

The index has historically spotted with significant precision the best times when it is more profitable to buy Bitcoin or other Cryptocurrencies. Filtering out the daily “noise” of price ups and downs provides valuable guidance for traders and investors.

How is the Index calculated?

The index updates every day and uses multiple weighted indicators to determine a simple meter from 0 to 100.

Currently, both technical and sentiment indicators blend into the Crypto Fear and Greed index.

- The volatility measures the magnitude of price swings in the last 30 and 90 days.

- The market momentum and volume capture how market participants are aggressively participating in the price moves.

- The analysis of social media provides a snapshot of the current market sentiment.

- The Bitcoin Dominance measures the investors’ appetite for risk. Generally, the higher is the Bitcoin Dominance, and the more conservative the traders are, as they seek refuge in Bitcoin rather than other cryptocurrencies.

- The Trends tracks various Bitcoin-related search queries on Google.

Understanding the index

When the Crypto and Fear index is low, it means “Extreme Fear,” while when it prints higher values, it means “Extreme Greed.”

As the main rule for every trader and investor is to Buy Low and Sell High, using the Crypto Fear and Greed index makes sense as it helps to spot the highs and lows of each market cycle.

When the index signals intermediate values (between 50 to 70), the market may look uncertain or trading sideways. That is the perfect time for running specific strategies for these market conditions.

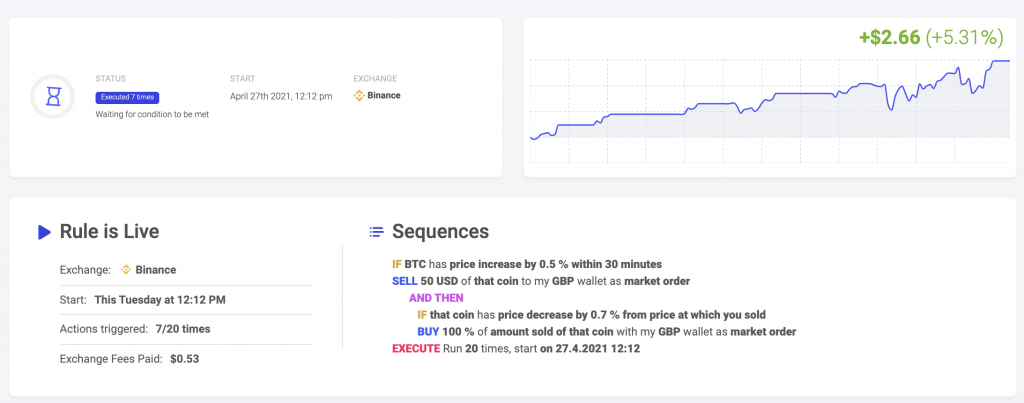

With Coinrule, you can catch the opportunity of selling into short-term price rallies to aim to buy back Bitcoin or other cryptocurrencies at lower prices. Thanks to a strategy like this, you can accumulate more of your favorite coin when the price moves with low volatility.

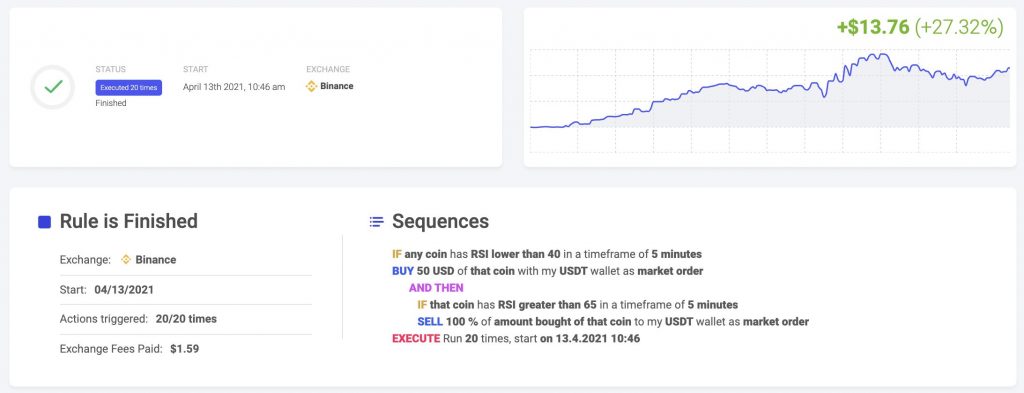

On the other hand, as soon as investors get more greedy (signaled by index values above 70), the market becomes very exuberant. So other trading strategies allow you to capture upside potentials for all the coins on the market. This is an example of rules which enable scalping short-term trades while keeping a flexible stop-loss to protect your positions.

What is the Crypto Fear and Greed Index showing now?

Currently, the fear and greed index sits at 52, recovering from an extreme drop on 26 of April that hit the level of 26, the lowest level that has been recorded since April, 28th 2020. Since this shows that the index has just increased from a period of extreme fear, this generally signals a good time to buy Bitcoin.

Using the index as a strict buy indicator is not advised, however using it along side your usual trading tools, like technical indicators can be of further confirmation about an entry point.

The level of the index coupled with other indicators such as RSI can prove to be a great strategy. Just like the Crypto Fear and Greed Index, also the RSI usually spots great buy opportunities for Bitcoin.

Applying the Index to your strategy

The best way to optimize the return of your trading strategies is to set up the parameters according to market conditions.

For example, given that the Crypto Fear and Greed Index is signaling still uncertainty in the market, this could be an interesting opportunity to run a strategy to profit from sideways price swings like the following.

Should the value of the index increase above 70, that will be a positive signal of momentum. A strategy to buy short-term dips on Altcoins could provide positive returns.

Key takeaways

Overall the Fear & Greed Index can be a valuable tool to anticipate when to launch certain types of rules according to market conditions. Ultimately the profitability of rules is linked to the market conditions, insight into the sentiment of the market can be a valuable asset in positioning rules.

- The Crypto Fear & Greed Index analyzes emotions and sentiments from different sources, then aggregates them into a single metric.

- Zero on the index means “Extreme Fear,” and 100 means “Extreme Greed.” The index gives a more real-time reading of the cryptocurrency market than price alone provides.

- You can use the index to assess the current market conditions and launch your trading strategies accordingly.

Disclaimer

I am not an analyst or investment advisor. Everything that I provide here site is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies.